- Denmark

- /

- Medical Equipment

- /

- CPSE:AMBU B

European Value Stocks That May Be Priced Below Intrinsic Estimates In April 2025

Reviewed by Simply Wall St

In April 2025, European markets are grappling with significant volatility following the imposition of higher-than-expected U.S. trade tariffs, which have led to notable declines in major indices such as the STOXX Europe 600 and Germany's DAX. Amidst this uncertainty, investors may find opportunities in stocks that appear undervalued relative to their intrinsic estimates, potentially offering a favorable risk-reward balance in a turbulent economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK48.885 | SEK97.65 | 49.9% |

| Zinzino (OM:ZZ B) | SEK141.20 | SEK279.83 | 49.5% |

| LPP (WSE:LPP) | PLN15495.00 | PLN30700.35 | 49.5% |

| ArcticZymes Technologies (OB:AZT) | NOK15.85 | NOK31.21 | 49.2% |

| Stille (OM:STIL) | SEK205.00 | SEK402.86 | 49.1% |

| 3U Holding (XTRA:UUU) | €1.42 | €2.79 | 49.1% |

| F-Secure Oyj (HLSE:FSECURE) | €1.688 | €3.31 | 49% |

| Fodelia Oyj (HLSE:FODELIA) | €7.00 | €13.91 | 49.7% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €7.32 | €14.57 | 49.7% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.45 | €6.79 | 49.2% |

We're going to check out a few of the best picks from our screener tool.

Ambu (CPSE:AMBU B)

Overview: Ambu A/S is a medical technology company that develops, produces, and sells medical devices to hospitals, clinics, and rescue services globally with a market cap of DKK31.14 billion.

Operations: The company's revenue is primarily derived from its Disposable Medical Products segment, which generated DKK5.65 billion.

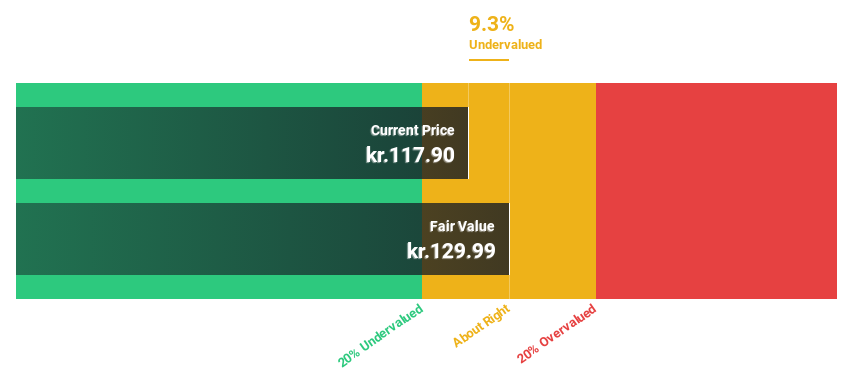

Estimated Discount To Fair Value: 10.6%

Ambu A/S is trading at DKK116.9, below its fair value estimate of DKK130.73, suggesting potential undervaluation based on cash flows. The company forecasts revenue growth of 11.1% annually, outpacing the Danish market's 8.8%. Recent earnings showed significant improvement with sales reaching DKK1.51 billion and net income rising to DKK183 million from a year ago's DKK92 million. However, return on equity is expected to remain low at 14.2% in three years.

- Our comprehensive growth report raises the possibility that Ambu is poised for substantial financial growth.

- Dive into the specifics of Ambu here with our thorough financial health report.

Kempower Oyj (HLSE:KEMPOWR)

Overview: Kempower Oyj is a company that manufactures and sells electric vehicle charging equipment and solutions for various vehicles across the Nordics, Europe, North America, and internationally, with a market cap of €621.03 million.

Operations: The company's revenue primarily comes from its electric equipment segment, which generated €223.70 million.

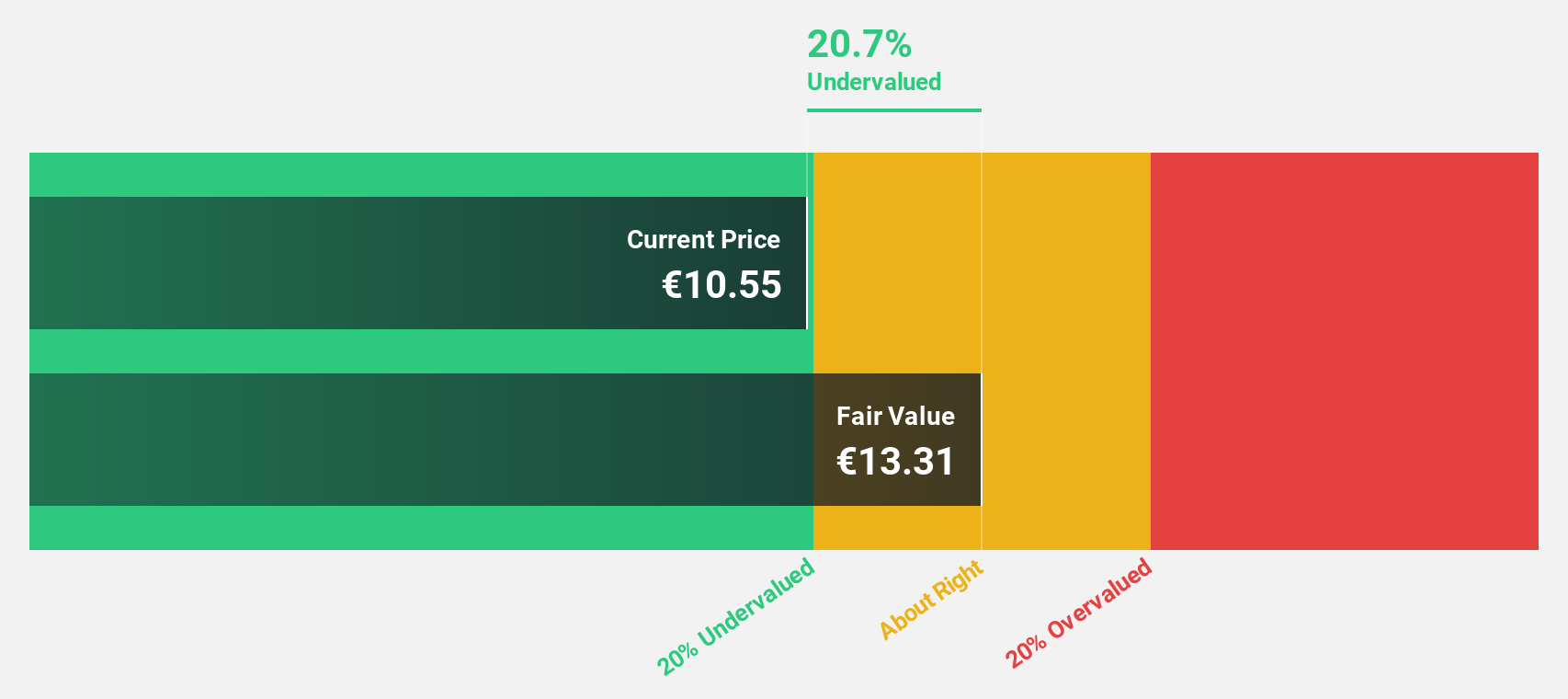

Estimated Discount To Fair Value: 19.7%

Kempower Oyj, trading at €11.23, is undervalued compared to its fair value estimate of €13.99. The company anticipates revenue growth of 19.4% annually, surpassing the Finnish market's 3.7%. Despite a challenging past year with a net loss of €23.2 million, Kempower forecasts significant profit improvement over the next three years and high return on equity at 22%. Recent leadership changes aim to bolster growth in North America and enhance strategic direction.

- The analysis detailed in our Kempower Oyj growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Kempower Oyj's balance sheet health report.

Better Collective (OM:BETCO)

Overview: Better Collective A/S is a digital sports media company operating in Europe, North America, and internationally with a market cap of SEK6.77 billion.

Operations: The company generates revenue through its digital sports media operations across Europe, North America, and other international markets.

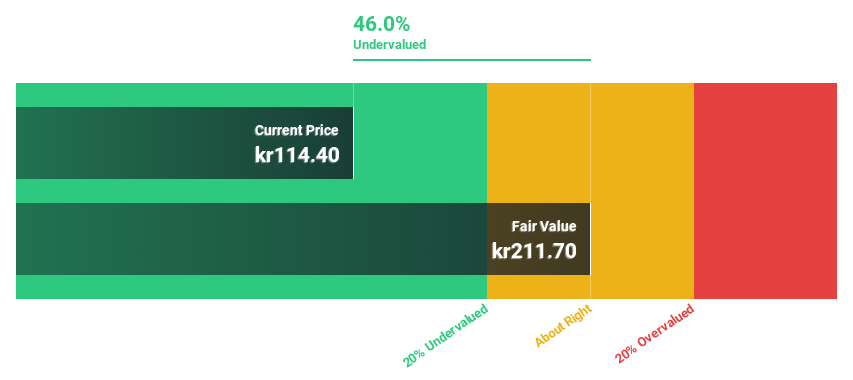

Estimated Discount To Fair Value: 47.3%

Better Collective, priced at SEK110.3, trades significantly below its fair value estimate of SEK209.18, indicating undervaluation based on cash flows. Despite a forecasted revenue growth of 4% annually, slower than the industry average but faster than the Swedish market's 0.7%, earnings are expected to grow significantly at 23.5% per year over the next three years. Recent financials show increased Q4 sales and net income compared to last year, though annual net income declined slightly.

- In light of our recent growth report, it seems possible that Better Collective's financial performance will exceed current levels.

- Get an in-depth perspective on Better Collective's balance sheet by reading our health report here.

Next Steps

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 189 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:AMBU B

Ambu

A medical technology company, develops, produces, and sells medical devices to hospitals, clinics, and rescue services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives