- Philippines

- /

- Real Estate

- /

- PSE:CPG

Betolar Oyj Leads The Charge With 2 Intriguing Penny Stocks

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, with the U.S. Federal Reserve holding steady on interest rates while the European Central Bank opts for a rate cut to stimulate growth. Amidst these broader economic shifts, investors are increasingly exploring opportunities beyond traditional blue-chip stocks. Penny stocks, representing smaller or newer companies, continue to intrigue investors with their potential for growth and value despite the term's somewhat outdated connotation. In this article, we explore three penny stocks that stand out due to their financial resilience and potential long-term promise in today's market climate.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.69 | HK$42.39B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.89 | £482.95M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £178.85M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.10 | HK$698.27M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| China Lilang (SEHK:1234) | HK$3.92 | HK$4.69B | ★★★★★☆ |

Click here to see the full list of 5,728 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Betolar Oyj (HLSE:BETOLAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Betolar Oyj is a materials technology company focused on providing solutions to reduce CO2 emissions in the construction industry, with a market cap of €16.28 million.

Operations: The company's revenue is entirely derived from its construction materials segment, amounting to €0.66 million.

Market Cap: €16.28M

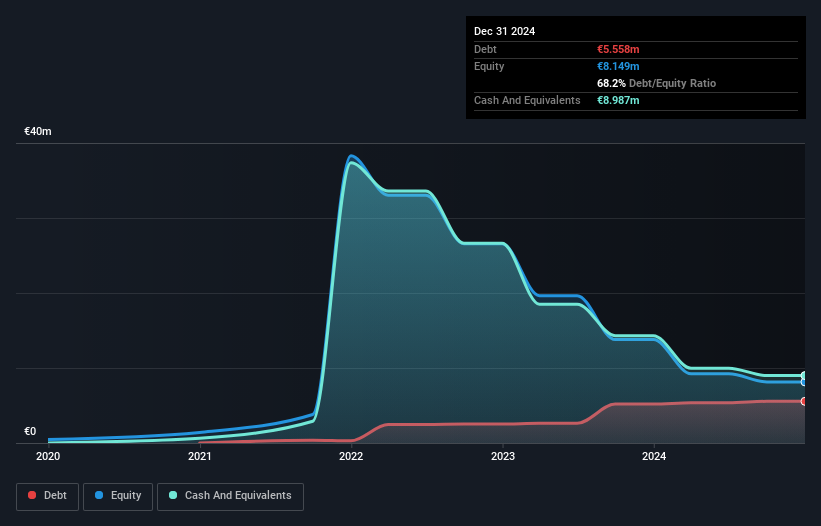

Betolar Oyj, a materials technology company, is currently pre-revenue with €0.66 million in revenue and a market cap of €16.28 million. Despite its unprofitability and high share price volatility, Betolar has made strategic moves to enhance its position in sustainable construction and mining industries. Recent collaborations include a three-year agreement with Consolis Parma for low-emission hollow core slabs production using Betolar's Geoprime® solution, which could potentially expand across 17 countries. Additionally, Betolar's partnership with Outokumpu aims to achieve carbon neutrality at the Kemi chrome mine by 2025 through innovative shotcrete solutions.

- Click here and access our complete financial health analysis report to understand the dynamics of Betolar Oyj.

- Evaluate Betolar Oyj's prospects by accessing our earnings growth report.

Century Properties Group (PSE:CPG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Century Properties Group, Inc., along with its subsidiaries, operates as a real estate company in the Philippines with a market capitalization of ₱5.10 billion.

Operations: The company's revenue is primarily derived from Real Estate Development, which generated ₱12.10 billion, followed by Leasing at ₱1.25 billion, and Hotel and Property Management contributing ₱533.15 million.

Market Cap: ₱5.1B

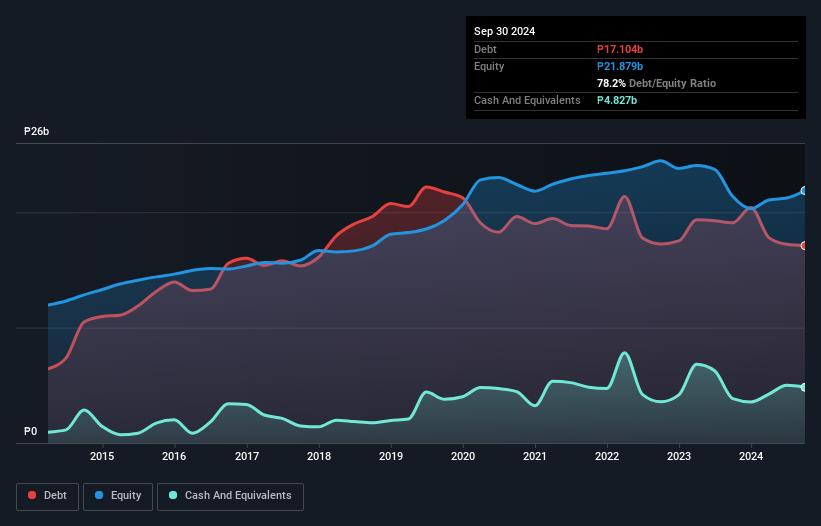

Century Properties Group, with a market cap of ₱5.10 billion, has demonstrated significant earnings growth, increasing by 163.6% over the past year and surpassing industry averages. The company's net profit margin improved to 15.7%, reflecting enhanced profitability. While its debt-to-equity ratio remains high at 56.1%, short-term assets comfortably cover both short and long-term liabilities. Recent board decisions include the declaration of cash dividends for preferred shares, indicating a commitment to shareholder returns despite an unstable dividend history for common shares. Earnings per share have increased significantly year-on-year, showcasing strong financial performance amidst sector challenges.

- Navigate through the intricacies of Century Properties Group with our comprehensive balance sheet health report here.

- Gain insights into Century Properties Group's past trends and performance with our report on the company's historical track record.

Polytec Holding (WBAG:PYT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Polytec Holding AG, with a market cap of €51.47 million, develops and manufactures plastic solutions for passenger cars, light commercial vehicles, commercial vehicles, and smart plastic and industrial applications.

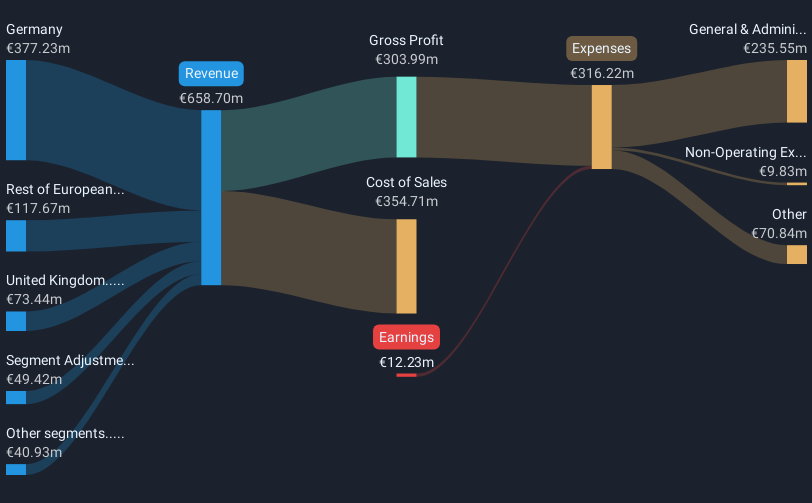

Operations: Polytec Holding's revenue from plastics processing amounts to €658.70 million.

Market Cap: €51.47M

Polytec Holding AG, with a market cap of €51.47 million, has shown some improvement in its financial performance despite ongoing challenges. The company reported increased sales for the third quarter and nine months ending September 2024 compared to the previous year. However, it remains unprofitable with a net loss of €4.69 million for the quarter and €7.04 million for the nine-month period. While its debt-to-equity ratio is high at 52.6%, short-term assets exceed both short and long-term liabilities, indicating decent liquidity management. The seasoned management team adds stability amidst high share price volatility and ongoing profitability issues.

- Unlock comprehensive insights into our analysis of Polytec Holding stock in this financial health report.

- Understand Polytec Holding's earnings outlook by examining our growth report.

Next Steps

- Discover the full array of 5,728 Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:CPG

Century Properties Group

Operates as a real estate company in the Philippines.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives