Do Oma Säästöpankki Oyj's (HEL:OMASP) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Oma Säästöpankki Oyj (HEL:OMASP). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Oma Säästöpankki Oyj

Oma Säästöpankki Oyj's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that Oma Säästöpankki Oyj has managed to grow EPS by 33% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

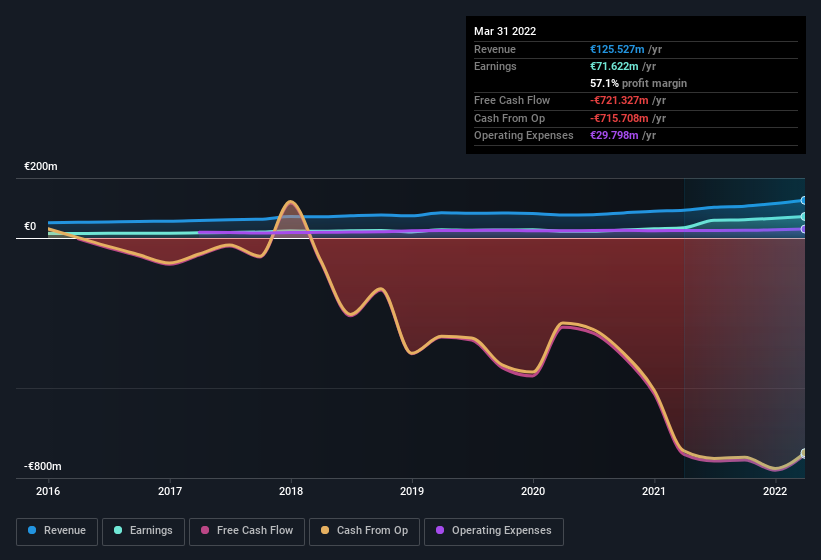

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Oma Säästöpankki Oyj's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Oma Säästöpankki Oyj's EBIT margins were flat over the last year, revenue grew by a solid 36% to €126m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Oma Säästöpankki Oyj's balance sheet strength, before getting too excited.

Are Oma Säästöpankki Oyj Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Oma Säästöpankki Oyj insiders have a significant amount of capital invested in the stock. Indeed, they hold €20m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 3.5% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Oma Säästöpankki Oyj Worth Keeping An Eye On?

You can't deny that Oma Säästöpankki Oyj has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. You still need to take note of risks, for example - Oma Säästöpankki Oyj has 1 warning sign we think you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:OMASP

Oma Säästöpankki Oyj

Provides banking products and services to private customers, small and medium-sized enterprises, and agriculture and forestry entrepreneurs in Finland.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives