How Grifols' 33% Rally in 2025 Stacks Up After Recent Q1 Earnings Beat

Reviewed by Bailey Pemberton

If you have been considering what to do with Grifols stock lately, you are not alone. After all, few stocks have sparked as much debate as Grifols over the past couple of years. The price movements tell an intriguing story. So far this year, the stock is up an impressive 32.5%, with a recent seven-day gain of 4.0% and a 30-day return of 5.1%. Even on a one-year timescale, Grifols is up 23.7%. On the flip side, it is hard to ignore that over five years, shares are still down nearly 50%. Quite the rollercoaster, right?

Some of this volatility can be traced back to shifting market sentiment and updated outlooks on the biopharma sector. For Grifols, investor perception seems to be evolving more quickly in response to broader healthcare trends and important company-specific developments, including changes in the plasma industry and adjustments in regulatory environments. Risk perception seems to be moderating, as reflected in the stock’s steady climb this year.

The big question most investors have now is whether Grifols is undervalued or if recent gains have left things fairly priced for the future. That is where our valuation score helps: Grifols currently scores a 3 out of 6, meaning it checks the box for undervaluation in half of the key areas assessed. Not perfect, not terrible—certainly enough to warrant a closer look.

Next, let’s break down these valuation methods, see where Grifols shines or stumbles, and most importantly, consider a better approach for truly understanding what this company’s price tag means for investors like you.

Approach 1: Grifols Discounted Cash Flow (DCF) Analysis

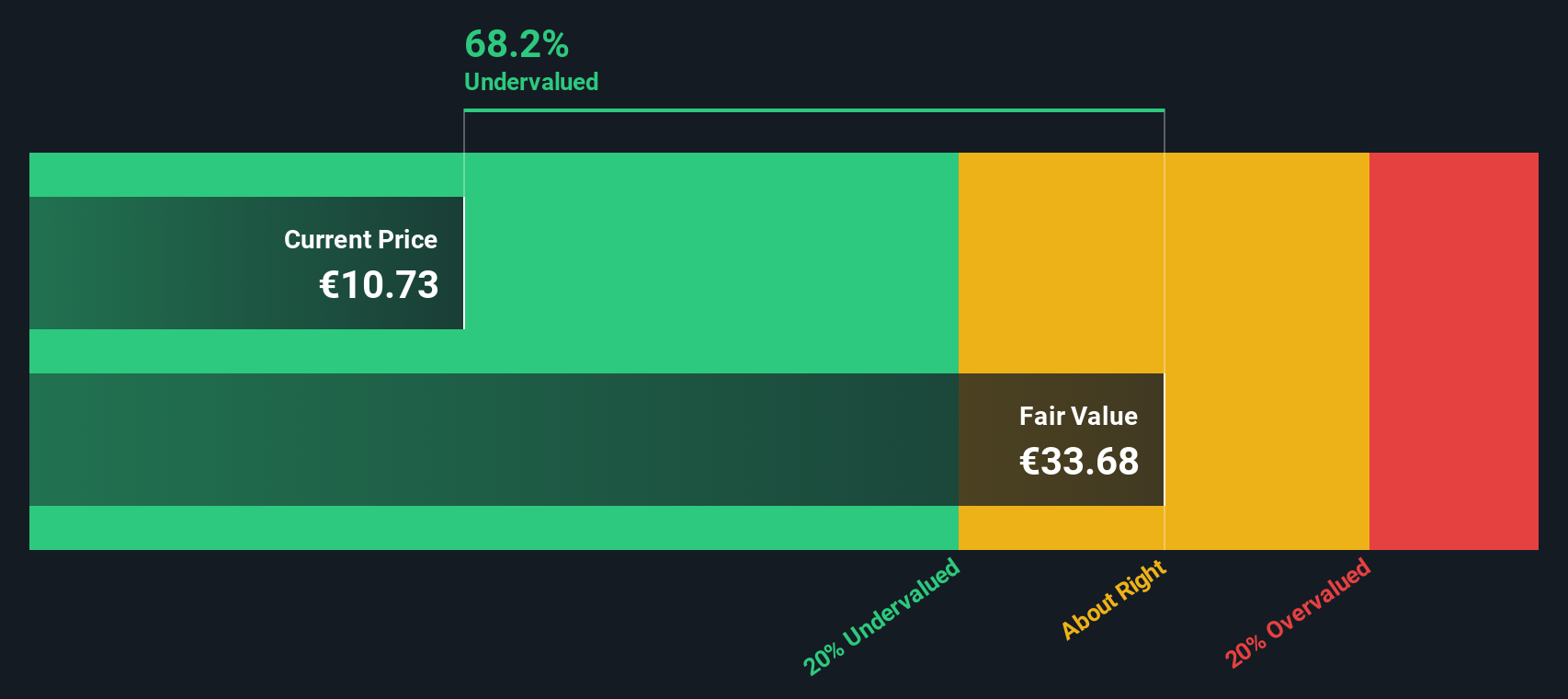

The Discounted Cash Flow (DCF) model tries to estimate the fundamental value of Grifols by projecting its future cash flows and then discounting them to reflect today's value in euros. This type of analysis aims to provide a view of what the business is worth based entirely on the cash it can generate for shareholders.

Starting with the latest reported Free Cash Flow of €711 million, analyst consensus expects consistent growth. Notably, free cash flow is projected to rise to €1.31 billion in 2029, according to the estimates. While direct analyst forecasts go out five years, longer-term projections by Simply Wall St suggest this growth trend could continue, though with more uncertainty the further out you go.

The DCF model for Grifols uses a two-stage Free Cash Flow to Equity approach. It takes these future projections and discounts them back to their value today. The resulting intrinsic value is €26.36 per share. With Grifols currently trading at a price that is a 52.5% discount to this estimated fair value, the numbers imply the stock is significantly undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Grifols is undervalued by 52.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

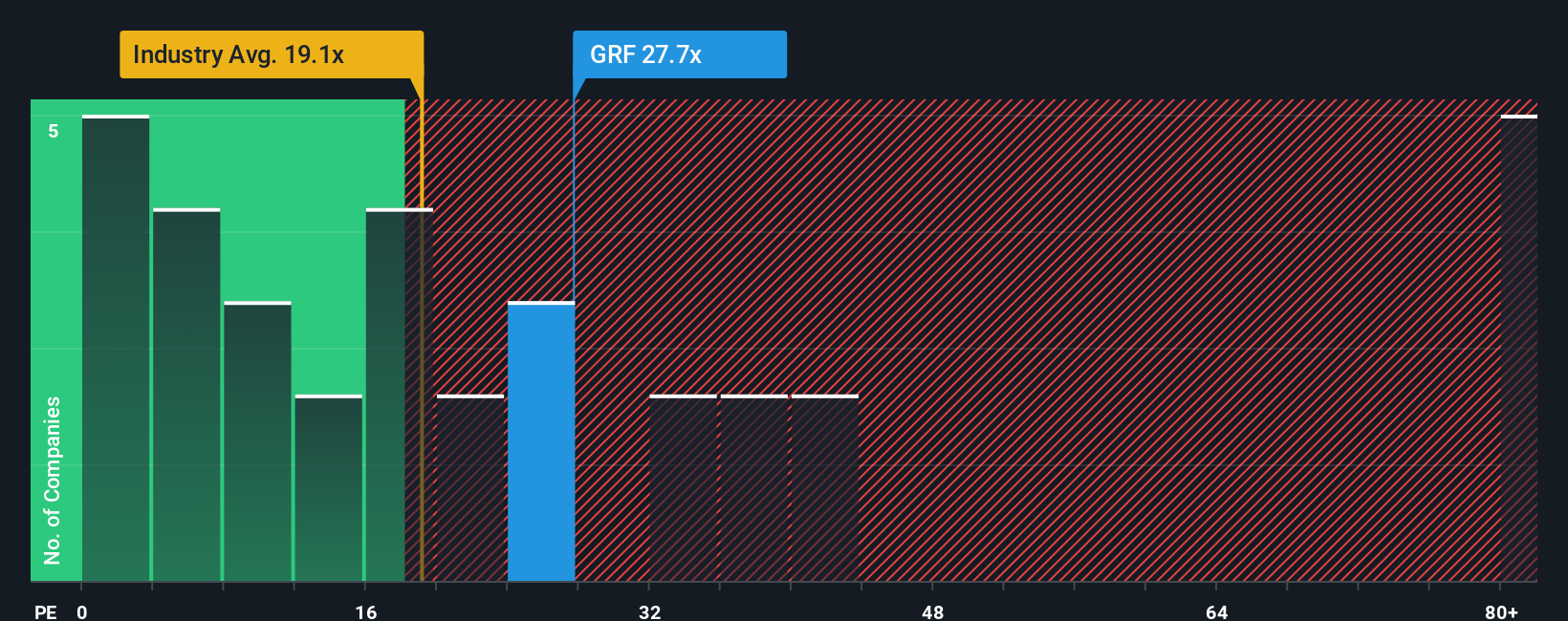

Approach 2: Grifols Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a popular metric for valuing established, profitable companies like Grifols because it directly relates a company's share price to its per-share earnings. For investors, the PE ratio provides a simple way to gauge what the market is willing to pay today for future earnings growth.

