News Flash: Analysts Just Made A Captivating Upgrade To Their Olvi Oyj (HEL:OLVAS) Forecasts

Celebrations may be in order for Olvi Oyj (HEL:OLVAS) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

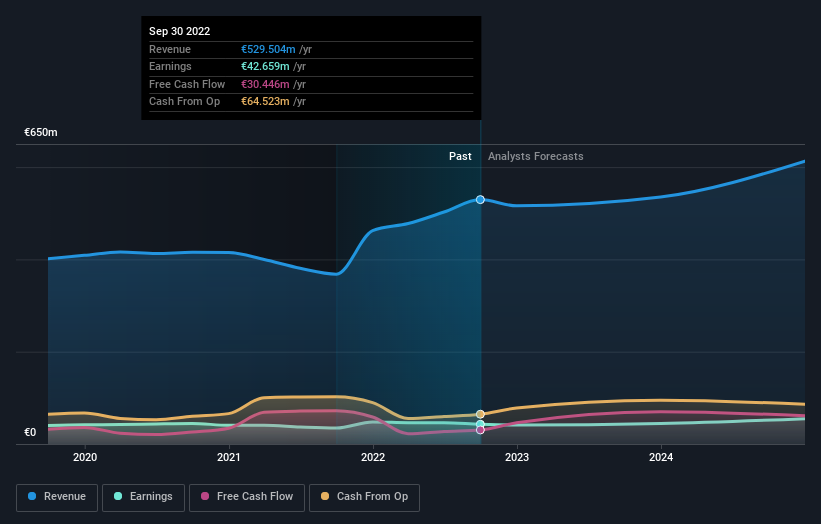

Following the latest upgrade, Olvi Oyj's two analysts currently expect revenues in 2023 to be €535m, approximately in line with the last 12 months. Statutory earnings per share are presumed to increase 3.7% to €2.14. Before this latest update, the analysts had been forecasting revenues of €467m and earnings per share (EPS) of €1.76 in 2023. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

Check out the opportunities and risks within the XX Beverage industry.

Despite these upgrades, the analysts have not made any major changes to their price target of €37.00, suggesting that the higher estimates are not likely to have a long term impact on what the stock is worth. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Olvi Oyj analyst has a price target of €39.00 per share, while the most pessimistic values it at €35.00. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting Olvi Oyj is an easy business to forecast or the underlying assumptions are obvious.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Olvi Oyj's revenue growth is expected to slow, with the forecast 0.8% annualised growth rate until the end of 2023 being well below the historical 6.6% p.a. growth over the last five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 5.6% annually. Factoring in the forecast slowdown in growth, it seems obvious that Olvi Oyj is also expected to grow slower than other industry participants.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for next year. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. The lack of change in the price target is puzzling, but with a serious upgrade to next year's earnings expectations, it might be time to take another look at Olvi Oyj.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2024, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:OLVAS

Olvi Oyj

A beverage company, manufactures and sells alcoholic and non-alcoholic beverages in Finland, Estonia, Latvia, Lithuania, Denmark, and Belarus.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives