Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Apetit Oyj (HEL:APETIT) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Apetit Oyj

How Much Debt Does Apetit Oyj Carry?

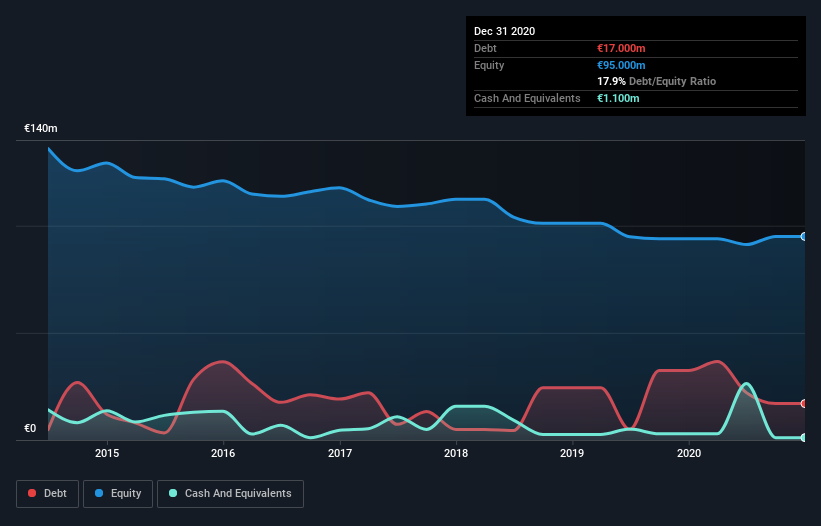

You can click the graphic below for the historical numbers, but it shows that Apetit Oyj had €17.0m of debt in December 2020, down from €32.4m, one year before. However, because it has a cash reserve of €1.10m, its net debt is less, at about €15.9m.

A Look At Apetit Oyj's Liabilities

According to the last reported balance sheet, Apetit Oyj had liabilities of €43.4m due within 12 months, and liabilities of €4.40m due beyond 12 months. Offsetting these obligations, it had cash of €1.10m as well as receivables valued at €14.7m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €32.0m.

Apetit Oyj has a market capitalization of €89.1m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

We'd say that Apetit Oyj's moderate net debt to EBITDA ratio ( being 1.8), indicates prudence when it comes to debt. And its commanding EBIT of 14.0 times its interest expense, implies the debt load is as light as a peacock feather. We also note that Apetit Oyj improved its EBIT from a last year's loss to a positive €4.2m. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Apetit Oyj can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Apetit Oyj actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

The good news is that Apetit Oyj's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. Looking at all the aforementioned factors together, it strikes us that Apetit Oyj can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Apetit Oyj you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Apetit Oyj or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:APETIT

Apetit Oyj

Manufactures and sells plant-based food products in Finland, Norway, Sweden, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives