- Spain

- /

- Electric Utilities

- /

- BME:HLZ

Holaluz-Clidom, S.A.'s (BME:HLZ) Share Price Boosted 28% But Its Business Prospects Need A Lift Too

Holaluz-Clidom, S.A. (BME:HLZ) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

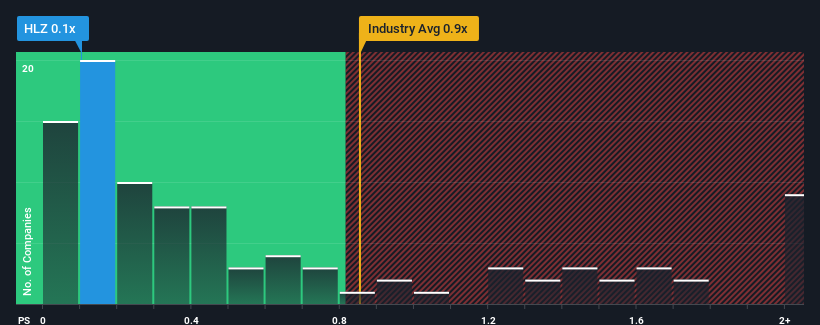

In spite of the firm bounce in price, it would still be understandable if you think Holaluz-Clidom is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in Spain's Electric Utilities industry have P/S ratios above 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Holaluz-Clidom

How Has Holaluz-Clidom Performed Recently?

Recent times haven't been great for Holaluz-Clidom as its revenue has been falling quicker than most other companies. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. You'd much rather the company improve its revenue performance if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Holaluz-Clidom's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Holaluz-Clidom?

In order to justify its P/S ratio, Holaluz-Clidom would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. Still, the latest three year period has seen an excellent 189% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to plummet, contracting by 13% each year during the coming three years according to the dual analysts following the company. Meanwhile, the broader industry is forecast to moderate by 0.8% per year, which indicates the company should perform poorly indeed.

With this in consideration, it's clear to us why Holaluz-Clidom's P/S isn't quite up to scratch with its industry peers. However, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Holaluz-Clidom's P/S

Despite Holaluz-Clidom's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Holaluz-Clidom's analyst forecasts revealed that its even shakier outlook against the industry is contributing factor to why its P/S is so low. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Typically when industry conditions are tough, there's a real risk of company revenues sliding further, which is a concern of ours in this case. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Holaluz-Clidom (including 1 which is concerning).

If these risks are making you reconsider your opinion on Holaluz-Clidom, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Holaluz-Clidom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:HLZ

Medium-low risk and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)