Potential Upside For Huhtamäki Oyj (HEL:HUH1V) Not Without Risk

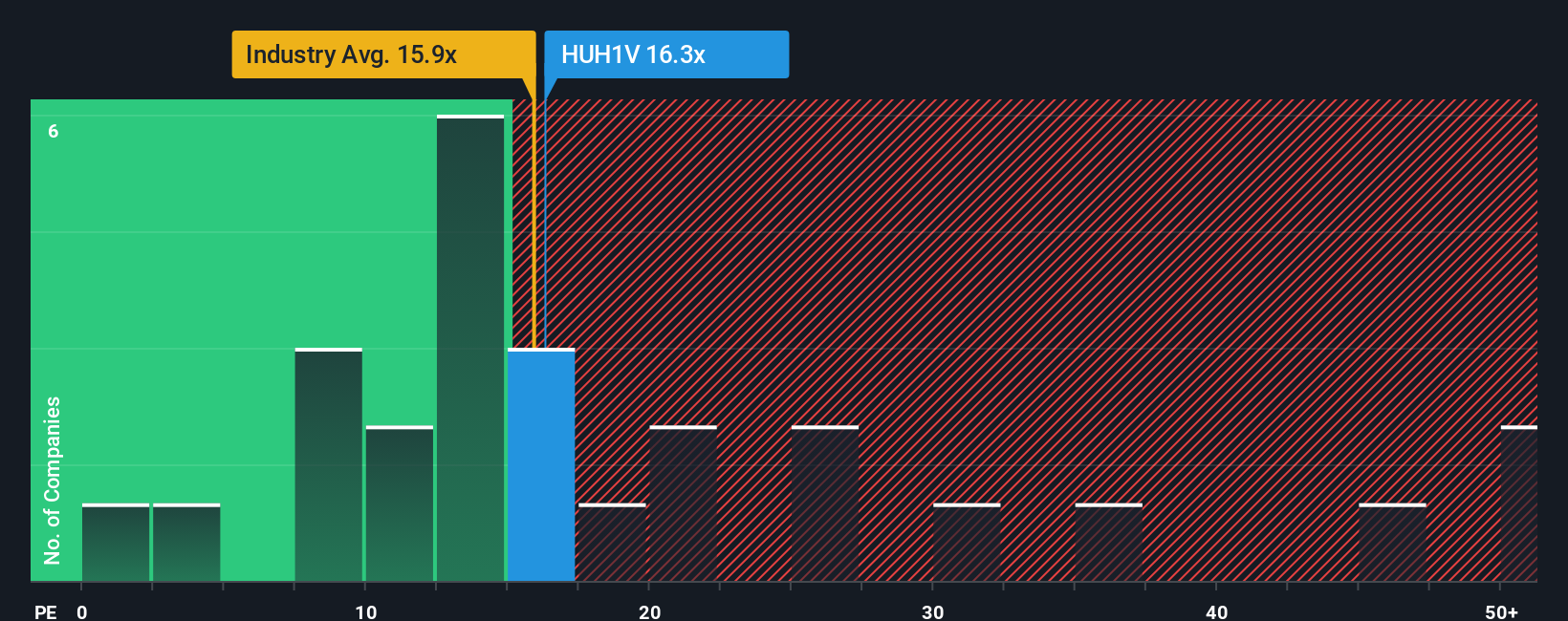

With a price-to-earnings (or "P/E") ratio of 16.3x Huhtamäki Oyj (HEL:HUH1V) may be sending bullish signals at the moment, given that almost half of all companies in Finland have P/E ratios greater than 21x and even P/E's higher than 31x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Huhtamäki Oyj has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Huhtamäki Oyj

Is There Any Growth For Huhtamäki Oyj?

In order to justify its P/E ratio, Huhtamäki Oyj would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. As a result, earnings from three years ago have also fallen 12% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the eleven analysts watching the company. That's shaping up to be similar to the 15% each year growth forecast for the broader market.

With this information, we find it odd that Huhtamäki Oyj is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Huhtamäki Oyj currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Huhtamäki Oyj, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Huhtamäki Oyj, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Huhtamäki Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:HUH1V

Huhtamäki Oyj

Provides packaging solutions in the United States, Germany, the United Kingdom, India, Turkey, Australia, Thailand, Poland, South Africa, Spain, Finland, and internationally.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives