Indra Sistemas (BME:IDR): Assessing Valuation After Strong Financial Growth and Strategic Innovation Push

Reviewed by Simply Wall St

Recent performance and strategic momentum

Indra Sistemas (BME:IDR) is back on many investors radar after a run of stronger quarters, with rising sales, higher net income and a clear push into innovation through acquisitions and leadership changes.

See our latest analysis for Indra Sistemas.

Despite a choppy last month with an 8.66 percent 1 month share price return decline, Indra’s 90 day share price gain of 32.03 percent and 1 year total shareholder return of 176.68 percent indicate that momentum is still firmly building from a longer term perspective.

If Indra’s surge has you rethinking the sector, this could be a good moment to scan other aerospace and defense names using our aerospace and defense stocks as potential next ideas.

With profits climbing, innovation accelerating and the share price already up sharply, is Indra still trading below what its fundamentals justify, or are investors now fully pricing in the company’s next leg of growth?

Most Popular Narrative: 10.6% Undervalued

With the narrative fair value set at €51.18 against a last close of €45.76, the story leans toward upside that hinges on specific long term growth levers.

The substantial acceleration of defense spending in Spain and across Europe, including the EU's ReArm Europe Plan and multi-year national budgets focused on strategic autonomy and onshoring of defense manufacturing, is set to drive a material expansion of Indra's order book and recurring revenue base, supporting robust long-term revenue growth and increased visibility.

Curious how this order pipeline, projected revenue lift, future margins and a richer earnings multiple all connect to that higher fair value? The narrative lays out a detailed roadmap of growth, profitability and rerating assumptions that go far beyond headline numbers.

Result: Fair Value of €51.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should watch for budget shifts in European defense spending, as well as execution risks on complex, long cycle contracts that could pressure margins and growth.

Find out about the key risks to this Indra Sistemas narrative.

Another View on Valuation

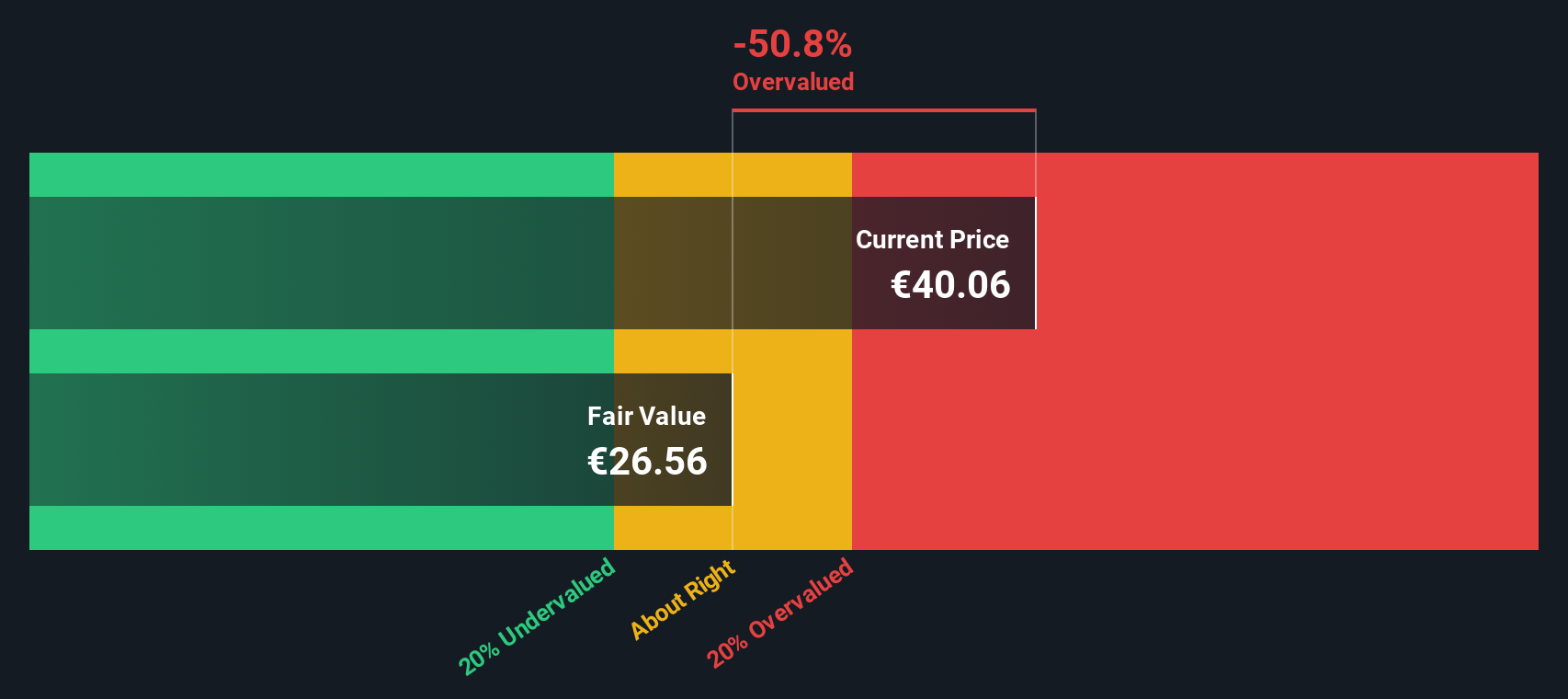

Our SWS DCF model paints a far less optimistic picture, putting Indra’s fair value closer to €22.68, which is well below the current €45.76 share price. If cash flows are right and growth cools, is today’s optimism setting up future downside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Indra Sistemas for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Indra Sistemas Narrative

If you see the numbers differently or prefer to dig into the data yourself, you can build a personalized story in just minutes: Do it your way.

A great starting point for your Indra Sistemas research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall St Screener to quickly surface fresh stocks that match your strategy before the market catches on.

- Capture potential bargain opportunities by scanning these 909 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully recognized yet.

- Capitalize on AI disruption by targeting these 26 AI penny stocks that are building real products and revenues around machine learning and automation.

- Boost your income potential by focusing on these 13 dividend stocks with yields > 3% that combine attractive yields with the capacity to sustain and grow payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:IDR

Indra Sistemas

Operates as a technology and consulting company for aerospace, defense, and mobility business worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion