- Spain

- /

- Infrastructure

- /

- BME:AENA

Assessing Aena (BME:AENA): Is the Recent Share Price Drop Creating an Undervalued Opportunity?

Reviewed by Kshitija Bhandaru

If you’re keeping an eye on Aena S.M.E (BME:AENA), the past week probably caught your attention. Shares declined about 5.5%, reflecting a broader slide among global airport operators. The pullback seems to be driven by shifting sentiment toward travel demand and uncertainty around infrastructure spending, two issues central to Aena’s business. It has sparked some tough questions for investors debating whether this is a passing setback or something more structural.

This recent dip stands out against the stock’s longer-term trend. Over the past year, Aena has delivered an impressive 18% return and is up 14% year-to-date, hinting at underlying momentum. Revenue and profit have continued to rise modestly, even as the sector faces evolving regulatory and market backdrops in Europe. However, this month’s drop interrupts that streak just as investors were beginning to warm up to infrastructure plays again.

Does the current weakness signal a genuine buying opportunity, or is the market already assuming further growth ahead for Aena S.M.E? Let’s take a closer look at the valuation story behind the headlines.

Most Popular Narrative: 5.3% Undervalued

The leading valuation view suggests that Aena S.M.E shares are modestly undervalued, with a fair value calculation forecasting upside potential compared to the current market price.

Ongoing expansion and modernization initiatives, including large-scale capital expenditures for airport terminals, commercial space build-out, and logistics, position Aena to capture both rising passenger traffic and higher retail and real estate income in future years. These factors are seen as supporting long-term revenue growth and improved operational leverage.

If you want to discover what is fueling these bullish predictions, pay close attention. The full narrative reveals the bold growth scenarios and ambitious profitability improvements behind this valuation. Get ready to see which key financial drivers are assumed to power Aena’s next leg higher. You might be surprised by how aggressive the outlook gets.

Result: Fair Value of €24.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory uncertainty in Spain and rising competition from high-speed rail could quickly challenge Aena’s ambitious growth outlook.

Find out about the key risks to this Aena S.M.E narrative.Another View: Challenging the Upside

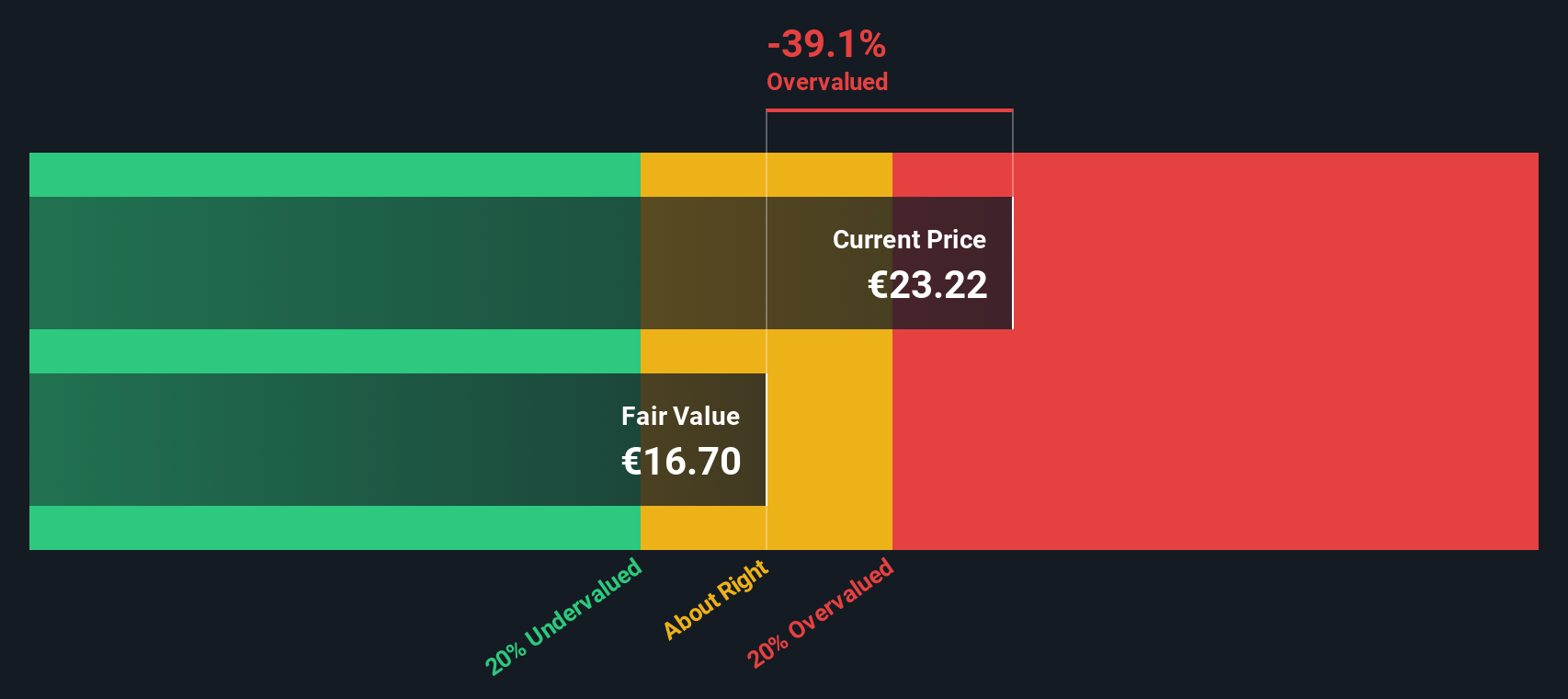

Our DCF model, however, offers a much less optimistic picture and suggests Aena shares could be overvalued relative to their long-term cash flow prospects. Which method provides the most accurate assessment for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aena S.M.E for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aena S.M.E Narrative

If you have a different perspective or want to investigate the details in your own way, there is nothing stopping you from building your own view. It only takes a few minutes to get started, so why not: Do it your way.

A great starting point for your Aena S.M.E research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Your next winning move could be just a click away. Don’t let opportunity pass you by. Expand your research with strong, unique ideas sourced by Simply Wall Street.

- Boost your passive income and tap into reliable market returns by checking out dividend stocks offering yields above 3% with a single click: dividend stocks with yields > 3%.

- Capitalize on the next big growth story in healthcare tech by scouting companies at the forefront of artificial intelligence in medicine: healthcare AI stocks.

- Unlock hidden value and seize potential bargains as you browse under-the-radar stocks featuring compelling cash flow metrics: undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:AENA

Aena S.M.E

Engages in the management of airports in Spain, Brazil, the United Kingdom, Mexico, and Colombia.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026