- Spain

- /

- Electric Utilities

- /

- BME:ANA

Acciona (BME:ANA): Assessing Valuation Perspectives After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Acciona.

Momentum around Acciona's stock has been building, with the share price steadily climbing over recent months and supporting a 1-year total shareholder return of nearly 0.5%. Investors appear to be warming to the company, especially as its consistent performance signals renewed confidence in spite of the turbulent market environment.

If you're weighing what else could show strong momentum, it is a great moment to broaden your search and discover fast growing stocks with high insider ownership

This raises a key question for investors: is Acciona's recent share price strength signaling undervaluation and a potential buying window, or is everything already priced in due to optimistic growth expectations?

Most Popular Narrative: 14% Overvalued

With Acciona shares trading at €175.5, the most tracked analyst narrative sees fair value lower than the current market price. This perspective hinges on ambitious growth plans and sector-leading project execution, both of which set the tone for Acciona's outlook.

ACCIONA's infrastructure backlog reached an all-time high of €54 billion, providing a strong foundation for future revenue growth through large-scale projects and concession awards. This is expected to drive an increase in revenue and operating margins as projects come to fruition.

Curious about which financial assumptions make analysts set the fair value below today's share price? The narrative leans on major backlog growth, bolder margin projections, and a shifting sector landscape. Discover what key figures truly steer this valuation to get the full story inside.

Result: Fair Value of €154.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, policy changes or extended periods of renewable energy price weakness could pressure Acciona's earnings and challenge the bullish outlook reflected in current valuations.

Find out about the key risks to this Acciona narrative.

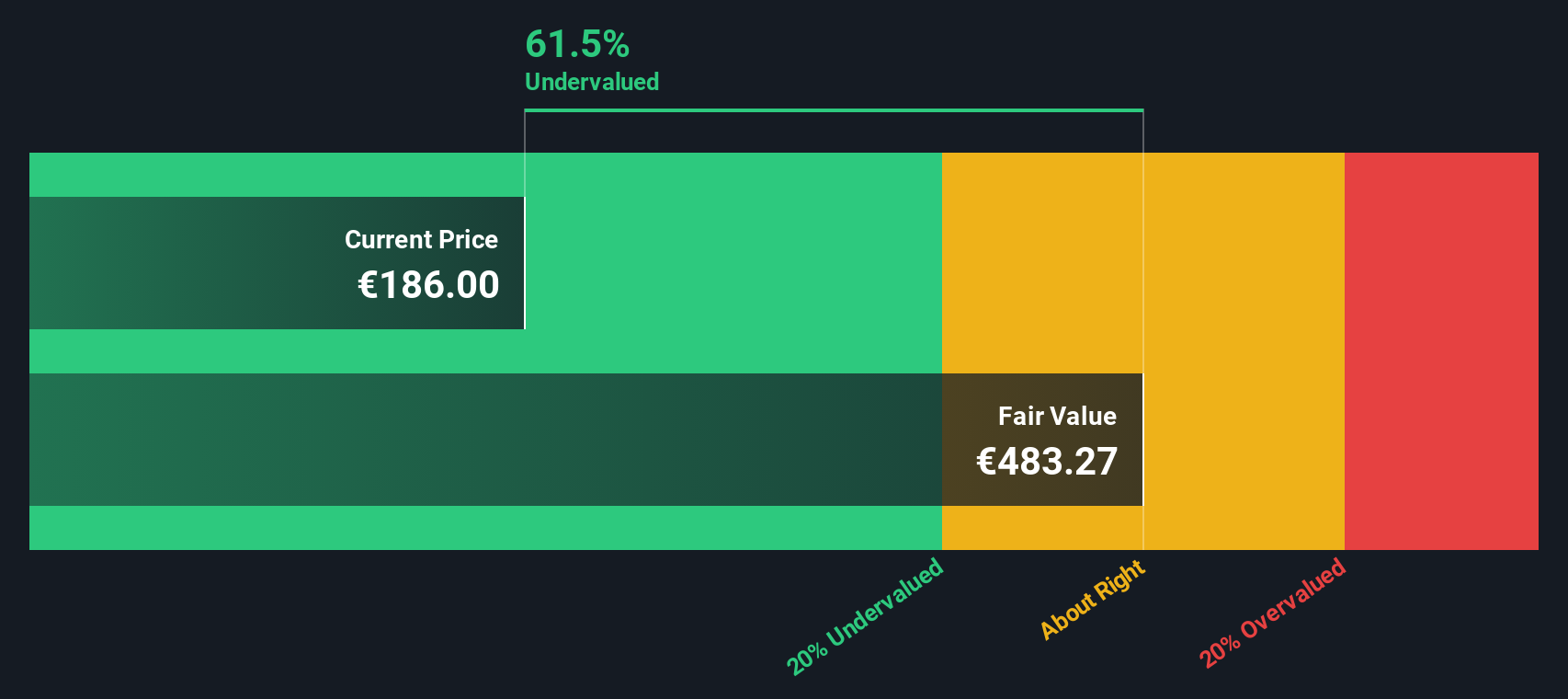

Another View: DCF Suggests Deep Undervaluation

While analysts' price targets suggest Acciona is overvalued, our SWS DCF model offers a starkly different perspective. According to this method, Acciona is trading well below its fair value, which implies significant undervaluation. Could market sentiment be missing a hidden opportunity here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Acciona for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Acciona Narrative

If you want to challenge these views or dive deeper into the numbers, you can easily craft your own analysis in just a few minutes with Do it your way.

A great starting point for your Acciona research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't settle for just one stock when the market is packed with unique opportunities. Get ahead of the crowd and secure your place among smart investors today.

- Capture income with stability and put your money to work by checking out these 19 dividend stocks with yields > 3%, which offers reliable dividend yields above 3%.

- Uncover the next wave of AI-driven innovations and position yourself early with these 24 AI penny stocks, powering tomorrow's technologies.

- Seize an edge in a transforming financial landscape by researching these 78 cryptocurrency and blockchain stocks at the forefront of blockchain and cryptocurrency advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ANA

Acciona

Engages in the energy, infrastructure, and other businesses in Spain and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion