Analyst Forecasts For Oma Säästöpankki Oyj (HEL:OMASP) Are Surging Higher

Oma Säästöpankki Oyj (HEL:OMASP) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects. The stock price has risen 8.2% to €13.85 over the past week, suggesting investors are becoming more optimistic. Could this big upgrade push the stock even higher?

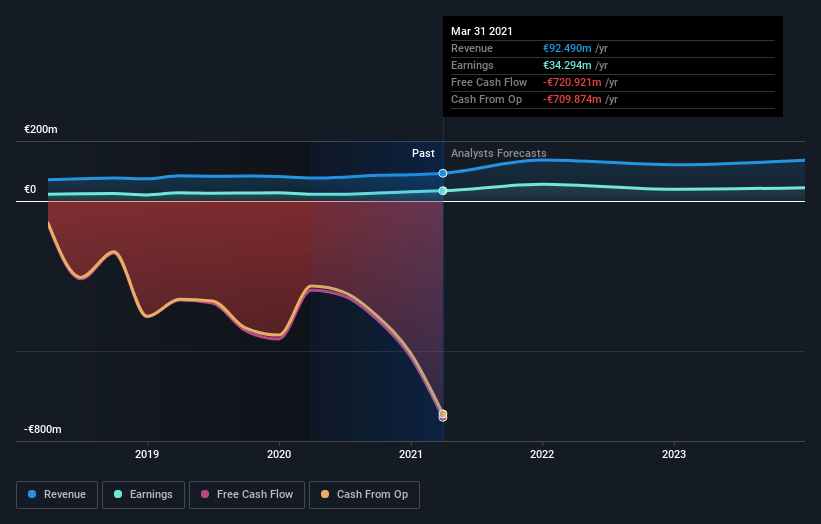

After the upgrade, the dual analysts covering Oma Säästöpankki Oyj are now predicting revenues of €137m in 2021. If met, this would reflect a huge 48% improvement in sales compared to the last 12 months. Per-share earnings are expected to bounce 63% to €1.89. Before this latest update, the analysts had been forecasting revenues of €115m and earnings per share (EPS) of €1.29 in 2021. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

View our latest analysis for Oma Säästöpankki Oyj

Although the analysts have upgraded their earnings estimates, there was no change to the consensus price target of €15.50, suggesting that the forecast performance does not have a long term impact on the company's valuation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Oma Säästöpankki Oyj's rate of growth is expected to accelerate meaningfully, with the forecast 69% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 11% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 4.6% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Oma Säästöpankki Oyj to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Some investors might be disappointed to see that the price target is unchanged, but we feel that improving fundamentals are usually a positive - assuming these forecasts are met! So Oma Säästöpankki Oyj could be a good candidate for more research.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 2 potential risk with Oma Säästöpankki Oyj, including concerns around earnings quality. You can learn more, and discover the 1 other risk we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:OMASP

Oma Säästöpankki Oyj

Provides banking products and services to private customers, small and medium-sized enterprises, and agriculture and forestry entrepreneurs in Finland.

Undervalued with mediocre balance sheet.