New Forecasts: Here's What Analysts Think The Future Holds For Raute Oyj (HEL:RAUTE)

Raute Oyj (HEL:RAUTE) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

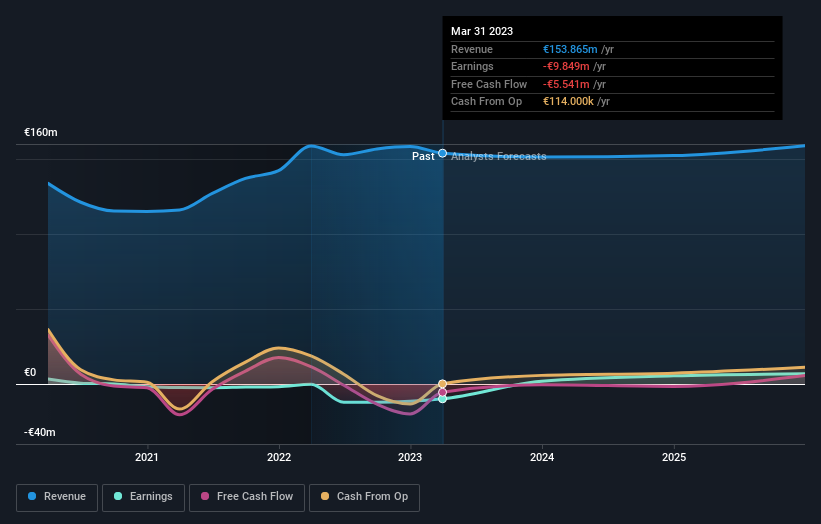

Following this upgrade, Raute Oyj's two analysts are forecasting 2023 revenues to be €151m, approximately in line with the last 12 months. The losses are expected to disappear over the next year or so, with forecasts for a profit of €0.40 per share this year. Before this latest update, the analysts had been forecasting revenues of €135m and earnings per share (EPS) of €0.36 in 2023. Sentiment certainly seems to have improved in recent times, with a decent improvement in revenue and a modest lift to earnings per share estimates.

Check out our latest analysis for Raute Oyj

Although the analysts have upgraded their earnings estimates, there was no change to the consensus price target of €11.00, suggesting that the forecast performance does not have a long term impact on the company's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Raute Oyj at €12.00 per share, while the most bearish prices it at €10.00. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

Of course, another way to look at these forecasts is to place them into context against the industry itself. One thing that stands out from these estimates is that revenues are expected to keep falling until the end of 2023, roughly in line with the historical decline of 2.7% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 3.3% per year. So while a broad number of companies are forecast to grow, unfortunately Raute Oyj is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, they also upgraded their revenue estimates, and are forecasting revenues to grow slower than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Raute Oyj.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2025, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:RAUTE

Raute Oyj

Operates as a technology and service company that serves the wood products industry in Europe, Africa, Finland, North America, South America, Russia, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives