- Spain

- /

- Real Estate

- /

- BME:ISUR

If You Like EPS Growth Then Check Out Inmobiliaria del Sur (BME:ISUR) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Inmobiliaria del Sur (BME:ISUR). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Inmobiliaria del Sur

Inmobiliaria del Sur's Improving Profits

In the last three years Inmobiliaria del Sur's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Inmobiliaria del Sur's EPS shot from €0.53 to €1.26, over the last year. Year on year growth of 138% is certainly a sight to behold.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Unfortunately, Inmobiliaria del Sur's revenue dropped 19% last year, but the silver lining is that EBIT margins improved from 10% to 24%. That falls short of ideal.

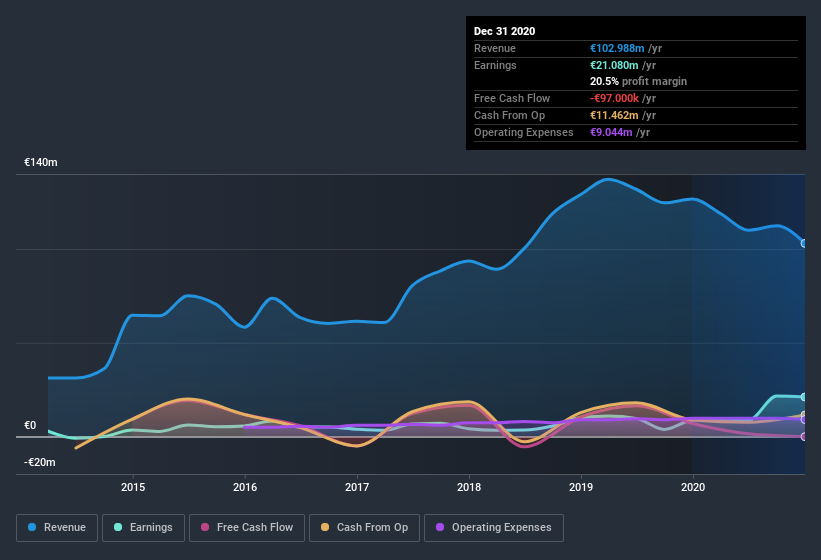

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Inmobiliaria del Sur is no giant, with a market capitalization of €132m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Inmobiliaria del Sur Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Inmobiliaria del Sur shares worth a considerable sum. Indeed, they hold €11m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 8.2% of the company; visible skin in the game.

Should You Add Inmobiliaria del Sur To Your Watchlist?

Inmobiliaria del Sur's earnings have taken off like any random crypto-currency did, back in 2017. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So to my mind Inmobiliaria del Sur is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Inmobiliaria del Sur (2 can't be ignored) you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Inmobiliaria del Sur, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:ISUR

Inmobiliaria del Sur

Operates as a property development and management company in Spain.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives