- Finland

- /

- Professional Services

- /

- HLSE:FONDIA

Fondia Oyj's (HEL:FONDIA) Profits Appear To Have Quality Issues

Fondia Oyj's (HEL:FONDIA) healthy profit numbers didn't contain any surprises for investors. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

View our latest analysis for Fondia Oyj

A Closer Look At Fondia Oyj's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

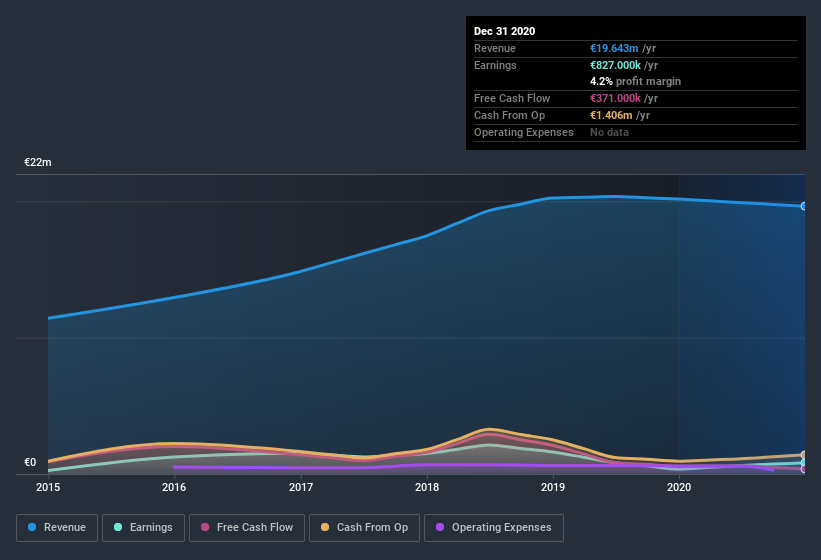

Over the twelve months to December 2020, Fondia Oyj recorded an accrual ratio of 0.86. Ergo, its free cash flow is significantly weaker than its profit. As a general rule, that bodes poorly for future profitability. Indeed, in the last twelve months it reported free cash flow of €371k, which is significantly less than its profit of €827.0k. Fondia Oyj shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months. The good news for shareholders is that Fondia Oyj's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Fondia Oyj's Profit Performance

As we discussed above, we think Fondia Oyj's earnings were not supported by free cash flow, which might concern some investors. For this reason, we think that Fondia Oyj's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. The silver lining is that its EPS growth over the last year has been really wonderful, even if it's not a perfect measure. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. When we did our research, we found 3 warning signs for Fondia Oyj (1 is a bit concerning!) that we believe deserve your full attention.

This note has only looked at a single factor that sheds light on the nature of Fondia Oyj's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Fondia Oyj or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:FONDIA

Fondia Oyj

Provides legal services primarily in Finland, Sweden, Estonia, and Lithuania.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives