Last Update04 Sep 25

With consensus revenue growth forecasts steady at 3.7% and a modest decline in future P/E from 19.53x to 18.83x indicating slightly improved valuation, Iberdrola’s consensus analyst price target remains unchanged at €15.94.

What's in the News

- Iberdrola announced a private placement of common shares for gross proceeds of €5,016,000.

- The company completed and filed follow-on equity offerings totaling approximately €5 billion, with shares offered at €15.15.

- Iberdrola has hired Barclays to advise on the sale of its remaining Mexican power generation assets, aiming for a full exit from Mexico in a deal worth around €4 billion; several US infrastructure funds have shown interest.

- Iberdrola is in preliminary merger talks with OVO Energy to potentially create Britain's third-largest energy supplier.

- Pedro Azagra, previously CEO of Avangrid, has been appointed CEO of Iberdrola, S.A. by the Board and Executive Chairman Ignacio Galán.

Valuation Changes

Summary of Valuation Changes for Iberdrola

- The Consensus Analyst Price Target remained effectively unchanged, at €15.94.

- The Future P/E for Iberdrola has fallen slightly from 19.53x to 18.83x.

- The Consensus Revenue Growth forecasts for Iberdrola remained effectively unchanged, at 3.7% per annum.

Key Takeaways

- Expansion of regulated network assets and clean energy projects, backed by supportive policies, drives predictable revenue growth and higher margins.

- Strong financing and operational cash flow support ambitious investments, maintaining reliable dividends and reducing the need for new equity.

- Heavy reliance on regulated markets, partnership funding, and favorable regulation exposes Iberdrola to political, financial, and execution risks that threaten profitability and growth targets.

Catalysts

About Iberdrola- Engages in the generation, production, transmission, distribution, and supply of electricity in Spain, the United Kingdom, the United States, Mexico, Brazil, Germany, France, and Australia.

- Major expansion of regulated network investments in the US and UK, supported by stable and attractive policy frameworks and recently approved regulatory determinations, is expected to nearly triple Iberdrola's regulated asset base to €90bn by 2031. This should drive sustained, predictable growth in revenues and a structural increase in regulated net margins.

- Ongoing acceleration of grid modernization and digitalization-driven by enhanced incentives in the new regulatory regimes-will improve operational efficiency, reduce network losses, and boost EBITDA margins over time as these investments scale across core regions.

- A multi-year pipeline of large offshore wind and renewable projects in the US, UK, and continental Europe, backed by supportive government policies and long-term power purchase agreements, underpins forward-looking growth in clean generation capacity and future revenues.

- The electrification of transport, heating, and industrial sectors in both Europe and the US is expected to steadily raise electricity demand over the next decade, expanding Iberdrola's addressable market and enhancing long-term top-line and EBITDA growth prospects.

- Growing access to green finance, along with robust operational cash flow and a successful equity raise, ensures Iberdrola can fund its ambitious expansion with comfortable leverage and no need for additional equity until at least 2030, supporting sustained investment, future earnings growth, and reliability of dividend policies.

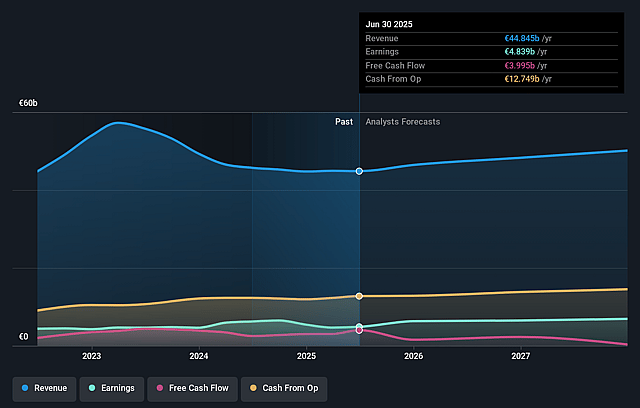

Iberdrola Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Iberdrola's revenue will grow by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.8% today to 14.0% in 3 years time.

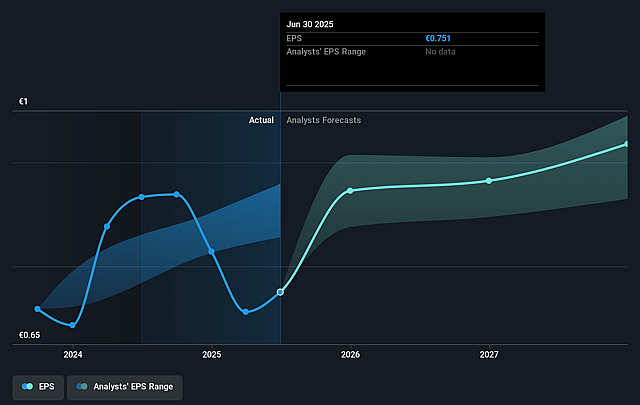

- Analysts expect earnings to reach €7.0 billion (and earnings per share of €1.06) by about September 2028, up from €4.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €6.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.5x on those 2028 earnings, down from 21.8x today. This future PE is greater than the current PE for the GB Electric Utilities industry at 15.1x.

- Analysts expect the number of shares outstanding to grow by 1.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.49%, as per the Simply Wall St company report.

Iberdrola Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Iberdrola's significant reliance on regulated markets-particularly in the U.K. and the U.S., which will account for approximately 75% of the regulated asset base by 2031-increases exposure to potential adverse changes in regulatory frameworks or political intervention, which could negatively impact allowed returns, pricing power, and future net margins.

- The company is undertaking a large €5 billion equity raise to fund an unprecedented acceleration in network investments, indicating heavy dependence on favorable capital market conditions and access to green financing; should macroeconomic conditions shift (e.g., rising interest rates or tighter credit), Iberdrola may face higher financing costs, pressuring future profitability and earnings growth.

- While Iberdrola's focus shifts to networks, growth in renewables investment is largely being maintained only through asset rotation and co-investment strategies; heavy reliance on these partnership and asset sale mechanisms to fund growth could expose the company to execution risk, dilution of returns, or subdued revenue growth if market appetite weakens or partners become scarce.

- Spanish regulatory uncertainty, as highlighted by ongoing concerns regarding investment caps, slow recognition of investment, and unfavorable draft proposals for network remuneration, suggests downside risks for Iberdrola's domestic regulated business, with potential impacts on revenue growth, cost recovery, and regional net margins.

- The group's rapidly expanding asset base and leverage (despite improved ratios post-asset rotation) could become a long-term financial risk if regulatory returns fail to keep pace with cost inflation, future rate hikes, or if investments face delays and overruns-collectively jeopardizing targets for EBITDA growth, net profit, and dividend sustainability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €15.944 for Iberdrola based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €18.5, and the most bearish reporting a price target of just €9.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €50.1 billion, earnings will come to €7.0 billion, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 7.5%.

- Given the current share price of €15.8, the analyst price target of €15.94 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.