Amid a challenging landscape marked by fresh U.S. trade tariffs and fluctuating consumer confidence, European markets have experienced volatility, with the STOXX Europe 600 Index ending the week lower. Despite this uncertainty, opportunities may exist in value stocks that are trading below their estimated worth, offering potential for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK49.30 | SEK96.82 | 49.1% |

| LPP (WSE:LPP) | PLN16295.00 | PLN31758.31 | 48.7% |

| Cenergy Holdings (ENXTBR:CENER) | €9.07 | €18.00 | 49.6% |

| BAWAG Group (WBAG:BG) | €93.90 | €182.92 | 48.7% |

| Net Insight (OM:NETI B) | SEK4.51 | SEK9.00 | 49.9% |

| Vimi Fasteners (BIT:VIM) | €0.985 | €1.95 | 49.5% |

| Cavotec (OM:CCC) | SEK17.40 | SEK33.94 | 48.7% |

| Wall to Wall Group (OM:WTW A) | SEK56.00 | SEK110.76 | 49.4% |

| BlueNord (OB:BNOR) | NOK605.00 | NOK1196.63 | 49.4% |

| HBX Group International (BME:HBX) | €9.76 | €18.96 | 48.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

CapMan Oyj (HLSE:CAPMAN)

Overview: CapMan Oyj is a leading Nordic private assets management and investment firm specializing in growth capital investments, industry consolidation, and various financing strategies across unquoted companies, real estate, and infrastructure sectors, with a market cap of €309.49 million.

Operations: CapMan Oyj generates revenue primarily through its Management Company Business, which accounts for €56.76 million, and its Service Business, contributing €0.27 million.

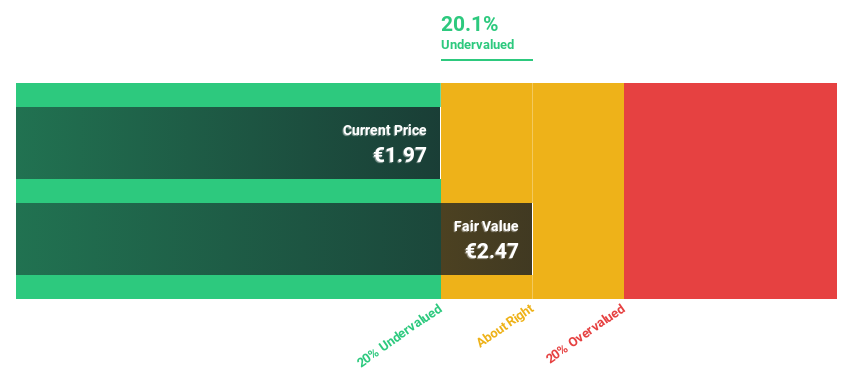

Estimated Discount To Fair Value: 29.7%

CapMan Oyj appears undervalued based on discounted cash flow analysis, trading over 20% below its estimated fair value of €2.49. Despite recent large one-off items affecting earnings quality, the company has become profitable with a notable increase in net income to €68.57 million from €1.35 million the previous year. Forecasted revenue and earnings growth rates of 8.4% and 29.19% per annum respectively surpass Finnish market averages, although dividend coverage remains weak against earnings or free cash flows.

- The analysis detailed in our CapMan Oyj growth report hints at robust future financial performance.

- Navigate through the intricacies of CapMan Oyj with our comprehensive financial health report here.

Deutsche Beteiligungs (XTRA:DBAN)

Overview: Deutsche Beteiligungs AG is a private equity and venture capital firm that focuses on direct and fund of fund investments, with a market cap of €423.68 million.

Operations: The company's revenue segments include Fund Investment Services generating €55.24 million and Private Equity Investments contributing -€137.61 million.

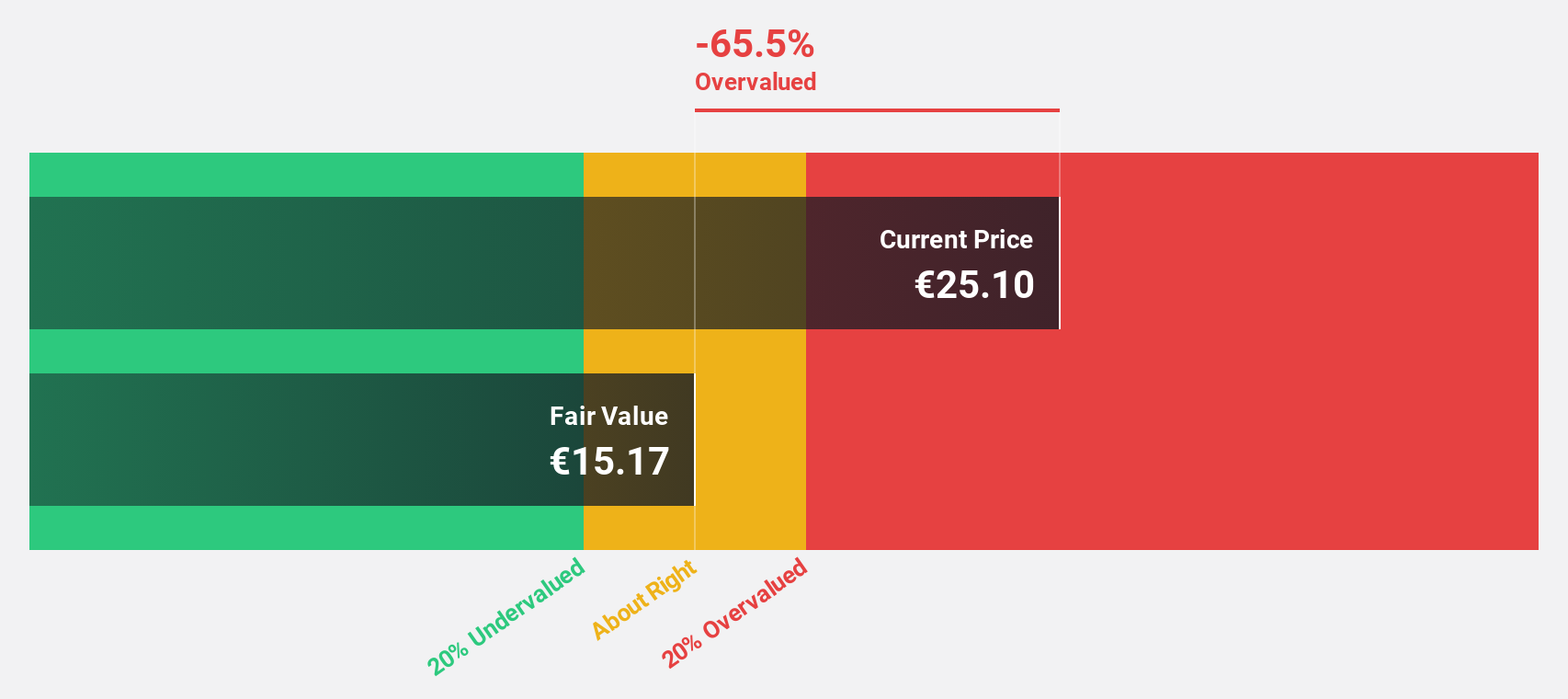

Estimated Discount To Fair Value: 45%

Deutsche Beteiligungs AG is trading significantly below its estimated fair value of €42.72, with a current price of €23.5, indicating potential undervaluation based on discounted cash flow analysis. Despite recent financial challenges, including a net loss of €35.23 million in Q4 2024 and negative revenue of €20.69 million, the company is expected to achieve profitability within three years and outpace the German market with forecasted annual revenue growth of 72.2%. However, its dividend yield remains unsustainable against earnings or free cash flows.

- The growth report we've compiled suggests that Deutsche Beteiligungs' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Deutsche Beteiligungs stock in this financial health report.

Formycon (XTRA:FYB)

Overview: Formycon AG is a biotechnology company that develops biosimilar drugs in Germany and Switzerland, with a market cap of €402.58 million.

Operations: The company's revenue primarily comes from its Drug Delivery Systems segment, which generated €69.67 million.

Estimated Discount To Fair Value: 45.9%

Formycon AG is trading at a significant discount to its estimated fair value of €42.13, with a current price of €22.8, suggesting undervaluation based on cash flow analysis. Despite reporting a net loss of €125.67 million for 2024, the company anticipates becoming profitable in three years and expects annual revenue growth of 18.4%, surpassing the German market's average growth rate. However, recent share price volatility could pose risks for investors focused on stability.

- Our expertly prepared growth report on Formycon implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Formycon with our detailed financial health report.

Summing It All Up

- Reveal the 192 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FYB

Formycon

A biotechnology company, develops biosimilar drugs in Germany and Switzerland.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives