As European markets navigate the complexities of U.S. trade policy and economic shifts, recent developments have seen mixed returns across major indices. For investors exploring beyond established giants, penny stocks—despite their somewhat antiquated label—remain a compelling area of interest. These smaller or newer companies can offer unique growth opportunities when backed by solid financials, making them intriguing options for those seeking potential long-term gains.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.79 | SEK284.19M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.996 | €33.35M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.67 | €52.44M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK4.04 | SEK245.79M | ★★★★★★ |

| Deceuninck (ENXTBR:DECB) | €2.22 | €307.24M | ★★★★★★ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.38 | €23.9M | ★★★★★☆ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.08 | SEK1.99B | ★★★★☆☆ |

| IRCE (BIT:IRC) | €1.99 | €52.67M | ★★★★★★ |

| Riber (ENXTPA:ALRIB) | €3.10 | €64.95M | ★★★★★☆ |

| IMS (WSE:IMS) | PLN3.66 | PLN124.05M | ★★★★☆☆ |

Click here to see the full list of 431 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Nextedia (ENXTPA:ALNXT)

Simply Wall St Financial Health Rating: ★★★★☆☆

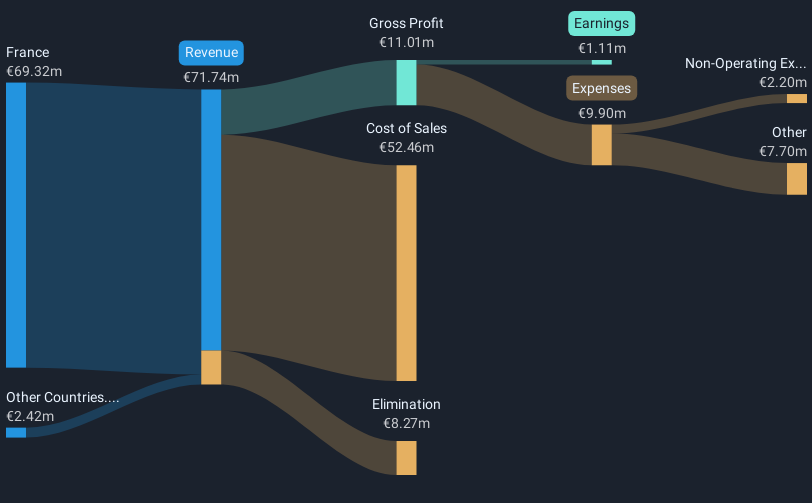

Overview: Nextedia S.A. operates in France, offering cybersecurity, cloud and digital workspace, and customer experience solutions with a market capitalization of €19.74 million.

Operations: The company generates its revenue from Direct Marketing, amounting to €63.47 million.

Market Cap: €19.74M

Nextedia S.A., with a market cap of €19.74 million, trades significantly below its estimated fair value and faces challenges such as negative earnings growth and volatile share prices. Despite this, the company maintains a satisfactory net debt to equity ratio of 1.3% and covers interest payments well with EBIT at 15.2 times coverage. However, operating cash flow remains negative, impacting debt coverage capabilities. While short-term assets exceed liabilities, profitability is hampered by a one-off €1.4 million loss in recent financials. The experienced board offers stability amid volatility, but earnings have declined over five years despite forecasted growth ahead.

- Get an in-depth perspective on Nextedia's performance by reading our balance sheet health report here.

- Learn about Nextedia's future growth trajectory here.

Tulikivi (HLSE:TULAV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tulikivi Corporation manufactures and sells fireplaces, sauna heaters, and interior decoration products in Finland, the United States, and Europe with a market cap of €29.28 million.

Operations: No specific revenue segments are reported for this company.

Market Cap: €29.28M

Tulikivi Corporation, with a market cap of €29.28 million, has faced challenges including negative earnings growth over the past year and declining profit margins from 8.1% to 3.5%. Despite these hurdles, the company maintains strong financial positioning with short-term assets exceeding both short and long-term liabilities, and debt levels have significantly decreased over five years. Earnings are forecasted to grow annually by 19.7%, aligning with expectations for improved net sales and operating profit in 2025. The experienced board and management team provide stability as Tulikivi trades below its estimated fair value, offering potential upside for investors mindful of risks associated with penny stocks.

- Click to explore a detailed breakdown of our findings in Tulikivi's financial health report.

- Evaluate Tulikivi's prospects by accessing our earnings growth report.

Getin Holding (WSE:GTN)

Simply Wall St Financial Health Rating: ★★★★☆☆

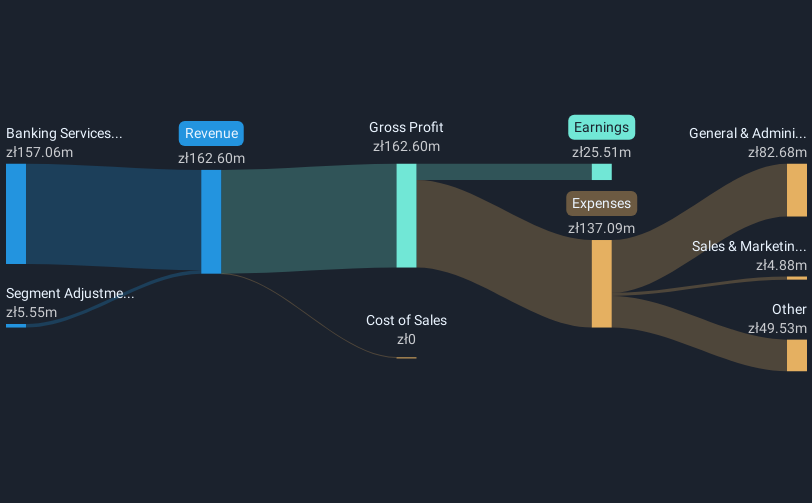

Overview: Getin Holding S.A. is a financial holding company involved in investment activities both in Poland and internationally, with a market cap of PLN122.97 million.

Operations: The company generates revenue from banking services in Ukraine, amounting to PLN157.06 million.

Market Cap: PLN122.97M

Getin Holding S.A., with a market cap of PLN122.97 million, has recently achieved profitability, demonstrating high-quality earnings and an outstanding return on equity of 41.3%. Its price-to-earnings ratio of 4.8x suggests it is undervalued compared to the Polish market average of 12.4x. The company’s financial structure is robust, with an appropriate loans to assets ratio and primarily low-risk funding from customer deposits. However, the sustainability of its dividend remains uncertain as it is not well covered by current or forecasted earnings. Despite limited data on management experience and bad loan allowances, Getin's stable weekly volatility indicates consistent performance in a volatile sector like penny stocks.

- Click here to discover the nuances of Getin Holding with our detailed analytical financial health report.

- Assess Getin Holding's previous results with our detailed historical performance reports.

Make It Happen

- Unlock our comprehensive list of 431 European Penny Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nextedia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALNXT

Nextedia

Provides cybersecurity, cloud and digital workspace, and customer experience solutions in France.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives