- Spain

- /

- Telecom Services and Carriers

- /

- BME:TEF

Little Excitement Around Telefónica, S.A.'s (BME:TEF) Revenues

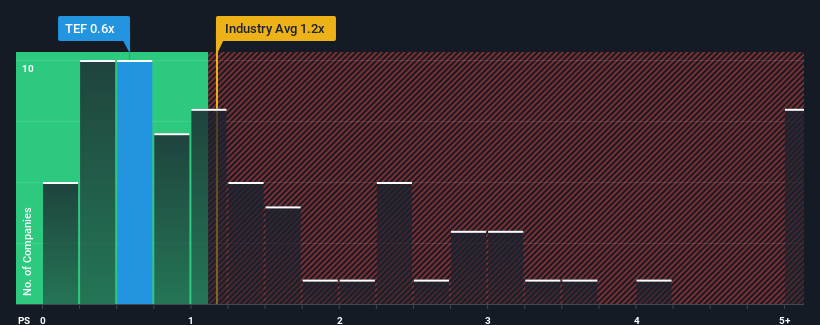

When you see that almost half of the companies in the Telecom industry in Spain have price-to-sales ratios (or "P/S") above 1.2x, Telefónica, S.A. (BME:TEF) looks to be giving off some buy signals with its 0.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Telefónica

What Does Telefónica's P/S Mean For Shareholders?

Recent revenue growth for Telefónica has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Telefónica will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Telefónica will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Telefónica would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 2.5% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 0.6% each year during the coming three years according to the analysts following the company. With the industry predicted to deliver 3.1% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Telefónica's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Telefónica's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Telefónica's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Telefónica (1 shouldn't be ignored) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Telefónica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:TEF

Telefónica

Provides telecommunications services in Europe and Latin America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives