- Spain

- /

- Real Estate

- /

- BME:UBS

The Urbas Grupo Financiero (BME:UBS) Share Price Has Gained 143%, So Why Not Pay It Some Attention?

Unless you borrow money to invest, the potential losses are limited. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Urbas Grupo Financiero, S.A. (BME:UBS) share price has soared 143% return in just a single year. Better yet, the share price has gained 173% in the last quarter. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for Urbas Grupo Financiero

We don't think that Urbas Grupo Financiero's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last twelve months, Urbas Grupo Financiero's revenue grew by 876%. That's well above most other pre-profit companies. And the share price has responded, gaining 143% as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

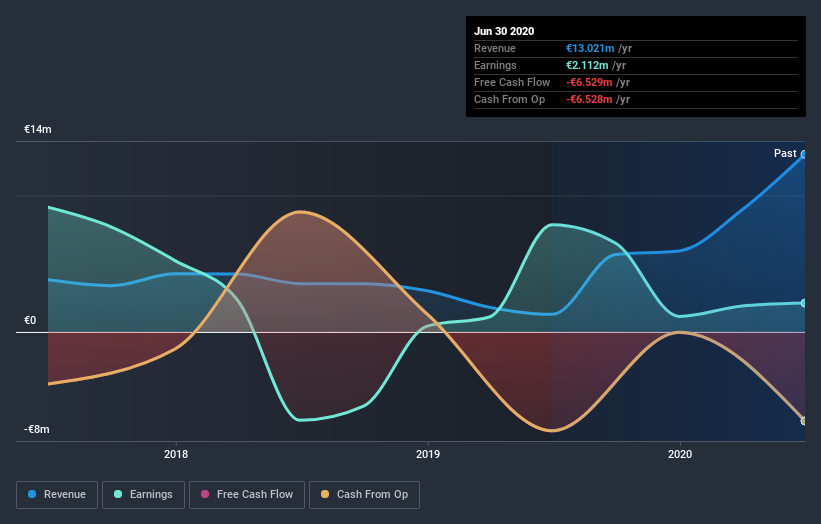

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Urbas Grupo Financiero shareholders have received a total shareholder return of 143% over the last year. That's better than the annualised return of 8% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Urbas Grupo Financiero you should be aware of, and 1 of them is a bit concerning.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you decide to trade Urbas Grupo Financiero, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BME:UBS

Urbas Grupo Financiero

Engages in the real estate business in Spain, Portugal, Algeria, and Latin America.

Adequate balance sheet low.