Indra Sistemas' (BME:IDR) three-year earnings growth trails the 30% YoY shareholder returns

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. To wit, the Indra Sistemas, S.A. (BME:IDR) share price has flown 111% in the last three years. Most would be happy with that. Also pleasing for shareholders was the 12% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for Indra Sistemas

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

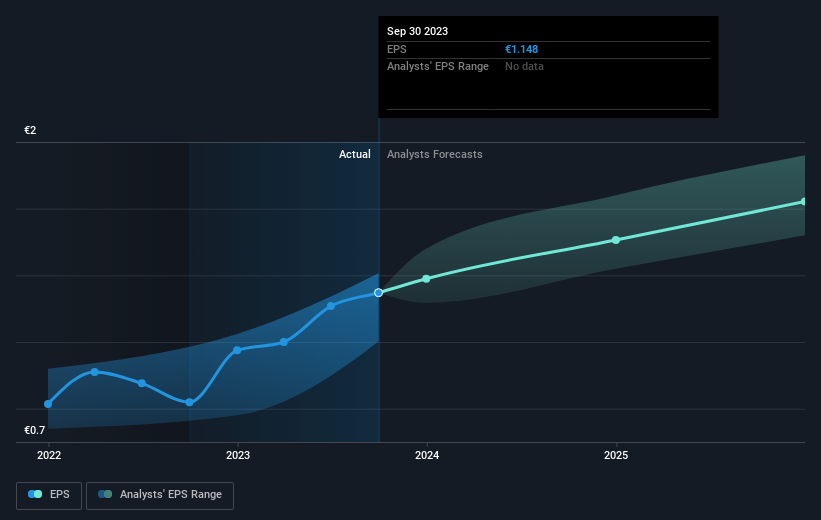

During three years of share price growth, Indra Sistemas achieved compound earnings per share growth of 99% per year. This EPS growth is higher than the 28% average annual increase in the share price. So one could reasonably conclude that the market has cooled on the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Indra Sistemas has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Indra Sistemas' financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Indra Sistemas' TSR for the last 3 years was 118%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Indra Sistemas shareholders have received a total shareholder return of 48% over the last year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 10% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Is Indra Sistemas cheap compared to other companies? These 3 valuation measures might help you decide.

We will like Indra Sistemas better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Spanish exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:IDR

Indra Sistemas

Operates as a technology and consulting company for aerospace, defense, and mobility business worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion