3 European Stocks That May Be Trading Below Their Estimated Value By Up To 48.8%

Reviewed by Simply Wall St

The European market has shown resilience, with the STOXX Europe 600 Index rising 0.77% amid positive economic data and earnings reports, while Germany's economy emerged from a two-year recession with modest growth. In this environment of mixed signals and cautious optimism, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors looking to capitalize on undervaluation in the market.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Streamwide (ENXTPA:ALSTW) | €71.80 | €142.62 | 49.7% |

| Ryvu Therapeutics (WSE:RVU) | PLN26.00 | PLN51.71 | 49.7% |

| Nexstim (HLSE:NXTMH) | €12.15 | €24.04 | 49.5% |

| Matica Fintec (BIT:MFT) | €1.83 | €3.61 | 49.4% |

| Honkarakenne Oyj (HLSE:HONBS) | €2.64 | €5.18 | 49.1% |

| Doxee (BIT:DOX) | €3.73 | €7.43 | 49.8% |

| DO & CO (WBAG:DOC) | €203.00 | €399.18 | 49.1% |

| DigiTouch (BIT:DGT) | €1.98 | €3.90 | 49.3% |

| B&S Group (ENXTAM:BSGR) | €5.85 | €11.66 | 49.8% |

| Allcore (BIT:CORE) | €1.335 | €2.65 | 49.5% |

We'll examine a selection from our screener results.

Línea Directa Aseguradora Compañía de Seguros y Reaseguros (BME:LDA)

Overview: Línea Directa Aseguradora, S.A., Compañía de Seguros y Reaseguros operates in the insurance and reinsurance sectors in Spain and Portugal, with a market cap of approximately €1.25 billion.

Operations: The company generates revenue through its primary segments: Motor insurance (€879.56 million), Home insurance (€166.52 million), and Health insurance (€36.96 million).

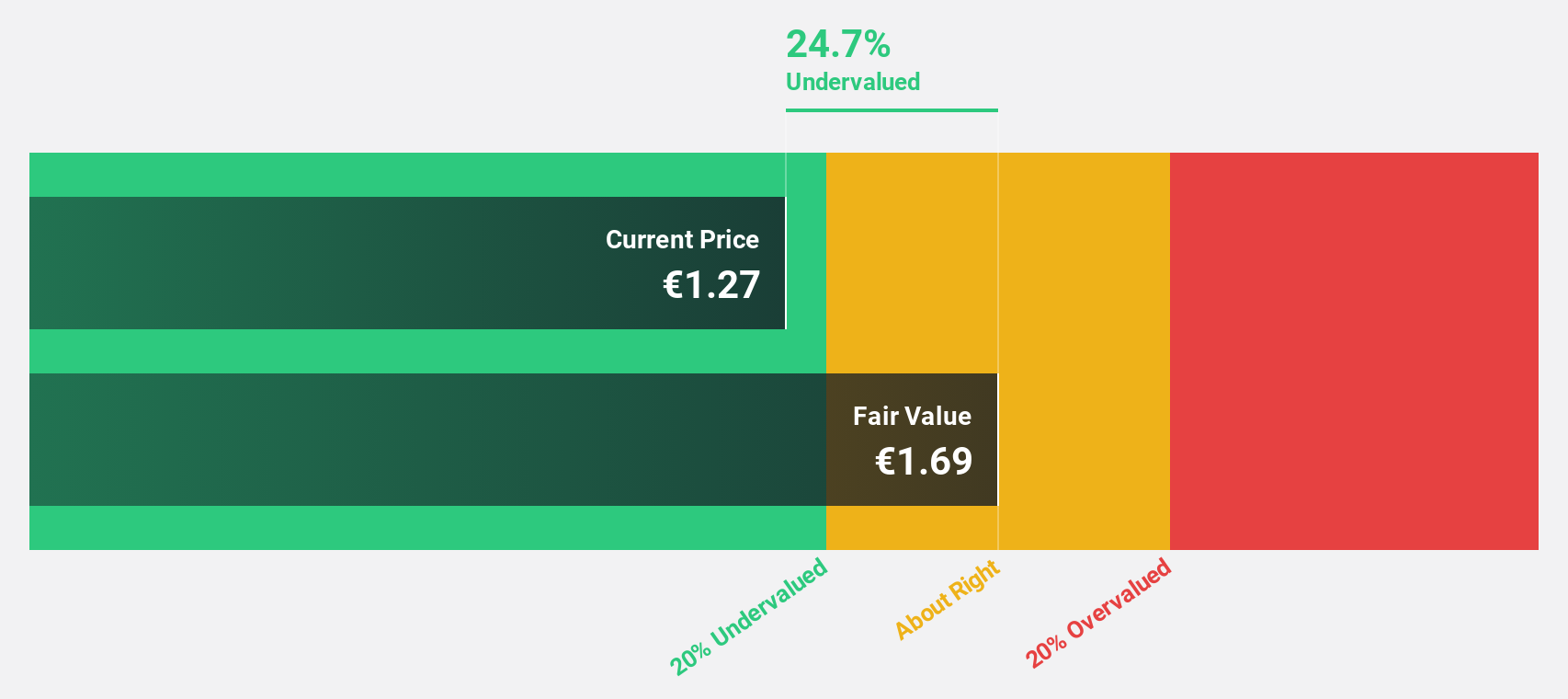

Estimated Discount To Fair Value: 32.2%

Línea Directa Aseguradora appears undervalued, trading over 20% below its estimated fair value of €1.69, with a current price of €1.15. Recent earnings growth is robust, showing a net income increase to €59.67 million for the first nine months of 2025 from €40.75 million the previous year. Despite slower revenue growth at 6.4% annually, its earnings are projected to grow faster than the Spanish market average at 12.1% per year, though dividends remain unstable.

- In light of our recent growth report, it seems possible that Línea Directa Aseguradora Compañía de Seguros y Reaseguros' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Línea Directa Aseguradora Compañía de Seguros y Reaseguros' balance sheet health report.

Cogelec (ENXTPA:ALLEC)

Overview: Cogelec SA designs, manufactures, and sells access control and wireless intercom systems in France and internationally, with a market cap of €242.19 million.

Operations: The company generates revenue of €80.43 million from its communications equipment segment.

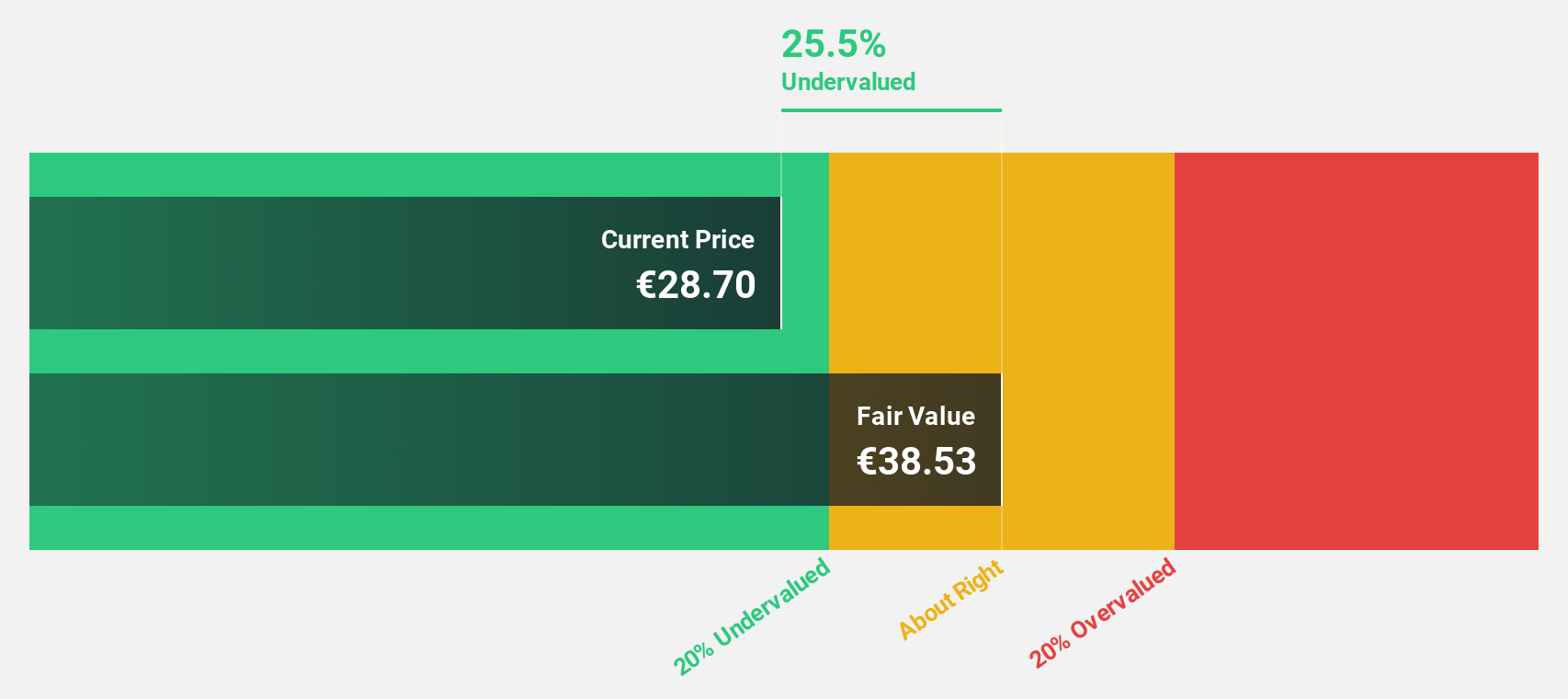

Estimated Discount To Fair Value: 27.7%

Cogelec is trading 27.7% below its estimated fair value of €40.36, with a current price of €29.2, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 9.6% to 6.5%, earnings are expected to grow significantly at 35.7% annually, outpacing the French market's growth rate of 11.9%. However, the dividend yield of 1.99% is not well covered by earnings or free cash flows, indicating potential sustainability concerns.

- Upon reviewing our latest growth report, Cogelec's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Cogelec's balance sheet by reading our health report here.

LINK Mobility Group Holding (OB:LINK)

Overview: LINK Mobility Group Holding ASA, along with its subsidiaries, offers mobile and communication-platform-as-a-service solutions and has a market capitalization of NOK9.82 billion.

Operations: The company's revenue is derived from several segments: Central Europe with NOK1.67 billion, Western Europe at NOK2.37 billion, Northern Europe contributing NOK1.58 billion, and Global Messaging generating NOK1.33 billion.

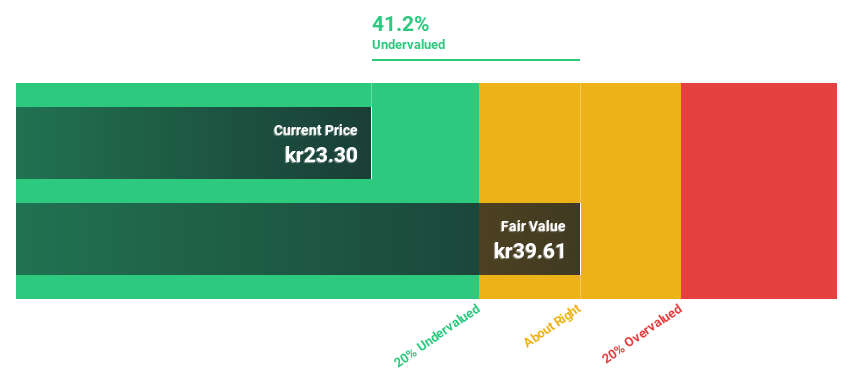

Estimated Discount To Fair Value: 48.8%

LINK Mobility Group Holding is trading at NOK 33.9, significantly below its fair value estimate of NOK 66.27, suggesting potential undervaluation based on cash flows. Despite recent profit margin declines from 2.5% to 1.5%, earnings are forecast to grow substantially at over 71% annually, surpassing the Norwegian market's growth rate of 15%. However, recent board member resignations and large one-off items impacting results should be considered when evaluating investment risks.

- Our earnings growth report unveils the potential for significant increases in LINK Mobility Group Holding's future results.

- Navigate through the intricacies of LINK Mobility Group Holding with our comprehensive financial health report here.

Next Steps

- Navigate through the entire inventory of 209 Undervalued European Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:LDA

Línea Directa Aseguradora Compañía de Seguros y Reaseguros

Engages in insurance and reinsurance business in Spain and Portugal.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Phase 3 HALEO results have a high probability of Success

Mader Group (ASX: MAD): Strong Growth, Strong Returns — But at a Price

Netflix - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion