- Finland

- /

- Construction

- /

- HLSE:LEHTO

If You Had Bought Lehto Group Oyj's (HEL:LEHTO) Shares Three Years Ago You Would Be Down 88%

Lehto Group Oyj (HEL:LEHTO) shareholders will doubtless be very grateful to see the share price up 42% in the last quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. The share price has sunk like a leaky ship, down 88% in that time. So it sure is nice to see a bit of an improvement. Of course the real question is whether the business can sustain a turnaround.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Lehto Group Oyj

Given that Lehto Group Oyj didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Lehto Group Oyj's revenue dropped 2.1% per year. That is not a good result. Having said that the 23% annualized share price decline highlights the risk of investing in unprofitable companies. This business clearly needs to grow revenues if it is to perform as investors hope. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

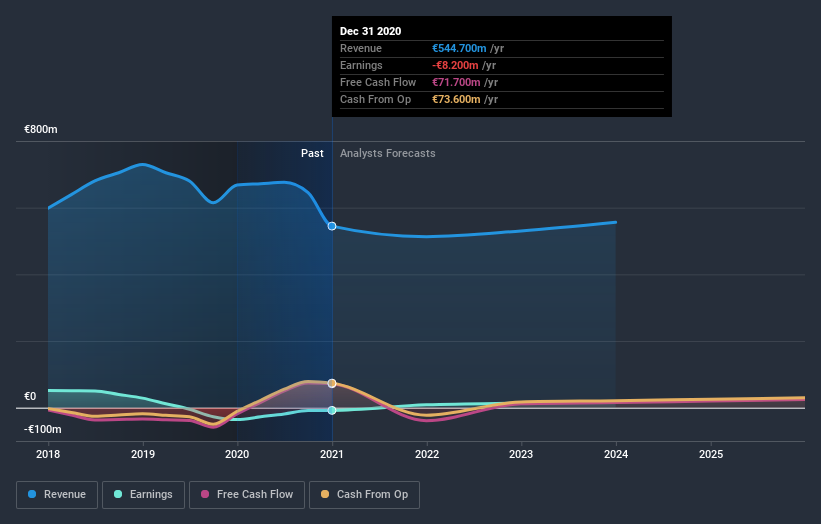

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Lehto Group Oyj stock, you should check out this free report showing analyst profit forecasts.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Lehto Group Oyj's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Lehto Group Oyj's TSR of was a loss of 84% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Lehto Group Oyj shareholders are down 6.3% for the year, but the broader market is up 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 22% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Lehto Group Oyj you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

If you’re looking to trade Lehto Group Oyj, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:LEHTO

Lehto Group Oyj

Lehto Group Oyj, together with its subsidiaries, engages in the construction and real estate business in Finland.

Good value with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives