- South Korea

- /

- Personal Products

- /

- KOSDAQ:A018290

Undiscovered Gems And 2 More Small Caps with Promising Potential

Reviewed by Simply Wall St

In a week marked by mixed performances across major indices, the Russell 2000 Index experienced a decline following its recent outperformance against larger-cap peers, highlighting the ongoing volatility and selective nature of small-cap investments. Amidst this backdrop of diverging market trends and economic indicators, identifying promising small-cap stocks requires a keen focus on companies with strong fundamentals and growth potential that can thrive even in uncertain conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Cementos Molins (BDM:CMO)

Simply Wall St Value Rating: ★★★★★★

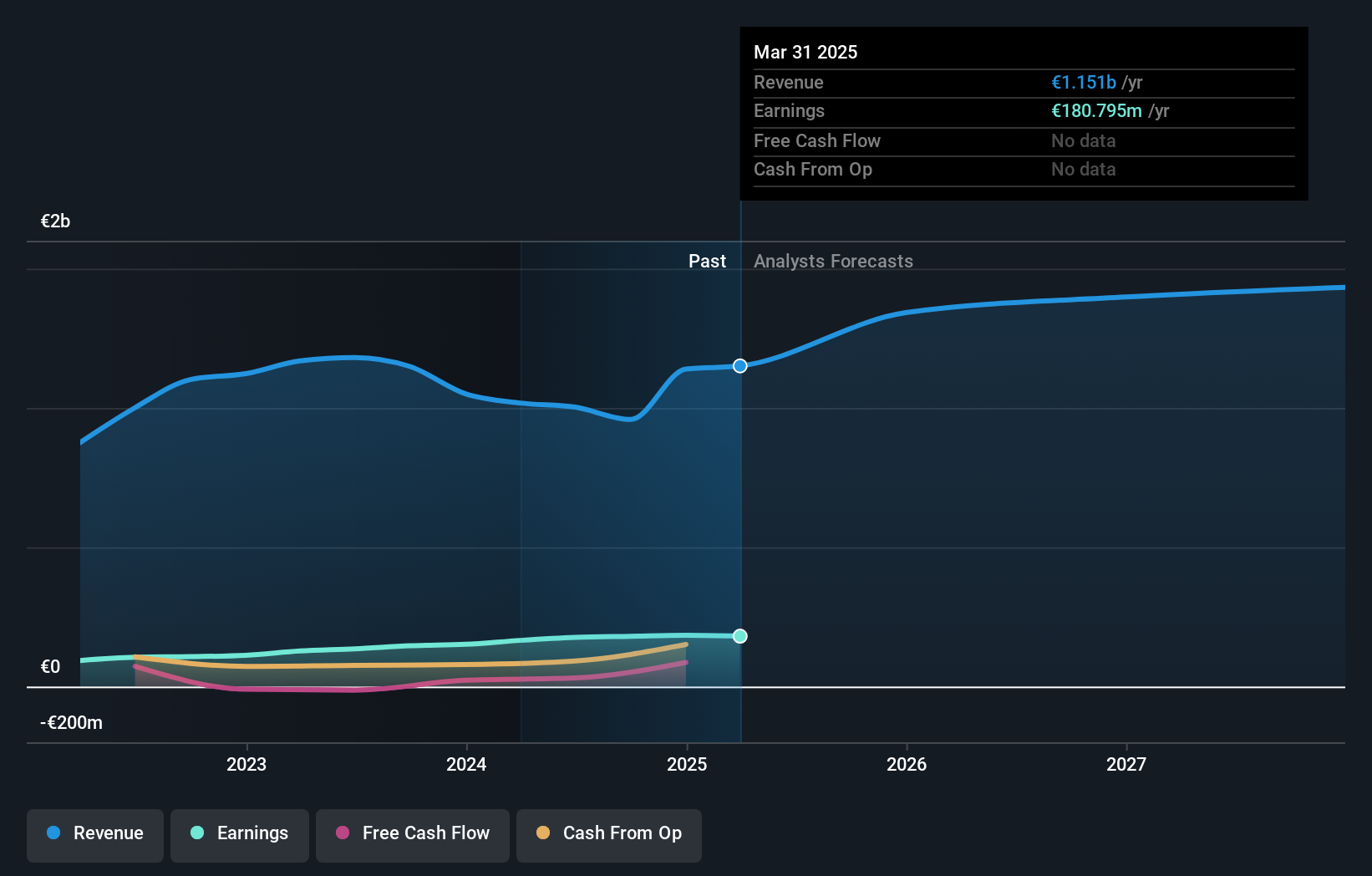

Overview: Cementos Molins, S.A. is a multinational company engaged in the manufacturing and sale of cement, lime, precast concrete, and other construction materials across various countries including Spain, Argentina, Mexico, and several others with a market cap of €1.52 billion.

Operations: Cementos Molins generates revenue primarily from the sale of cement, lime, and precast concrete across multiple countries. The company's net profit margin has shown variability over recent periods.

Earnings at Cementos Molins have grown by 23.3% in the past year, outpacing the Basic Materials industry's -11.5%. The company's debt to equity ratio improved significantly, dropping from 26.9% to 15.5% over five years, reflecting prudent financial management. With a price-to-earnings ratio of 8.8x, it offers good value compared to the Spanish market average of 19.7x. Interest payments are comfortably covered with EBIT at a robust 14.7 times coverage, indicating strong operational health and high-quality earnings that suggest stability and potential for future growth within its sector context.

- Delve into the full analysis health report here for a deeper understanding of Cementos Molins.

Evaluate Cementos Molins' historical performance by accessing our past performance report.

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

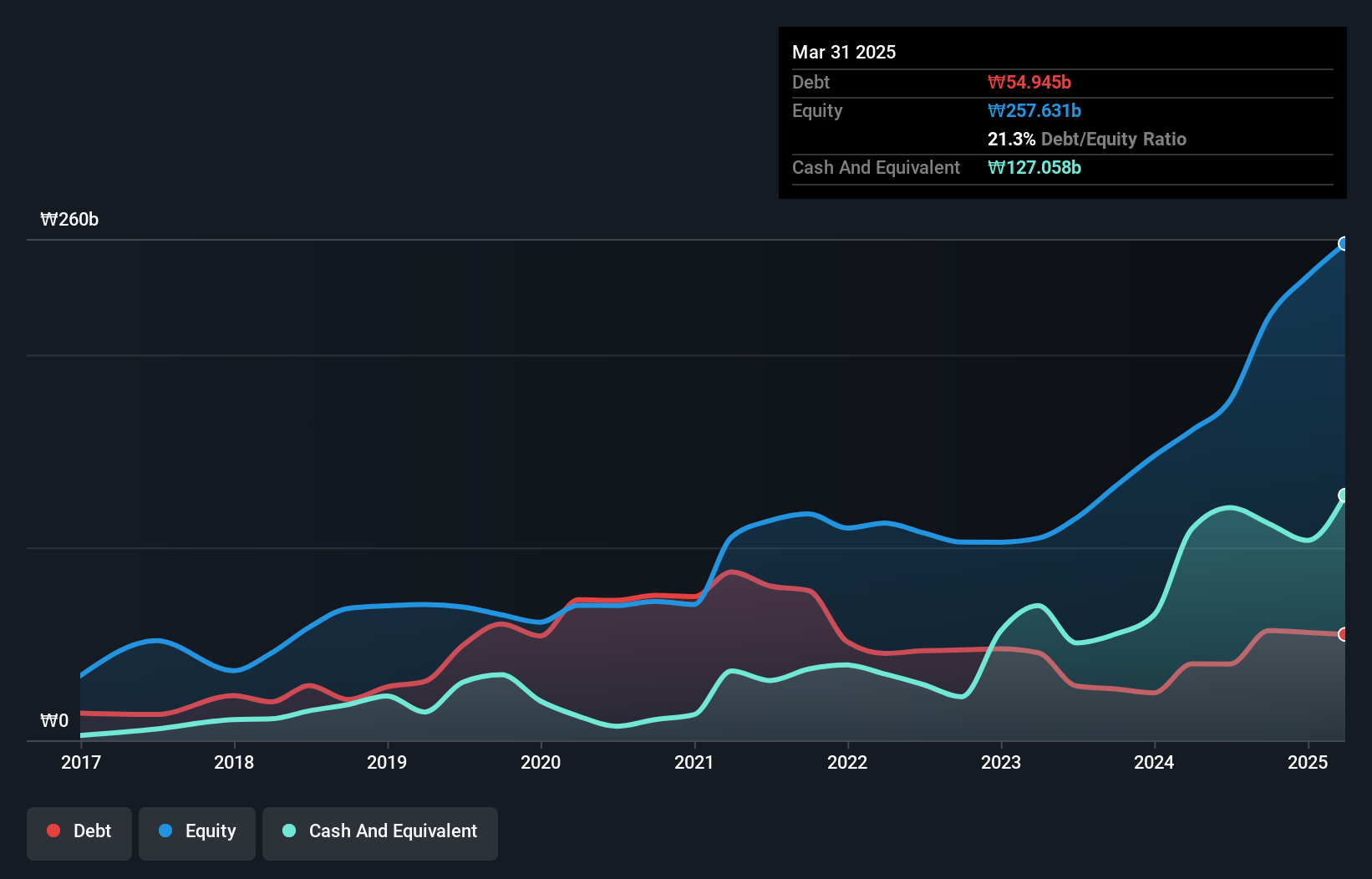

Overview: VT Co., Ltd. is a company that manufactures and exports laminating machines and films globally, with a market capitalization of ₩1.22 trillion.

Operations: VT Co., Ltd. generates revenue primarily from its cosmetic segment, contributing ₩298.75 billion, followed by entertainment and laminating segments at ₩72.81 billion and ₩31.48 billion, respectively.

VT Co., Ltd. has shown impressive financial momentum, with earnings surging 454% over the past year, significantly outpacing the Personal Products industry. The company trades at a substantial discount of 61% below its estimated fair value, suggesting potential upside for investors. Its debt to equity ratio has notably decreased from 93% to 26% in five years, reflecting improved financial health. Recent earnings reports highlight a net income increase to KRW 31 billion for Q3 compared to KRW 8 billion last year. Despite its volatile share price recently, VT's high-quality earnings and strong interest coverage (249x EBIT) bolster investor confidence.

Solar Applied Materials Technology (TPEX:1785)

Simply Wall St Value Rating: ★★★★☆☆

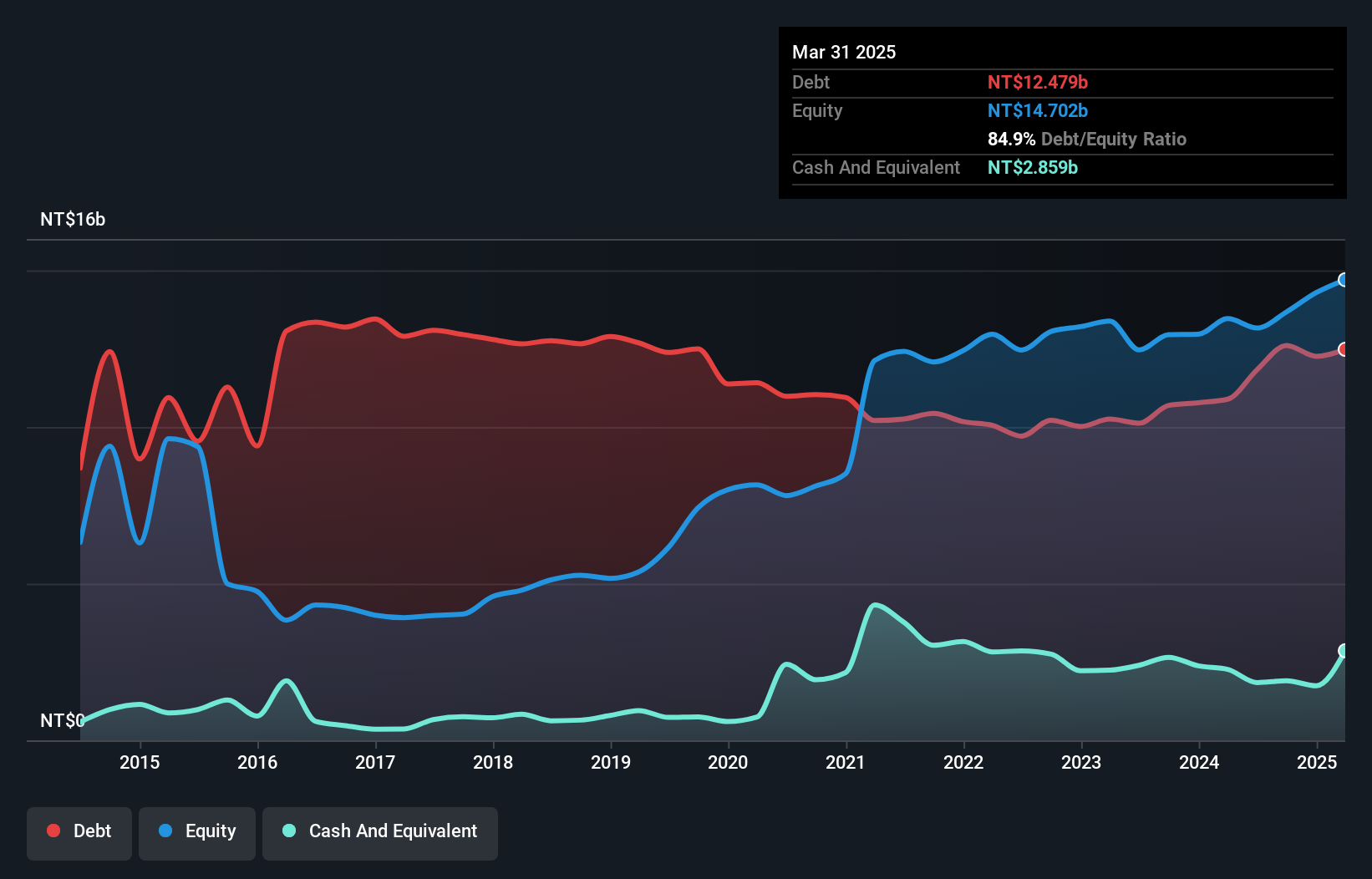

Overview: Solar Applied Materials Technology Corporation engages in the manufacturing, processing, recycling, refining, and trading of sputtering targets for thin film applications, precious metal materials, and specialty chemicals for the automotive industry across Taiwan, China, and international markets with a market cap of NT$40.78 billion.

Operations: Solar Applied Materials Technology generates revenue primarily from its operations in Taiwan and Kunshan, with contributions of NT$10.51 billion and NT$15.37 billion, respectively.

Solar Applied Materials Technology, a nimble player in the materials sector, has showcased robust financial performance recently. Sales for the third quarter of 2024 reached TWD 7.62 billion, up from TWD 5.95 billion the previous year. Net income also saw an increase to TWD 458 million from TWD 408 million year-over-year, reflecting healthy operational growth. The company's earnings per share rose to TWD 0.77 from TWD 0.69 in the same period last year, suggesting improved profitability and operational efficiency despite its high net debt to equity ratio of about 78%. This growth trajectory is supported by a consistent annual earnings increase of approximately 8% over five years, indicating potential resilience and adaptability in a competitive industry landscape.

Seize The Opportunity

- Navigate through the entire inventory of 4645 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A018290

Outstanding track record with flawless balance sheet.