- Spain

- /

- Renewable Energy

- /

- BME:GRE

Grenergy Renovables, S.A. (BME:GRE) Analysts Just Cut Their EPS Forecasts Substantially

The latest analyst coverage could presage a bad day for Grenergy Renovables, S.A. (BME:GRE), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

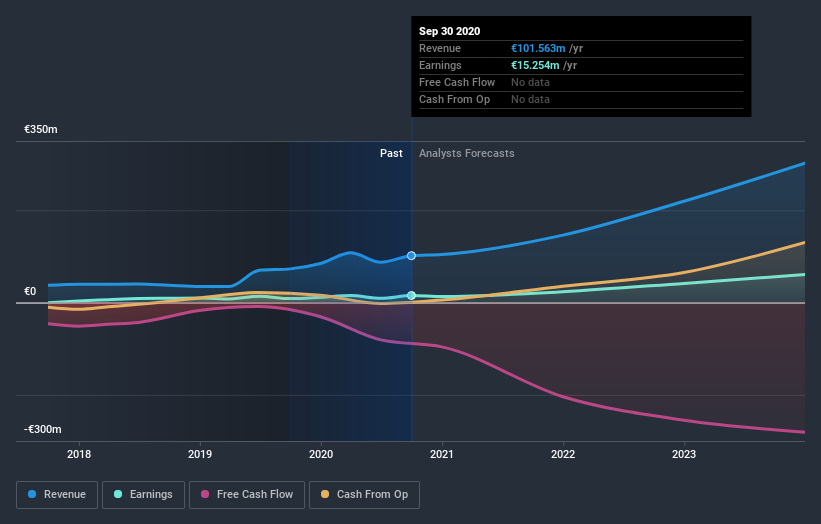

Following the downgrade, the most recent consensus for Grenergy Renovables from its dual analysts is for revenues of €104m in 2020 which, if met, would be an okay 2.4% increase on its sales over the past 12 months. Statutory earnings per share are supposed to decline 17% to €0.53 in the same period. Before this latest update, the analysts had been forecasting revenues of €139m and earnings per share (EPS) of €0.90 in 2020. It looks like analyst sentiment has declined substantially, with a pretty serious reduction to revenue estimates and a large cut to earnings per share numbers as well.

See our latest analysis for Grenergy Renovables

What's most unexpected is that the consensus price target rose 36% to €26.35, strongly implying the downgrade to forecasts is not expected to be more than a temporary blip. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Grenergy Renovables, with the most bullish analyst valuing it at €27.00 and the most bearish at €25.70 per share. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's pretty clear that there is an expectation that Grenergy Renovables' revenue growth will slow down substantially, with revenues next year expected to grow 2.4%, compared to a historical growth rate of 45% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 9.2% next year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Grenergy Renovables.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Grenergy Renovables. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. The rising price target is a puzzle, but still - with a serious cut to this year's outlook, we wouldn't be surprised if investors were a bit wary of Grenergy Renovables.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading Grenergy Renovables or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BME:GRE

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)