- Finland

- /

- Capital Markets

- /

- HLSE:CAPMAN

CapMan Oyj (HEL:CAPMAN) Analysts Just Trimmed Their Revenue Forecasts By 5.9%

The analysts covering CapMan Oyj (HEL:CAPMAN) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

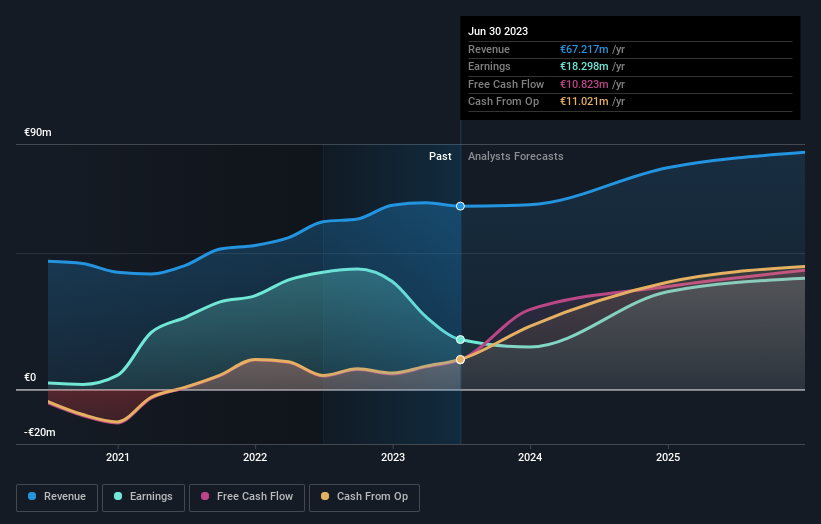

Following the downgrade, the current consensus from CapMan Oyj's three analysts is for revenues of €71m in 2023 which - if met - would reflect a reasonable 5.5% increase on its sales over the past 12 months. Statutory earnings per share are supposed to decline 15% to €0.098 in the same period. Before this latest update, the analysts had been forecasting revenues of €75m and earnings per share (EPS) of €0.16 in 2023. From this we can that analyst sentiment has definitely become more bearish after the latest update, leading to lower revenue forecasts and a pretty serious decline to earnings per share estimates.

View our latest analysis for CapMan Oyj

Despite the cuts to forecast earnings, there was no real change to the €2.85 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic CapMan Oyj analyst has a price target of €3.00 per share, while the most pessimistic values it at €2.70. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The period to the end of 2023 brings more of the same, according to the analysts, with revenue forecast to display 11% growth on an annualised basis. That is in line with its 14% annual growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 8.2% annually. So it's pretty clear that CapMan Oyj is forecast to grow substantially faster than its industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for CapMan Oyj. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on CapMan Oyj after today.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with CapMan Oyj's business, like recent substantial insider selling. For more information, you can click here to discover this and the 3 other concerns we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:CAPMAN

CapMan Oyj

A leading Nordic private assets management and investment firm with an active approach to value creation and private equity and venture capital firm specializing in growth capital investments, industry consolidation, special situations, turnaround, recapitalization, middle market buyouts, credit and mezzanine financing in unquoted companies, investments in value-add and income focused real estate, transportation, telecommunications infrastructure and investments in small and mid-cap companies.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.