- Spain

- /

- Renewable Energy

- /

- BME:ANE

Corporación Acciona Energías Renovables, S.A.'s (BME:ANE) Price Is Right But Growth Is Lacking

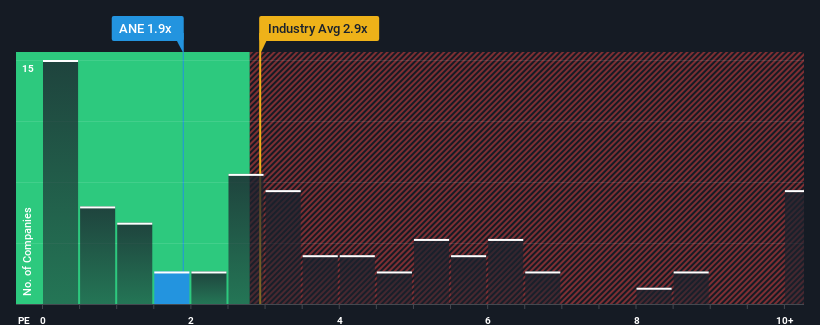

Corporación Acciona Energías Renovables, S.A.'s (BME:ANE) price-to-sales (or "P/S") ratio of 1.9x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Renewable Energy industry in Spain have P/S ratios greater than 3.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Corporación Acciona Energías Renovables

How Has Corporación Acciona Energías Renovables Performed Recently?

With revenue that's retreating more than the industry's average of late, Corporación Acciona Energías Renovables has been very sluggish. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Corporación Acciona Energías Renovables will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Corporación Acciona Energías Renovables' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. Still, the latest three year period has seen an excellent 55% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 4.4% each year during the coming three years according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 2.8% per annum, which paints a poor picture.

In light of this, it's understandable that Corporación Acciona Energías Renovables' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Corporación Acciona Energías Renovables' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Corporación Acciona Energías Renovables' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Corporación Acciona Energías Renovables has 3 warning signs (and 1 which is significant) we think you should know about.

If these risks are making you reconsider your opinion on Corporación Acciona Energías Renovables, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ANE

Corporación Acciona Energías Renovables

Corporación Acciona Energías Renovables, S.A.

Moderate with mediocre balance sheet.