- Spain

- /

- Electric Utilities

- /

- BME:IBE

How Neoenergia’s Alto Paranaíba Milestone May Influence Iberdrola’s (BME:IBE) Long-Term Growth Story

Reviewed by Sasha Jovanovic

- Neoenergia, a subsidiary of Iberdrola, recently announced it is close to completing the Alto Paranaíba project, one of Brazil's largest electricity transmission undertakings, with 99% of towers constructed and all foundational work finished across Minas Gerais and São Paulo.

- This progress highlights Iberdrola's continued investment in essential energy infrastructure in Brazil, underscoring the company's global reach in transmission projects beyond its core European and US markets.

- We'll explore how Neoenergia's advancement on this major Brazilian grid project could influence Iberdrola's long-term growth narrative and outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Iberdrola Investment Narrative Recap

To be a shareholder in Iberdrola, you need to believe in its ability to expand and operate efficiently in global regulated electric networks while navigating evolving policy environments. The near-completion of the Alto Paranaíba project in Brazil signals ongoing execution in growth markets, but does not materially alter near-term risks, particularly surrounding the company’s reliance on favorable regulatory conditions and large-scale external financing.

Among recent announcements, Iberdrola’s €5 billion equity offering is most relevant, as it directly supports the group’s accelerating infrastructure developments including global transmission projects like Alto Paranaíba. This capital raise stands as a key catalyst to fund new investments, but also heightens sensitivity to shifts in credit markets and the cost of capital, both of which are crucial factors for sustaining future growth targets.

Yet in contrast to robust infrastructure progress, investors should be aware that exposure to regulatory changes across Iberdrola’s key markets could…

Read the full narrative on Iberdrola (it's free!)

Iberdrola's narrative projects €50.1 billion revenue and €7.0 billion earnings by 2028. This requires 3.7% yearly revenue growth and a €2.2 billion earnings increase from €4.8 billion today.

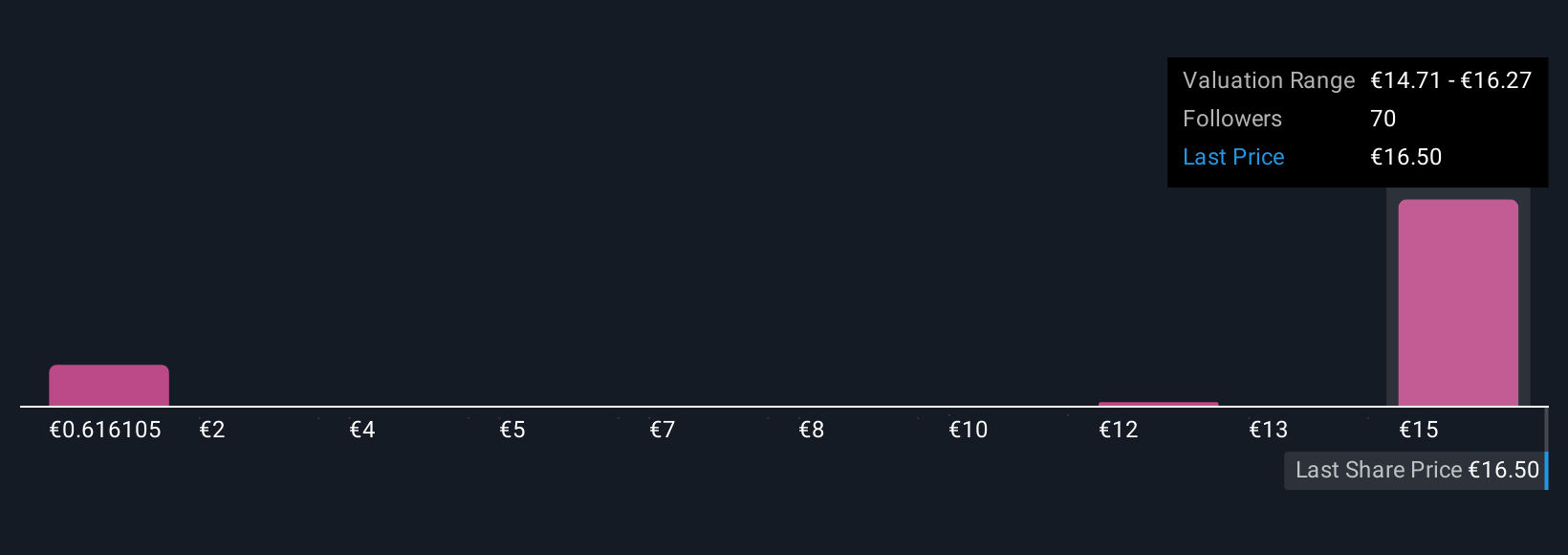

Uncover how Iberdrola's forecasts yield a €16.32 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Twelve fair value estimates from the Simply Wall St Community range widely from €0.51 to €16.42 per share. Many are focusing on Iberdrola’s exposure to regulatory risk and its potential impact on longer-term earnings and capital costs, highlighting how views on the company’s prospects can sharply differ.

Explore 12 other fair value estimates on Iberdrola - why the stock might be worth as much as €16.42!

Build Your Own Iberdrola Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iberdrola research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Iberdrola research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iberdrola's overall financial health at a glance.

No Opportunity In Iberdrola?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:IBE

Iberdrola

Engages in the generation, production, transmission, distribution, and supply of electricity in Spain, the United Kingdom, the United States, Mexico, Brazil, Germany, France, and Australia.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives