- Germany

- /

- Other Utilities

- /

- XTRA:MVV1

European Dividend Stocks Yielding Up To 4.1%

Reviewed by Simply Wall St

The European stock markets have recently experienced significant declines, with the pan-European STOXX Europe 600 Index dropping 8.44% in response to higher-than-expected U.S. trade tariffs, reflecting broader concerns about global economic growth and inflation pressures. Amid this volatility, dividend stocks can offer a measure of stability and income potential for investors seeking resilience during uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.08% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 5.07% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.73% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.84% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.98% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.48% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.29% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.54% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.71% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 8.47% | ★★★★★☆ |

Click here to see the full list of 249 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Cementos Molins (BDM:CMO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cementos Molins, S.A. is a company that produces and distributes cement, lime, precast concrete, and other construction materials across several countries including Spain, Argentina, and Mexico; it has a market capitalization of approximately €1.76 billion.

Operations: Cementos Molins, S.A. generates revenue through the production and sale of cement and lime, precast concrete, and various construction materials across multiple international markets including Spain, Argentina, Mexico, Uruguay, Bangladesh, India, Tunisia, Bolivia, Colombia, Croatia, Germany and Turkey.

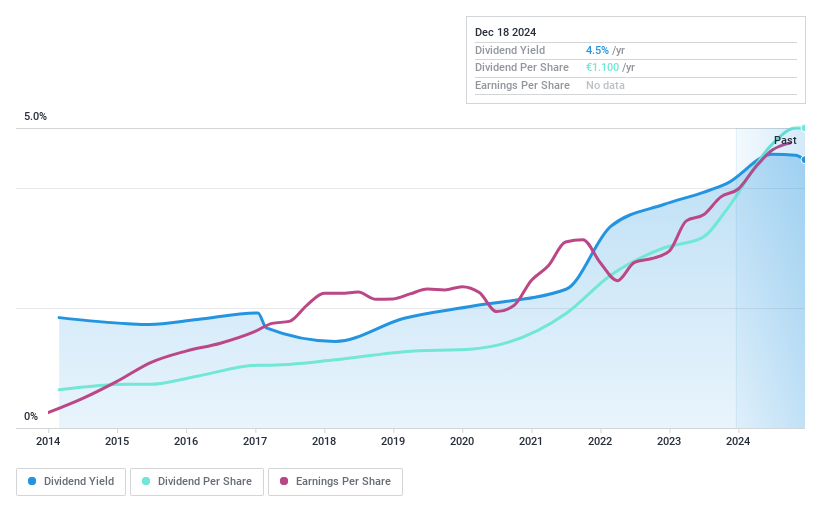

Dividend Yield: 4%

Cementos Molins offers a reliable dividend yield of 4.03%, though it falls short of the top quartile in Spain. Its dividends have grown steadily over the past decade, supported by a low payout ratio of 39.9%. The company's earnings rose by 21.6% last year, with net income reaching €184.1 million on sales of €1.06 billion, suggesting potential for continued dividend stability despite insufficient data on cash flow coverage.

- Click to explore a detailed breakdown of our findings in Cementos Molins' dividend report.

- Our expertly prepared valuation report Cementos Molins implies its share price may be too high.

Hypothekarbank Lenzburg (SWX:HBLN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hypothekarbank Lenzburg AG offers a range of banking services and products to private customers and companies in Switzerland, with a market cap of CHF287.27 million.

Operations: Hypothekarbank Lenzburg AG generates revenue primarily from its banking segment, amounting to CHF113.35 million.

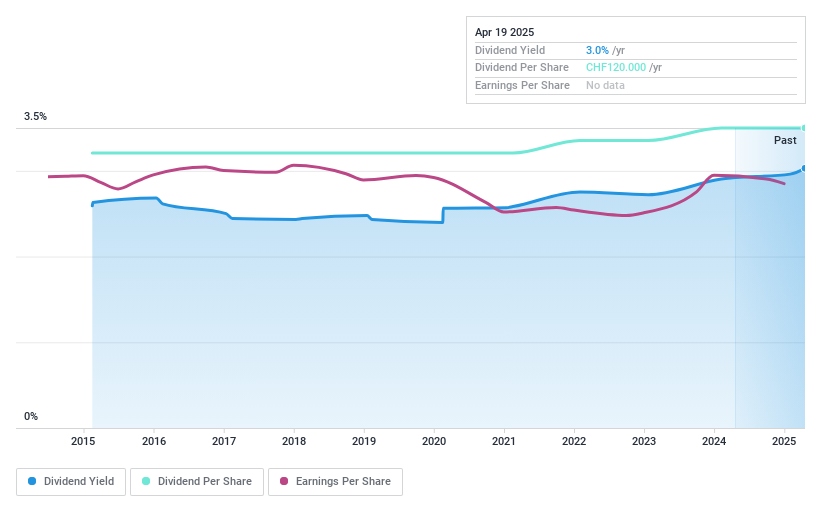

Dividend Yield: 3%

Hypothekarbank Lenzburg maintains a stable dividend history with a 3% yield, though it lags behind the top Swiss payers. The bank's dividends are well-covered by earnings, given its low payout ratio of 40.5%. Despite trading at 30.6% below fair value estimates, recent earnings show a slight decline to CHF 20.46 million from CHF 21.15 million the previous year, which may impact future dividend sustainability assessments due to insufficient data on long-term coverage.

- Get an in-depth perspective on Hypothekarbank Lenzburg's performance by reading our dividend report here.

- According our valuation report, there's an indication that Hypothekarbank Lenzburg's share price might be on the expensive side.

MVV Energie (XTRA:MVV1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MVV Energie AG, with a market cap of €1.98 billion, operates in Germany providing electricity, heat, gas, water, and waste treatment and disposal services through its subsidiaries.

Operations: MVV Energie AG's revenue segments include electricity (€2.22 billion), heat (€0.57 billion), gas (€1.15 billion), water (€0.10 billion), and waste treatment and disposal (€0.27 billion).

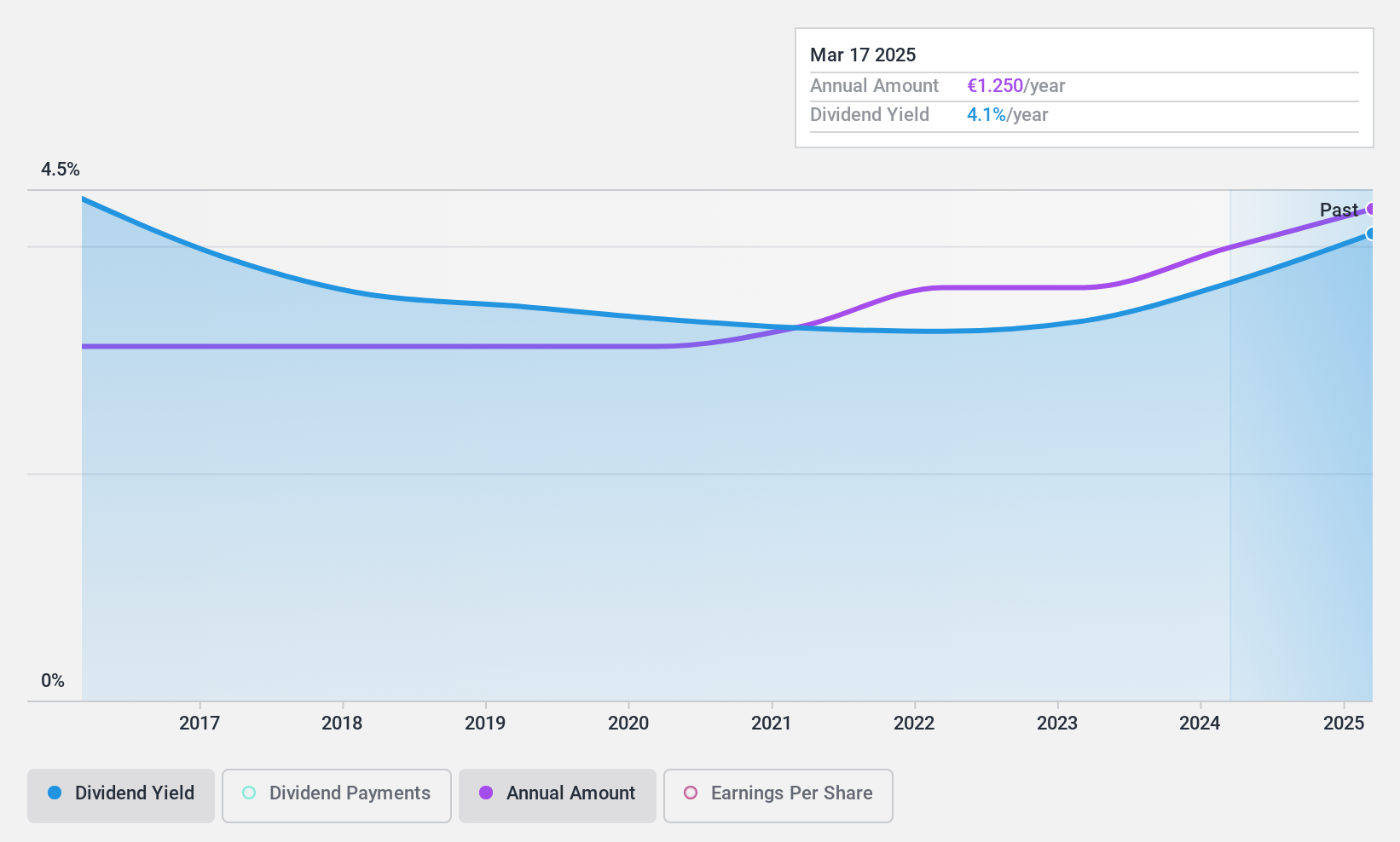

Dividend Yield: 4.2%

MVV Energie's dividend, yielding 4.17%, is well-covered by both earnings and cash flows with payout ratios of 51.8% and 24.5%, respectively, though it trails the top German dividend payers. The company's dividends have been stable and growing over the past decade, indicating reliability despite recent declines in sales (EUR 1.80 billion) and net income (EUR 34.57 million) for Q1 compared to last year. Leadership changes are forthcoming with a new CEO starting April 2025.

- Unlock comprehensive insights into our analysis of MVV Energie stock in this dividend report.

- Upon reviewing our latest valuation report, MVV Energie's share price might be too pessimistic.

Turning Ideas Into Actions

- Click this link to deep-dive into the 249 companies within our Top European Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MVV1

MVV Energie

Provides electricity, heat, gas, water, and waste treatment and disposal products primarily in Germany.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives