Ebro Foods (BME:EBRO) Is Paying Out A Larger Dividend Than Last Year

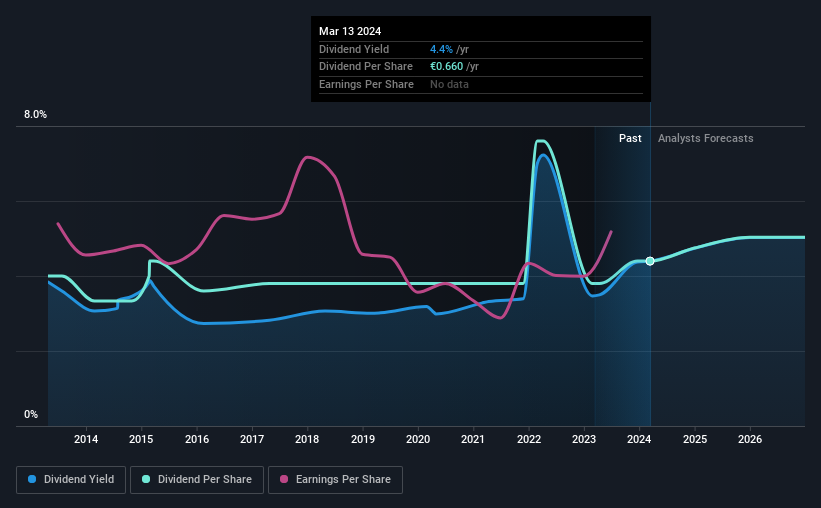

Ebro Foods, S.A.'s (BME:EBRO) dividend will be increasing from last year's payment of the same period to €0.1782 on 2nd of April. This will take the dividend yield to an attractive 4.4%, providing a nice boost to shareholder returns.

View our latest analysis for Ebro Foods

Ebro Foods' Earnings Easily Cover The Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. The last payment was quite easily covered by earnings, but it made up 144% of cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

The next year is set to see EPS grow by 5.4%. If the dividend continues along recent trends, we estimate the payout ratio will be 39%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the dividend has gone from €0.60 total annually to €0.66. Its dividends have grown at less than 1% per annum over this time frame. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

We Could See Ebro Foods' Dividend Growing

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. We are encouraged to see that Ebro Foods has grown earnings per share at 5.8% per year over the past five years. The company is paying out a lot of its cash as a dividend, but it looks okay based on the payout ratio.

Our Thoughts On Ebro Foods' Dividend

Overall, we always like to see the dividend being raised, but we don't think Ebro Foods will make a great income stock. While Ebro Foods is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 1 warning sign for Ebro Foods that investors should know about before committing capital to this stock. Is Ebro Foods not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Ebro Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:EBRO

Ebro Foods

Operates as a food company in Spain, rest of Europe, the United States, Canada, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.