European Stocks Estimated Below Intrinsic Value In December 2025

Reviewed by Simply Wall St

As European markets navigate a period of mixed performance, with the pan-European STOXX Europe 600 Index ending slightly lower and varied results across major indices like Germany’s DAX and France’s CAC 40, investors are keenly observing economic indicators for potential opportunities. In this context, identifying stocks that are estimated to be below their intrinsic value becomes crucial, as these could offer potential for growth despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.048 | €5.98 | 49% |

| Unimot (WSE:UNT) | PLN129.00 | PLN257.54 | 49.9% |

| Straumann Holding (SWX:STMN) | CHF94.80 | CHF187.48 | 49.4% |

| Rheinmetall (XTRA:RHM) | €1527.00 | €3012.61 | 49.3% |

| Jæren Sparebank (OB:JAREN) | NOK378.95 | NOK754.16 | 49.8% |

| Inission (OM:INISS B) | SEK48.90 | SEK96.14 | 49.1% |

| Esautomotion (BIT:ESAU) | €3.12 | €6.15 | 49.2% |

| Circle (BIT:CIRC) | €8.02 | €15.72 | 49% |

| Allegro.eu (WSE:ALE) | PLN30.445 | PLN60.31 | 49.5% |

| Aker BioMarine (OB:AKBM) | NOK91.20 | NOK178.52 | 48.9% |

Let's dive into some prime choices out of the screener.

Línea Directa Aseguradora Compañía de Seguros y Reaseguros (BME:LDA)

Overview: Línea Directa Aseguradora, S.A., Compañía de Seguros y Reaseguros operates in the insurance and reinsurance sectors across Spain and Portugal, with a market cap of approximately €1.19 billion.

Operations: The company's revenue segments include Motor insurance at €879.56 million, Home insurance at €166.52 million, and Health insurance at €36.96 million.

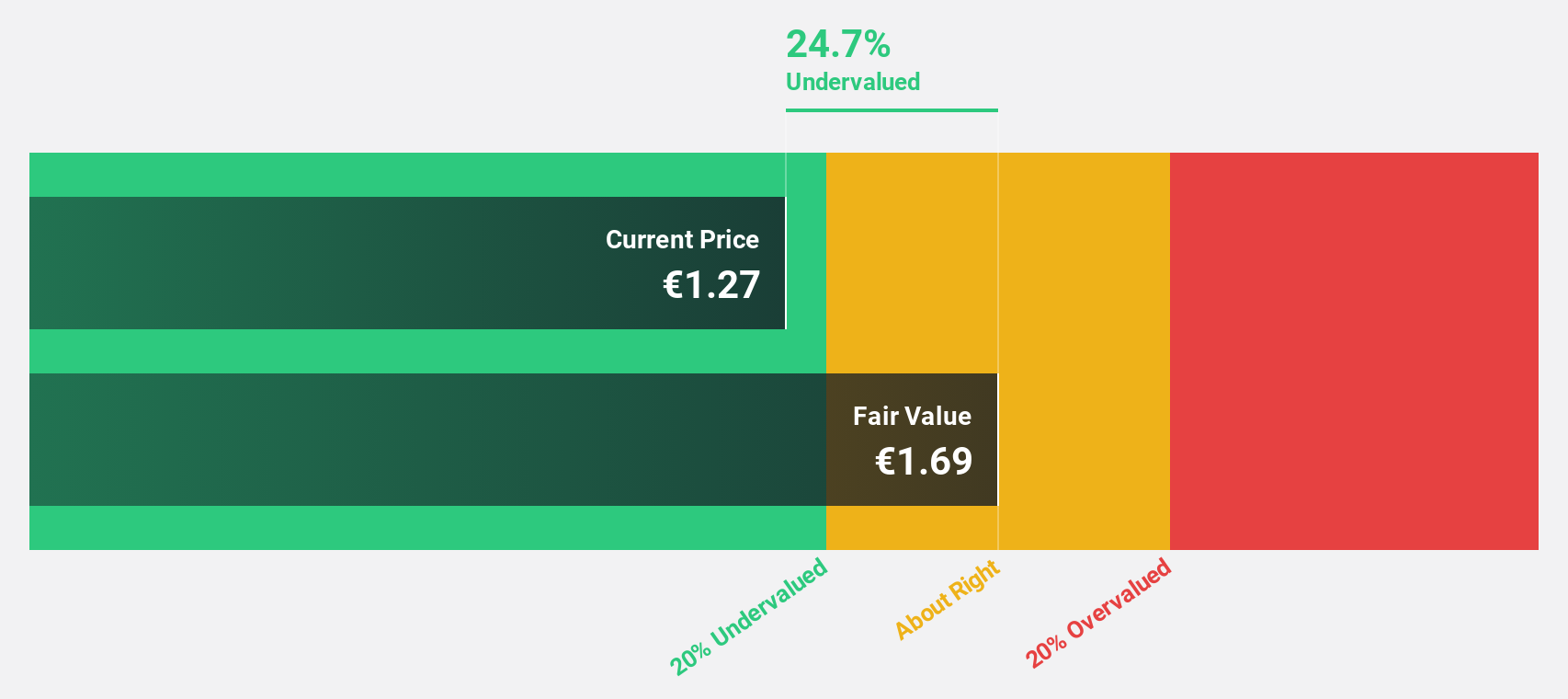

Estimated Discount To Fair Value: 29.8%

Línea Directa Aseguradora appears undervalued, trading at €1.1 against a fair value estimate of €1.56, offering a 29.8% discount. Recent earnings growth of 70.2% and forecasted annual profit growth of 12.07% suggest robust financial health, with revenue expected to outpace the Spanish market at 6.5%. Despite an unstable dividend track record, analysts anticipate a price rise by 20.3%, supported by strong return on equity projections reaching 24.5% in three years.

- Our expertly prepared growth report on Línea Directa Aseguradora Compañía de Seguros y Reaseguros implies its future financial outlook may be stronger than recent results.

- Take a closer look at Línea Directa Aseguradora Compañía de Seguros y Reaseguros' balance sheet health here in our report.

Talgo (BME:TLGO)

Overview: Talgo, S.A. specializes in the design, manufacture, and maintenance of railway and auxiliary machinery for railway systems globally, with a market cap of €347.82 million.

Operations: The company's revenue is primarily derived from its Rolling Stock segment, generating €532.19 million, and the Auxiliary Machines segment, contributing €60.97 million.

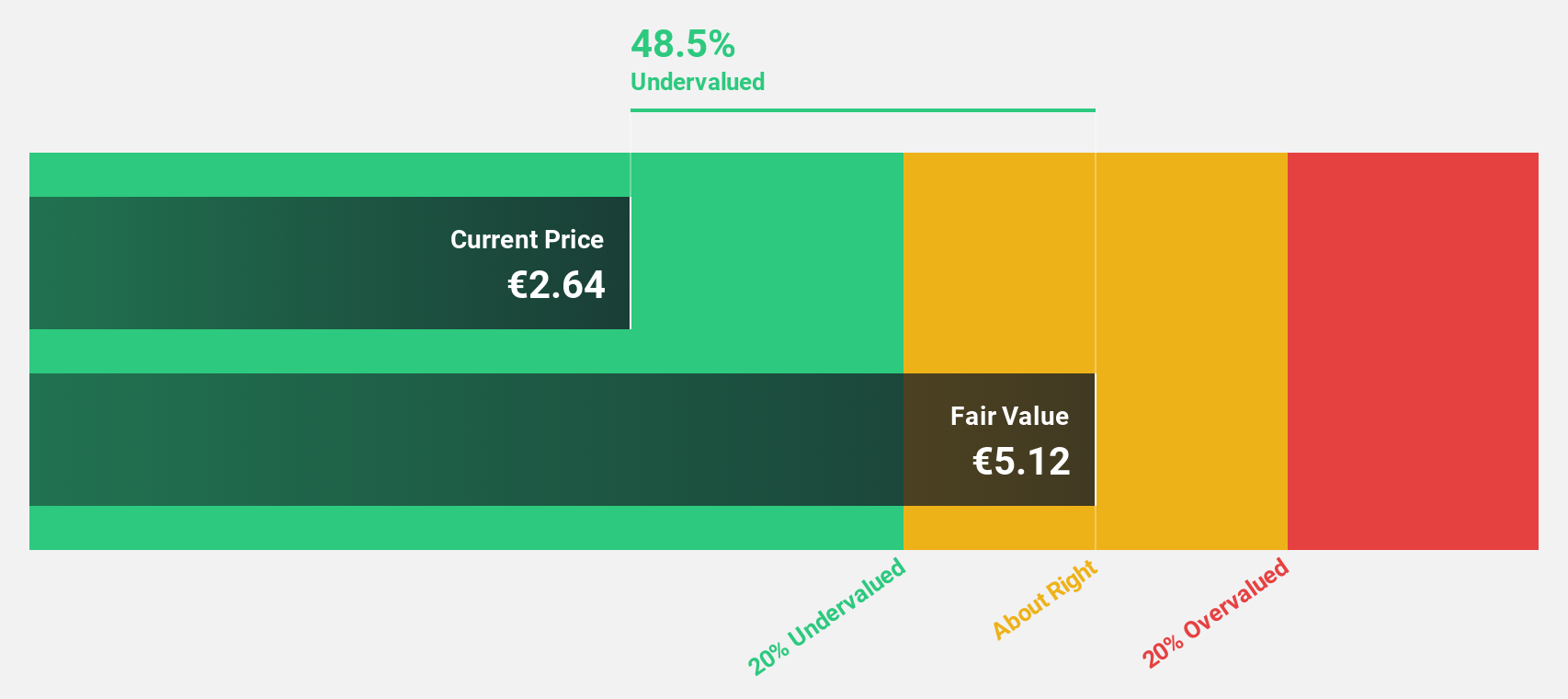

Estimated Discount To Fair Value: 47.1%

Talgo is trading at €2.83, significantly below its fair value estimate of €5.35, indicating a large undervaluation based on discounted cash flow analysis. Despite recent volatility and a net loss of €64.04 million for the first half of 2025, Talgo's earnings are forecast to grow by 97.59% annually and become profitable within three years, outpacing the Spanish market's revenue growth rate of 4.7%. Analyst consensus suggests a potential price increase of 24.6%.

- According our earnings growth report, there's an indication that Talgo might be ready to expand.

- Unlock comprehensive insights into our analysis of Talgo stock in this financial health report.

Sword Group (ENXTPA:SWP)

Overview: Sword Group S.E. provides IT and software solutions, with a market cap of €334 million.

Operations: The company's revenue segments include €108.49 million from Services in Belux, €124.26 million from Services in Switzerland, and €109.19 million from Services in the United Kingdom.

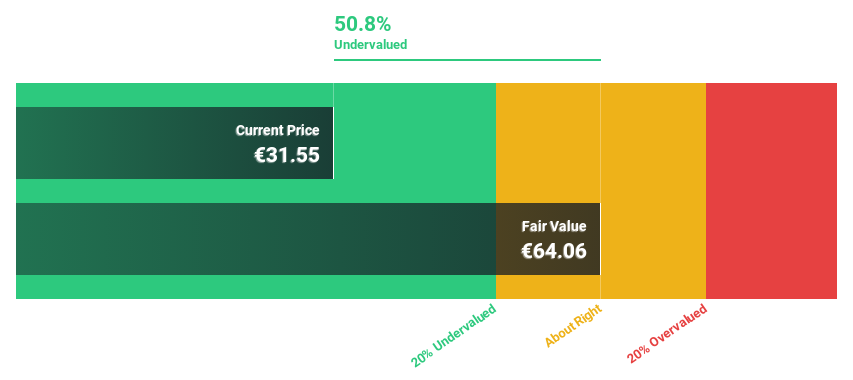

Estimated Discount To Fair Value: 35.7%

Sword Group, trading at €35.35, is undervalued compared to its fair value of €54.95 based on discounted cash flow analysis. Despite challenges with debt coverage by operating cash flow and a dividend not well covered by earnings or free cash flows, the company shows strong growth potential. Earnings are forecast to grow 18.15% annually, outpacing the French market's 12.3%. Recent acquisitions and index inclusion may bolster strategic positioning and investor confidence.

- Our growth report here indicates Sword Group may be poised for an improving outlook.

- Dive into the specifics of Sword Group here with our thorough financial health report.

Key Takeaways

- Dive into all 187 of the Undervalued European Stocks Based On Cash Flows we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:LDA

Línea Directa Aseguradora Compañía de Seguros y Reaseguros

Engages in insurance and reinsurance business in Spain and Portugal.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion