- Spain

- /

- Electric Utilities

- /

- BME:HLZ

There's No Escaping Holaluz-Clidom, S.A.'s (BME:HLZ) Muted Revenues Despite A 42% Share Price Rise

Holaluz-Clidom, S.A. (BME:HLZ) shareholders are no doubt pleased to see that the share price has bounced 42% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 50% in the last twelve months.

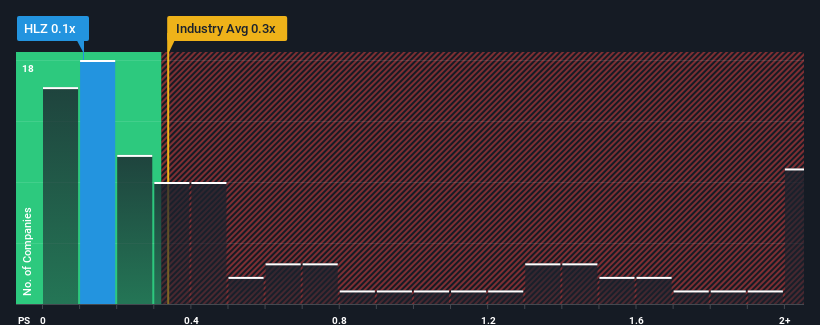

Even after such a large jump in price, when close to half the companies operating in Spain's Electric Utilities industry have price-to-sales ratios (or "P/S") above 0.7x, you may still consider Holaluz-Clidom as an enticing stock to check out with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Holaluz-Clidom

How Holaluz-Clidom Has Been Performing

Holaluz-Clidom could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Holaluz-Clidom will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Holaluz-Clidom's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. Even so, admirably revenue has lifted 189% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 15% per year as estimated by the dual analysts watching the company. Meanwhile, the broader industry is forecast to expand by 2.6% each year, which paints a poor picture.

In light of this, it's understandable that Holaluz-Clidom's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Holaluz-Clidom's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Holaluz-Clidom's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Holaluz-Clidom's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Holaluz-Clidom (of which 1 can't be ignored!) you should know about.

If these risks are making you reconsider your opinion on Holaluz-Clidom, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Holaluz-Clidom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:HLZ

Medium-low risk and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in