Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Prim, S.A. (BME:PRM) is about to trade ex-dividend in the next three days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important as the process of settlement involves at least two full business days. So if you miss that date, you would not show up on the company's books on the record date. Thus, you can purchase Prim's shares before the 16th of July in order to receive the dividend, which the company will pay on the 18th of July.

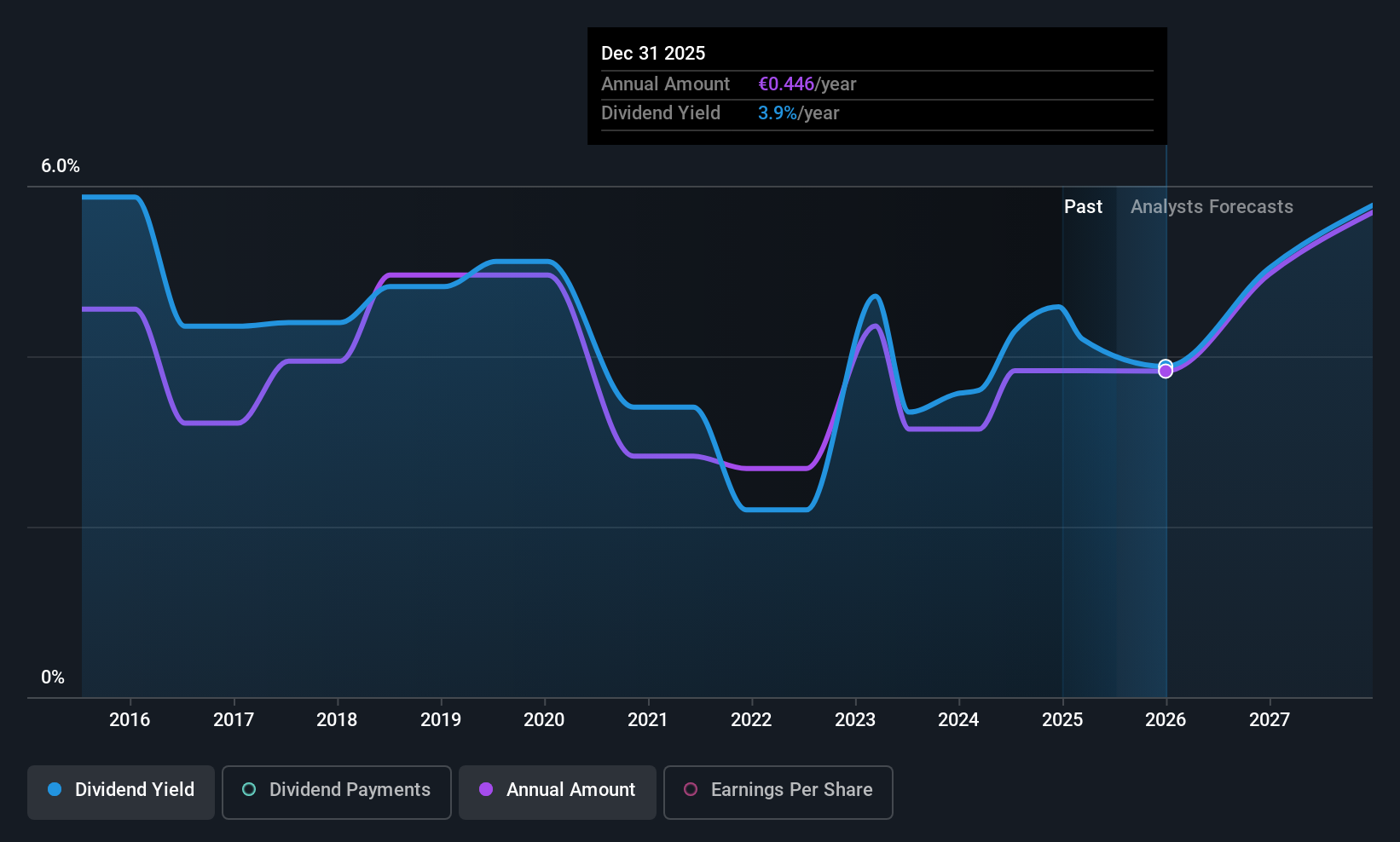

The company's next dividend payment will be €0.18549 per share, and in the last 12 months, the company paid a total of €0.45 per share. Based on the last year's worth of payments, Prim has a trailing yield of 3.9% on the current stock price of €11.50. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Fortunately Prim's payout ratio is modest, at just 42% of profit. A useful secondary check can be to evaluate whether Prim generated enough free cash flow to afford its dividend. Over the last year it paid out 71% of its free cash flow as dividends, within the usual range for most companies.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Check out our latest analysis for Prim

Click here to see how much of its profit Prim paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're not enthused to see that Prim's earnings per share have remained effectively flat over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, Prim has lifted its dividend by approximately 8.3% a year on average.

The Bottom Line

Has Prim got what it takes to maintain its dividend payments? Earnings per share are down very slightly in recent times, and Prim paid out less half its profit and more than half its cash flow as dividends, which is not the worst combination but could be better. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

If you want to look further into Prim, it's worth knowing the risks this business faces. For example, we've found 1 warning sign for Prim that we recommend you consider before investing in the business.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:PRM

Prim

Operates as a health technology, mobility, and health care products provider in Spain.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)