- Finland

- /

- Commercial Services

- /

- HLSE:ESENSE

Enersense International Oyj's (HEL:ESENSE) Share Price Is Still Matching Investor Opinion Despite 26% Slump

The Enersense International Oyj (HEL:ESENSE) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

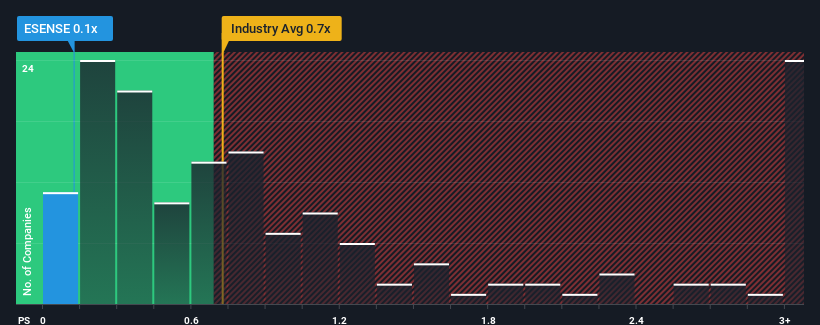

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Enersense International Oyj's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Commercial Services industry in Finland is also close to 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Enersense International Oyj

What Does Enersense International Oyj's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Enersense International Oyj has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Enersense International Oyj will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Enersense International Oyj?

In order to justify its P/S ratio, Enersense International Oyj would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. The strong recent performance means it was also able to grow revenue by 106% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 3.0% per annum during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 3.4% each year, which is not materially different.

With this in mind, it makes sense that Enersense International Oyj's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Enersense International Oyj's P/S

With its share price dropping off a cliff, the P/S for Enersense International Oyj looks to be in line with the rest of the Commercial Services industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Enersense International Oyj's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Enersense International Oyj you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Enersense International Oyj, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Enersense International Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:ESENSE

Enersense International Oyj

Provides energy solutions in Finland and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives