- Spain

- /

- Real Estate

- /

- BME:REN

European Penny Stocks To Consider In December 2025

Reviewed by Simply Wall St

As the European markets continue to show strength, with the STOXX Europe 600 Index climbing 2.35% and major single-country indexes also seeing gains, investors are keenly observing the economic landscape. Amidst this backdrop of relatively subdued inflation and strategic fiscal adjustments, opportunities for growth remain a focal point for market participants. While 'penny stocks' might seem like a term from past trading eras, these smaller or newer companies can still offer significant potential when backed by solid financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.65 | €82.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €0.985 | €14.63M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.98 | €27.36M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.95M | ✅ 3 ⚠️ 3 View Analysis > |

| Enervit (BIT:ENV) | €3.84 | €68.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.04 | €64.48M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.385 | €387.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.27 | €313.76M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.798 | €26.72M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 278 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Renta Corporación Real Estate (BME:REN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Renta Corporación Real Estate, S.A. is a real estate company focused on acquiring, rehabilitating, and selling properties in Barcelona and Madrid, Spain, with a market cap of €23.31 million.

Operations: The company's revenue is primarily generated from its Transactional Business segment, which accounts for €25.45 million.

Market Cap: €23.31M

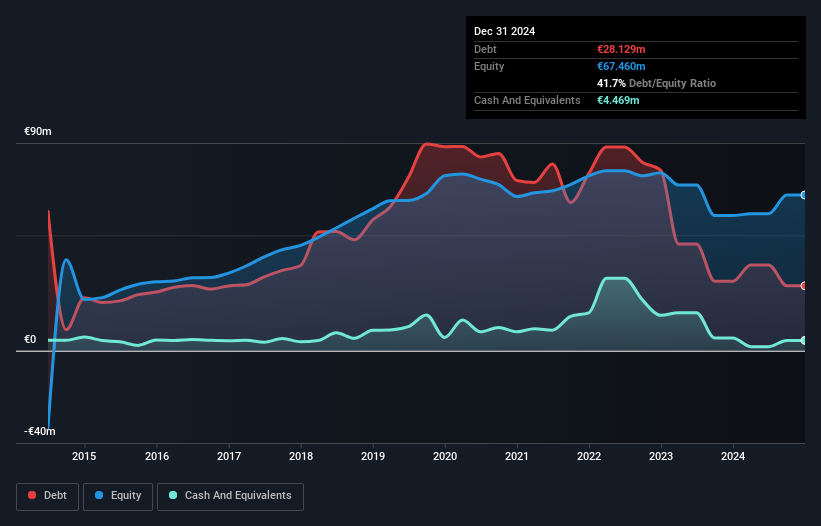

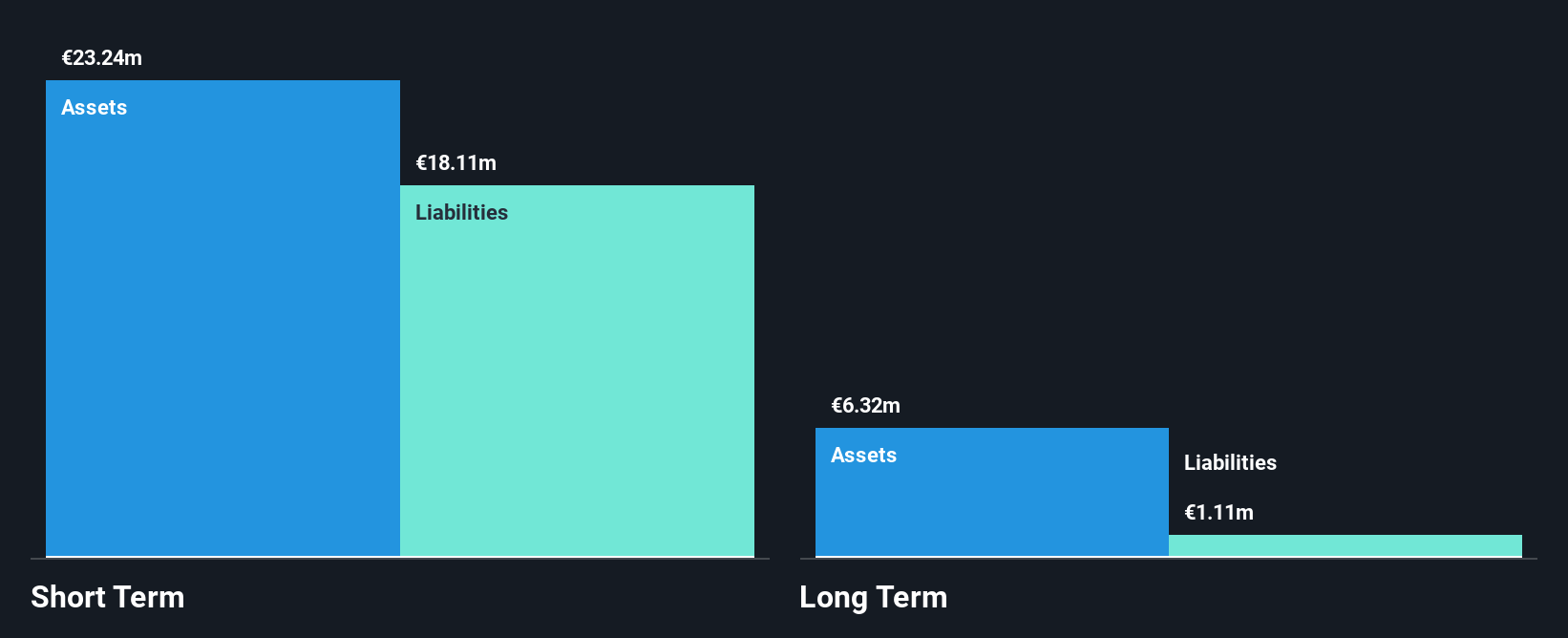

Renta Corporación Real Estate, with a market cap of €23.31 million, has recently turned profitable, though its earnings growth is hard to compare historically due to a significant one-off gain of €7.5 million. The company’s debt situation has improved markedly over the past five years, with a debt-to-equity ratio now at 25.9%, and its operating cash flow covers 36.7% of its debt obligations. Despite these improvements, the return on equity remains low at 9.4%. The management team and board are experienced, which may provide stability as they navigate the challenges typical for penny stocks in Europe.

- Jump into the full analysis health report here for a deeper understanding of Renta Corporación Real Estate.

- Understand Renta Corporación Real Estate's track record by examining our performance history report.

Riber (ENXTPA:ALRIB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Riber S.A. specializes in molecular beam epitaxy (MBE) products and services for the compound semiconductor research and industrial sectors, with a market cap of €66.57 million.

Operations: The company's revenue is derived entirely from its Semiconductor Equipment and Services segment, which generated €38.12 million.

Market Cap: €66.57M

Riber S.A., with a market cap of €66.57 million, has shown resilience despite recent challenges. The company reported a net loss of €0.809 million for the half year ending June 2025, compared to a previous profit, highlighting volatility common in penny stocks. However, Riber's strong cash position relative to debt and its ability to cover interest payments significantly enhance financial stability. Recent orders from international clients underscore its technological credibility in semiconductor equipment, particularly within quantum computing applications. While earnings growth has been negative recently, forecasts suggest potential improvement with expected revenue exceeding €40 million for 2025.

- Dive into the specifics of Riber here with our thorough balance sheet health report.

- Understand Riber's earnings outlook by examining our growth report.

Merus Power Oyj (HLSE:MERUS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Merus Power Oyj designs, manufactures, and sells battery energy storage systems and power quality solutions both in Finland and internationally, with a market cap of €39.12 million.

Operations: The company generates revenue of €56.25 million from its electric equipment segment.

Market Cap: €39.12M

Merus Power Oyj, with a market cap of €39.12 million, has recently become profitable, marking a significant milestone for the company. While its operating cash flow remains negative and interest coverage is weak at 1.4x EBIT, the company's short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. Recent developments include commissioning the first grid-forming battery energy storage system in the Nordic region and securing a €17 million project with Exilion in Finland. These initiatives highlight Merus Power's competitive edge in energy storage technology and its strategic role in enhancing grid stability amidst renewable energy integration challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Merus Power Oyj.

- Examine Merus Power Oyj's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Investigate our full lineup of 278 European Penny Stocks right here.

- Interested In Other Possibilities? Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:REN

Renta Corporación Real Estate

A real estate company, engages in the acquisition, rehabilitation, and sale of real estate properties in Barcelona and Madrid, Spain.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026