“Normal” or “fair” PE ratios vary because fast-growing, low-risk companies usually command a higher multiple, while slower growth or greater risk tends to pull that multiple down. For Grifols, the current PE ratio sits at 28.7x. That is just below the Biotechs industry average of about 29.6x, and well below the average for Grifols’ direct peers, which is 52.6x. This suggests the stock is not running hot compared to its sector, despite its recent surge.

Simply Wall St’s proprietary “Fair Ratio” offers a more tailored perspective. This metric factors in not just growth and risk, but also profit margin, industry dynamics, and the company’s size. The Fair Ratio for Grifols comes in at 28.4x. Because this approach builds a more nuanced picture than a direct peer or industry comparison, it helps investors assess value with greater precision.

With Grifols’ current PE ratio at 28.7x and a Fair Ratio of 28.4x, the stock is very close to what would be considered fairly valued based on these fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Grifols Narrative

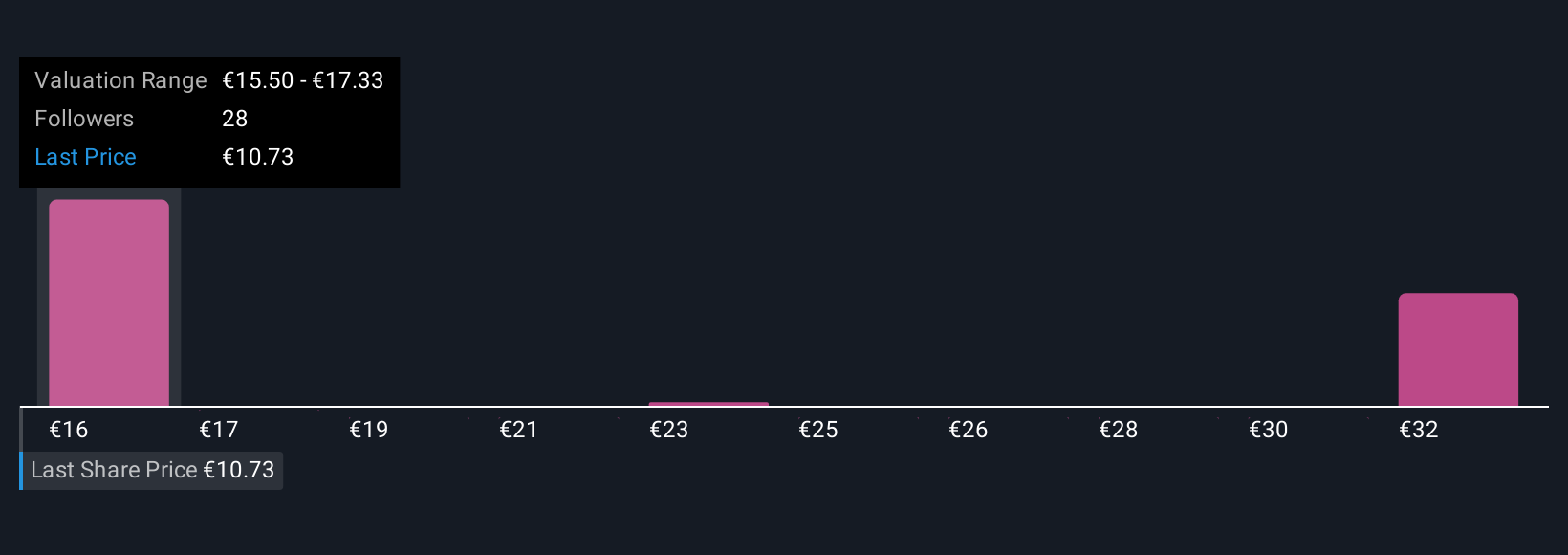

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a straightforward, user-driven story that ties together your perspective on Grifols, the numbers you expect for things like future revenue, earnings, and margins, and what you believe to be a fair price for the stock.

Rather than just relying on industry averages or analyst estimates, Narratives let you connect a company’s underlying story, including its business strengths, challenges, and growth drivers, to a customized financial forecast and ultimately your own calculation of fair value. Narratives are accessible on Simply Wall St's Community page, where millions of investors share and compare their perspectives in real time.

This tool helps investors cut through the noise by making clear when Grifols’ current price is above, below, or right in line with their personal fair value, making “buy,” “hold,” or “sell” decisions much easier. Because Narratives automatically update when news or earnings come in, your outlook and fair value move with the facts.

For example, among Grifols Narratives, the most optimistic outlook projects a price target of €24.0, while the most cautious estimates €9.0. This demonstrates how powerful it can be to see and understand the full spectrum of investor viewpoints.

Do you think there's more to the story for Grifols? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:GRF

Grifols

Operates as a plasma therapeutic company in Spain, the United States, Canada, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)