As European markets continue to navigate the complexities of global trade tensions, the pan-European STOXX Europe 600 Index has shown resilience, rising for a fourth consecutive week amid optimism for easing U.S.-China trade disputes. In this environment, high-growth tech stocks in Europe are capturing attention as investors seek opportunities that align with strong industrial output and favorable monetary policies; these stocks often exhibit innovative capabilities and robust growth potential even amidst broader market uncertainties.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Digital Value | 29.11% | 29.54% | ★★★★★★ |

| KebNi | 21.29% | 66.10% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 77.62% | ★★★★★★ |

| Elliptic Laboratories | 23.60% | 51.89% | ★★★★★★ |

| CD Projekt | 33.48% | 37.39% | ★★★★★★ |

| Norbit | 20.46% | 26.58% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★★

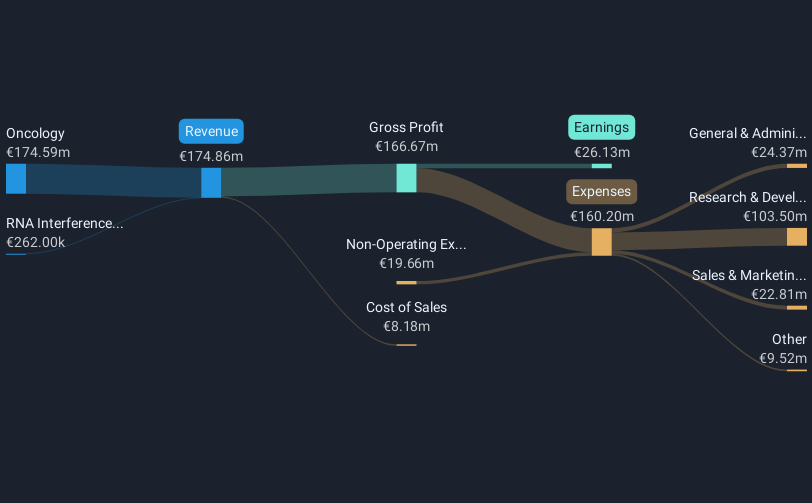

Overview: Pharma Mar, S.A. is a biopharmaceutical company focused on the research, development, production, and commercialization of bio-active principles for oncology across various international markets with a market cap of approximately €1.31 billion.

Operations: The company generates revenue primarily from its oncology segment, totaling €178.70 million.

Pharma Mar's trajectory in the high-growth tech sector is underscored by a robust annual revenue growth rate of 25.2% and an even more impressive earnings growth forecast at 43.1% per year. This performance outpaces the broader Spanish market significantly, where average earnings growth hovers around 5.2%. Notably, its R&D commitment is reflected in its substantial investment, aligning with recent strategic moves including a proposed dividend increase and multiple high-profile conference presentations that could bolster its industry standing and innovation pipeline.

- Get an in-depth perspective on Pharma Mar's performance by reading our health report here.

Examine Pharma Mar's past performance report to understand how it has performed in the past.

Bittium Oyj (HLSE:BITTI)

Simply Wall St Growth Rating: ★★★★☆☆

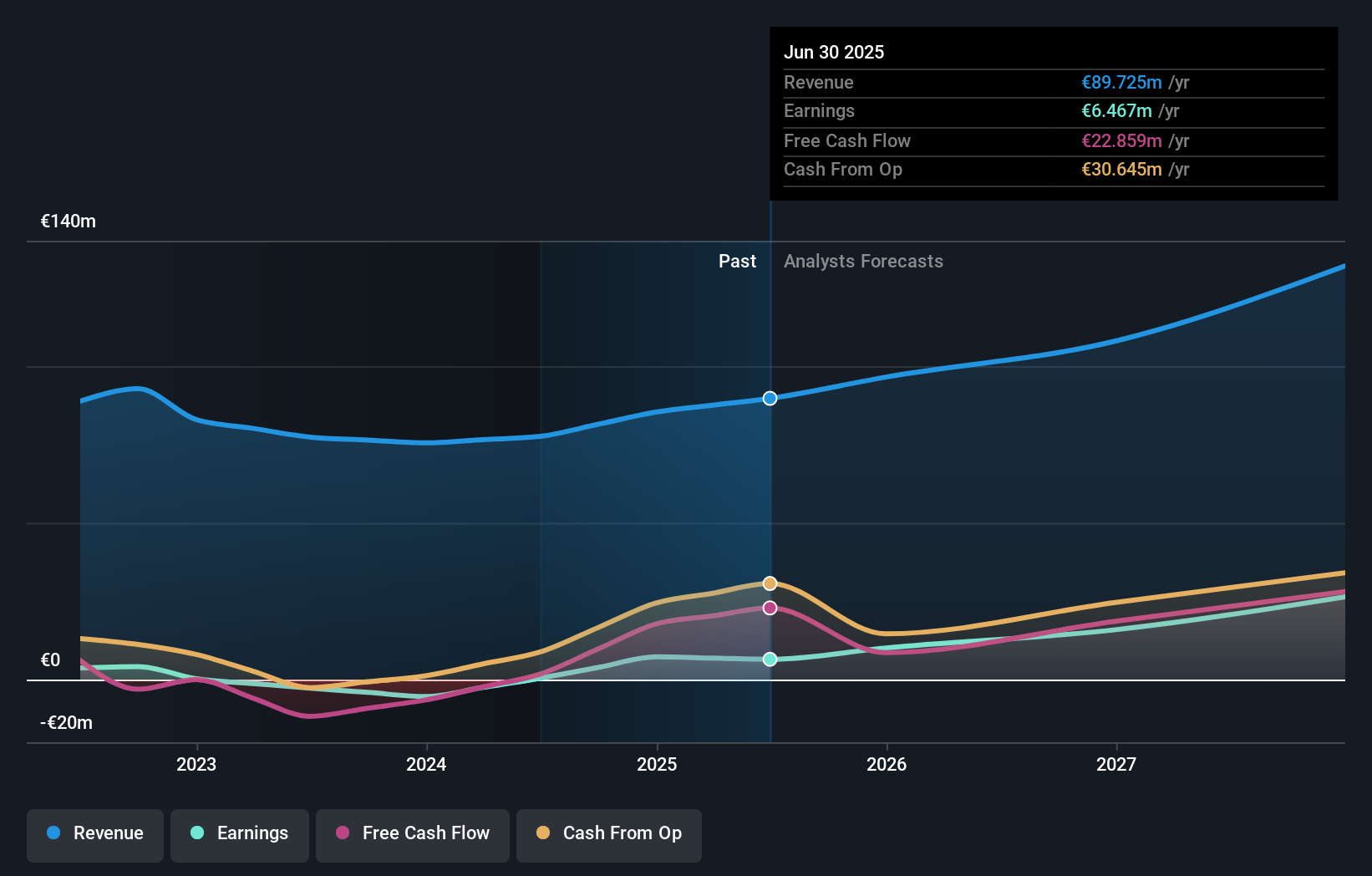

Overview: Bittium Oyj offers communications and connectivity solutions, healthcare technology products and services, and biosignal measuring and monitoring across Finland, Germany, and the United States with a market capitalization of €229.60 million.

Operations: The company generates revenue primarily from its Defense & Security segment, which accounts for €51.60 million, followed by Medical at €29.80 million and Engineering Services at €14.32 million. The focus on these segments highlights the company's diverse approach to communications and healthcare technology solutions across multiple regions.

Bittium Oyj's recent performance and strategic decisions underscore its potential in the tech sector, particularly with a dividend increase to EUR 0.10 per share and reaffirmed earnings guidance projecting net sales between EUR 95 million and EUR 105 million for 2025, up from EUR 85.2 million in the previous year. This growth trajectory is complemented by an expected operating result improvement to EUR 10 million - EUR 13 million, up from EUR 8.6 million, reflecting a robust financial footing. The appointment of Niina Huikuri as Senior Vice President of the Medical Business Segment heralds a stronger focus on expanding Bittium's footprint in health technology, leveraging her extensive experience in commercializing medical devices internationally. These moves are poised to enhance Bittium’s market position and drive future growth within high-tech sectors across Europe.

- Click to explore a detailed breakdown of our findings in Bittium Oyj's health report.

Understand Bittium Oyj's track record by examining our Past report.

Modern Times Group MTG (OM:MTG B)

Simply Wall St Growth Rating: ★★★★☆☆

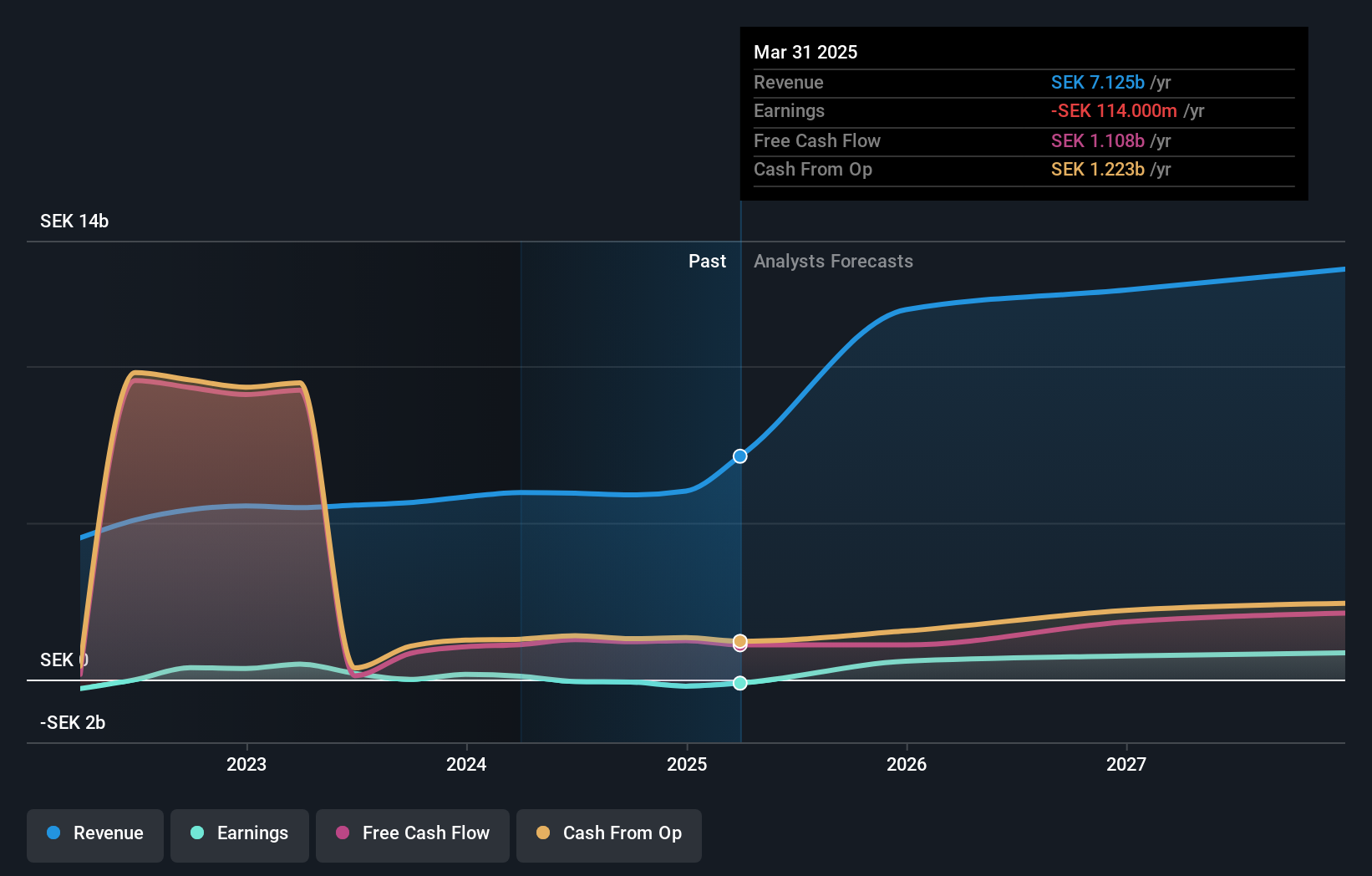

Overview: Modern Times Group MTG AB operates through its subsidiaries to provide game franchises across various countries including Sweden, the United Kingdom, Germany, and others, with a market cap of SEK12.96 billion.

Operations: The company generates revenue primarily from its game franchises, with broadcasting contributing SEK7.13 billion. It operates across diverse geographical regions including Europe, Asia, and North America.

Modern Times Group MTG AB is navigating a transformative phase with promising financial forecasts, as evidenced by its recent performance and strategic executive appointments. The company's revenue is expected to grow by 18.1% annually, outpacing the Swedish market average of 4.2%, while earnings are projected to surge by 61.6% per year over the next three years, marking a significant turnaround from previous losses. This growth trajectory is underpinned by MTG's focused R&D investments which are crucial for sustaining innovation and competitiveness in the rapidly evolving tech landscape. Moreover, the recent appointment of Nick Hopkins as CFO could enhance strategic financial management amidst MTG’s expansion efforts in gaming and digital entertainment sectors, signaling robust prospects for future profitability and market position strengthening within Europe’s tech scene.

Summing It All Up

- Delve into our full catalog of 223 European High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Bittium Oyj, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bittium Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:BITTI

Bittium Oyj

Provides solutions for communications and connectivity, healthcare technology products and services, and biosignal measuring and monitoring in Finland, Germany, and the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives