- South Korea

- /

- Machinery

- /

- KOSE:A079900

Unveiling 3 Undiscovered Gems with Strong Financial Foundations

Reviewed by Simply Wall St

In a turbulent start to the year, global markets have been marked by a stronger-than-expected U.S. labor market and persistent inflation concerns, leading to underperformance in small-cap stocks as the Russell 2000 Index dipped into correction territory. Amidst this backdrop of economic uncertainty and fluctuating investor sentiment, identifying stocks with strong financial foundations becomes crucial for navigating potential market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Abu Dhabi Ship Building PJSC (ADX:ADSB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Abu Dhabi Ship Building PJSC operates in the United Arab Emirates, focusing on the construction, maintenance, repair, and overhaul of commercial and military ships and vessels, with a market capitalization of AED1.43 billion.

Operations: ADSB generates revenue primarily from its New Build and Engineering segment, contributing AED1.29 billion, followed by Military Repairs and Maintenance at AED166.90 million. The Small Boats and Mission Systems segments add AED50.88 million and AED26.33 million, respectively, while Commercial Repairs and Maintenance contributes AED27.91 million.

Abu Dhabi Ship Building (ADSB) showcases a promising trajectory, having significantly reduced its debt to equity ratio from 155.6% to 25.8% over the past five years. The company's earnings surged by an impressive 92.9% last year, outpacing the Aerospace & Defense industry's growth of just 7%. Despite its volatile share price recently, ADSB's strategic partnership with SIATT enhances its product offerings without additional costs, potentially boosting future sales and visibility at events like NAVDEX in February 2025. With a price-to-earnings ratio of 24.8x below the industry average of 49.1x, it presents an attractive valuation in this niche market segment.

- Click here to discover the nuances of Abu Dhabi Ship Building PJSC with our detailed analytical health report.

Gain insights into Abu Dhabi Ship Building PJSC's past trends and performance with our Past report.

Junjin Construction and RobotLtd (KOSE:A079900)

Simply Wall St Value Rating: ★★★★★☆

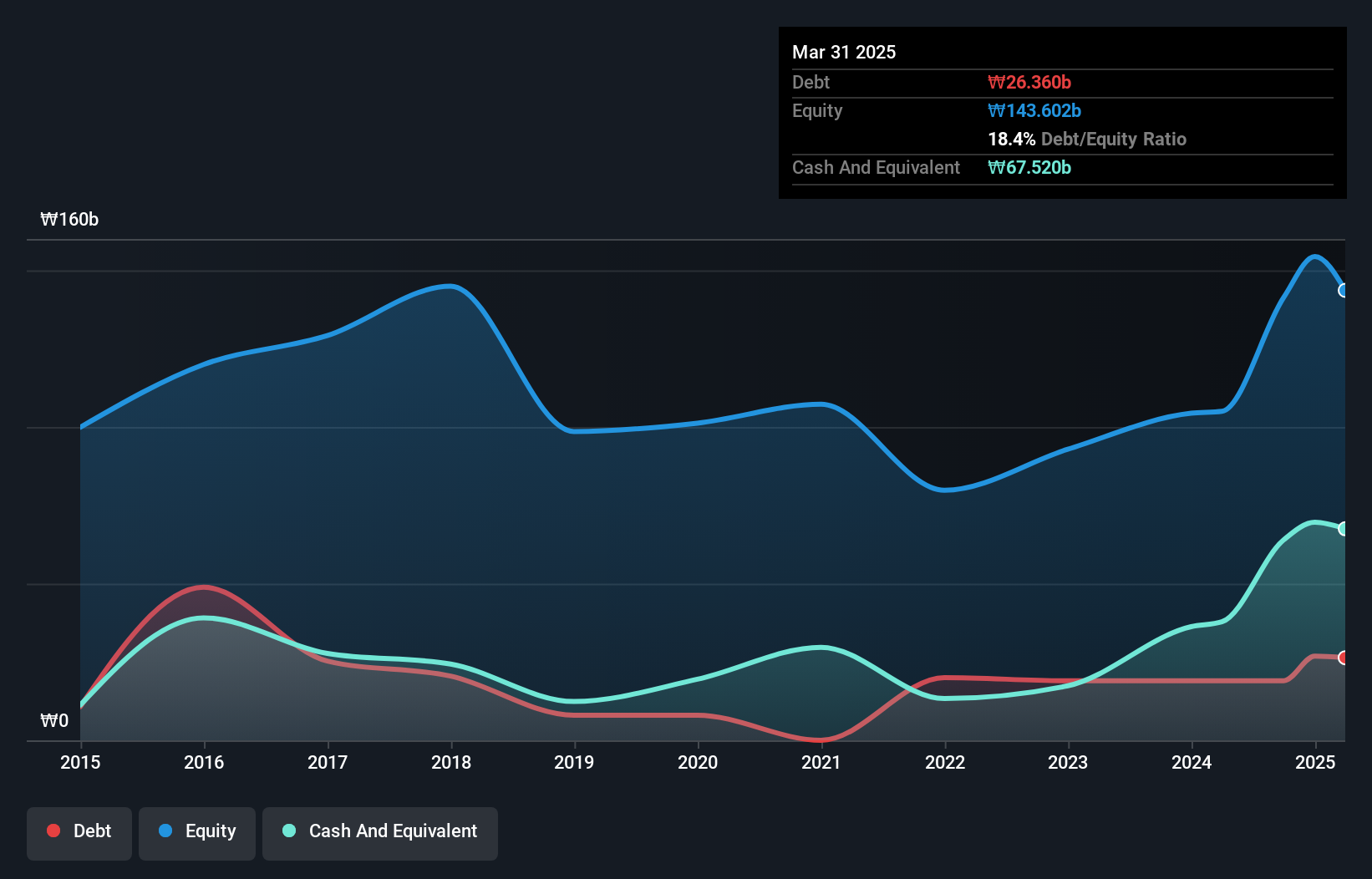

Overview: Junjin Construction and Robot Co., Ltd. is a company that manufactures and sells construction equipment both in South Korea and internationally, with a market capitalization of ₩594.19 billion.

Operations: Junjin generates revenue primarily from its Construction Machinery & Equipment segment, amounting to ₩165.32 billion.

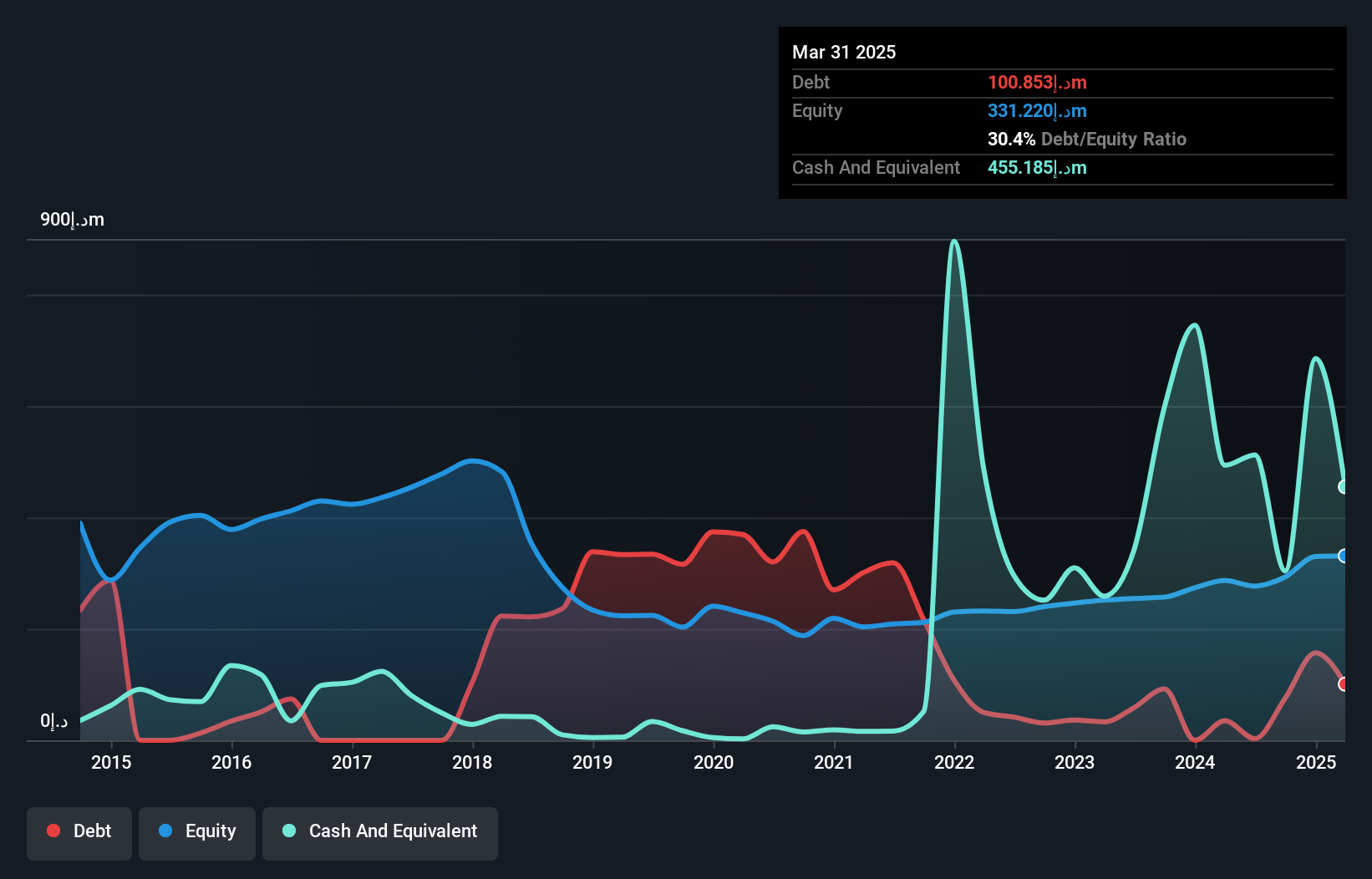

Junjin Construction, a compact player in the industry, has shown resilience with a 3.3% earnings growth over the past year, outpacing the broader Machinery sector's -0.3%. The company's debt to equity ratio has risen from 8% to 13.4% in five years, indicating increased leverage but remains manageable due to its high-quality earnings and sufficient interest coverage. Despite recent volatility in share prices, Junjin maintains positive free cash flow at US$31.54 million as of September 2024, suggesting operational efficiency and potential for future growth amidst market fluctuations.

- Click to explore a detailed breakdown of our findings in Junjin Construction and RobotLtd's health report.

Understand Junjin Construction and RobotLtd's track record by examining our Past report.

Ling Yun Industrial (SHSE:600480)

Simply Wall St Value Rating: ★★★★★★

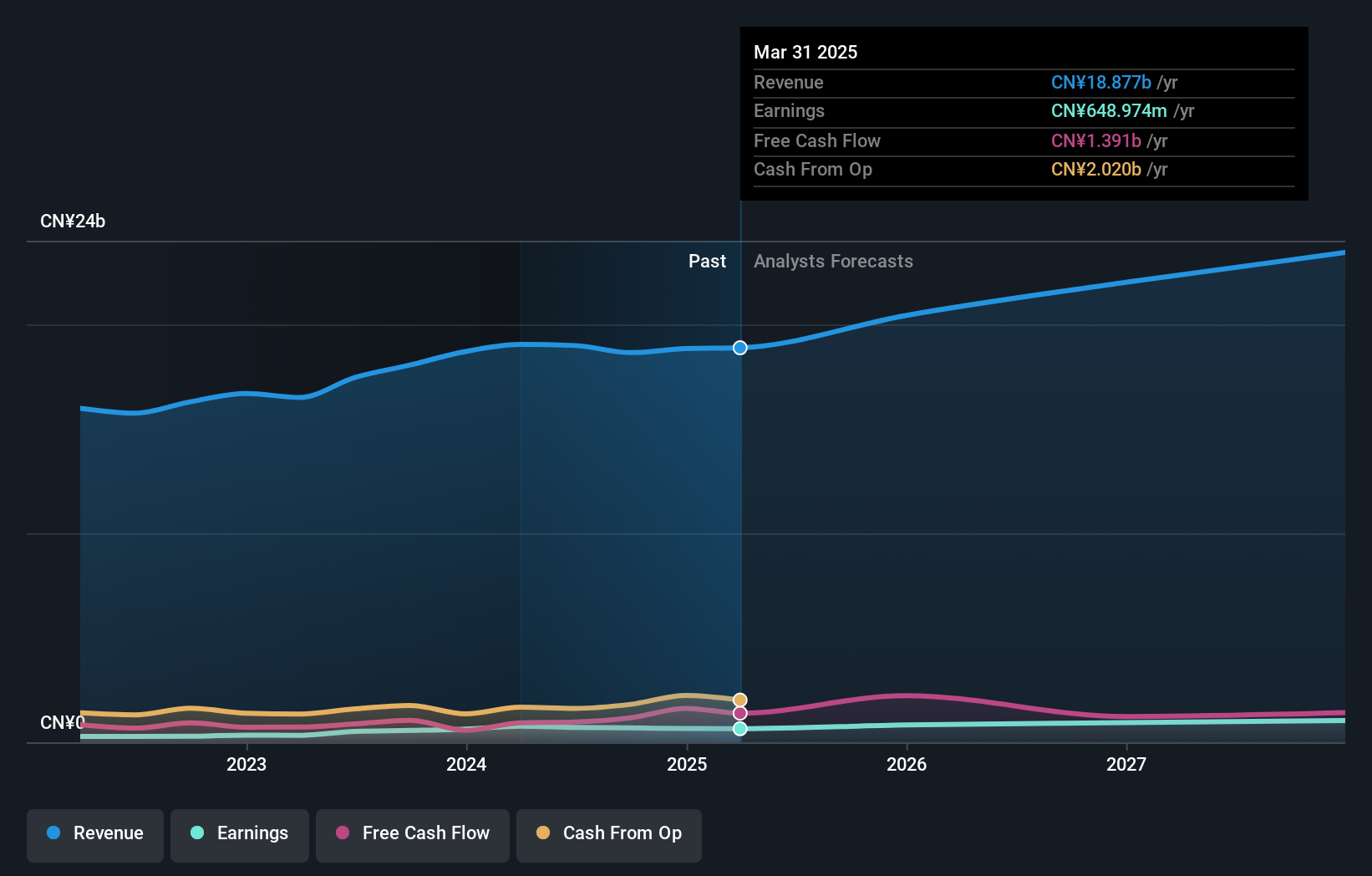

Overview: Ling Yun Industrial Corporation Limited focuses on the production and sale of metal, automotive plastic, and plastic piping systems in China, with a market cap of CN¥11.06 billion.

Operations: Ling Yun Industrial derives its revenue primarily from the sale of metal, automotive plastic, and plastic piping systems. The company's net profit margin has shown fluctuations over recent periods, reflecting the impact of varying production costs and market conditions.

Ling Yun Industrial, a promising player in the auto components sector, has seen its earnings grow by 21.9% over the past year, outpacing industry growth of 10.5%. The company is trading at a significant discount of 45.4% below estimated fair value, presenting a compelling case for potential investors. With more cash than total debt and free cash flow positivity evident from recent figures like CNY 973 million as of June 2024, financial stability appears robust. Earnings per share increased to CNY 0.55 from CNY 0.48 last year, reinforcing its solid performance trajectory despite slightly lower sales figures this period compared to last year (CNY13 billion).

Make It Happen

- Gain an insight into the universe of 4618 Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A079900

Junjin Construction and RobotLtd

Junjin Construction & Robot Co., Ltd. manufactures and sells construction equipment in South Korea and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.