- Spain

- /

- Paper and Forestry Products

- /

- BME:IBG

Upgrade: Analysts Just Made A Substantial Increase To Their Iberpapel Gestión, S.A. (BME:IBG) Forecasts

Celebrations may be in order for Iberpapel Gestión, S.A. (BME:IBG) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. Investors have been pretty optimistic on Iberpapel Gestión too, with the stock up 12% to €18.60 over the past week. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

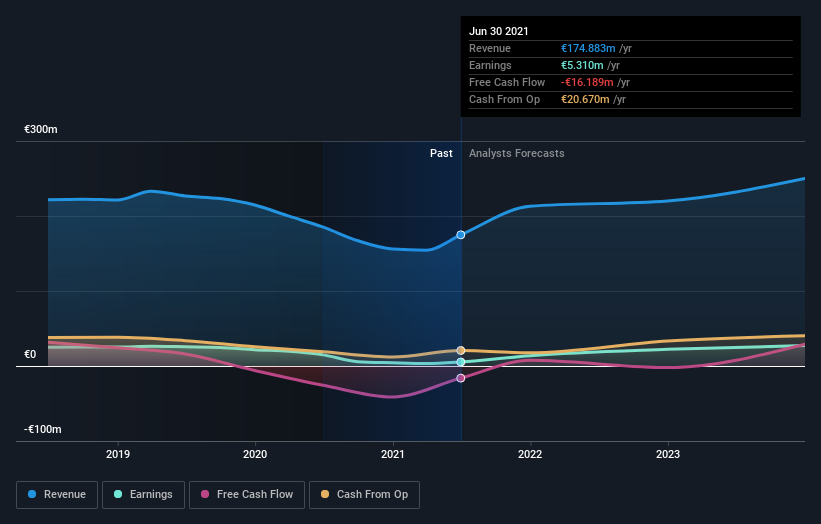

Following the upgrade, the latest consensus from Iberpapel Gestión's twin analysts is for revenues of €213m in 2021, which would reflect a huge 22% improvement in sales compared to the last 12 months. Per-share earnings are expected to leap 154% to €1.24. Prior to this update, the analysts had been forecasting revenues of €189m and earnings per share (EPS) of €1.04 in 2021. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

View our latest analysis for Iberpapel Gestión

Despite these upgrades, the analysts have not made any major changes to their price target of €24.45, suggesting that the higher estimates are not likely to have a long term impact on what the stock is worth. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Iberpapel Gestión at €26.10 per share, while the most bearish prices it at €23.30. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

Of course, another way to look at these forecasts is to place them into context against the industry itself. For example, we noticed that Iberpapel Gestión's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 48% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 4.1% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 2.8% per year. Not only are Iberpapel Gestión's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. The lack of change in the price target is puzzling, but with a serious upgrade to this year's earnings expectations, it might be time to take another look at Iberpapel Gestión.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Iberpapel Gestión going out as far as 2023, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Iberpapel Gestión or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:IBG

Iberpapel Gestión

Engages in the manufacture and marketing of printing and writing paper in Spain, rest of the European Union, South America, Africa, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.