- Japan

- /

- Metals and Mining

- /

- TSE:5602

3 High-Quality Dividend Stocks Yielding Up To 5.6%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rate cuts from the ECB and SNB, alongside expectations for a Federal Reserve rate cut, investors are witnessing mixed performances across major indices. Amid these dynamics, with inflationary pressures and labor market shifts in focus, dividend stocks stand out as attractive options for those seeking steady income streams. In the current environment, high-quality dividend stocks can offer stability and potential yield benefits that align well with investor needs.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.70% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.75% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.32% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.20% | ★★★★★★ |

Click here to see the full list of 1858 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Ebro Foods (BME:EBRO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ebro Foods, S.A. is a food company operating in Spain, the rest of Europe, the United States, Canada, and internationally with a market cap of €2.46 billion.

Operations: Ebro Foods generates revenue through its Rice Business, which accounts for €2.45 billion, and its Pasta Business, contributing €682.24 million.

Dividend Yield: 4.1%

Ebro Foods offers a dividend yield of 4.13%, which is below the top quartile in Spain. Despite this, its dividends are well-covered by earnings and cash flow, with payout ratios of 50.1% and 28.1%, respectively, indicating sustainability. However, the dividend history has been volatile over the past decade. Recent financials show improved net income at €169.22 million for nine months ending September 2024, up from €140.14 million year-on-year.

- Get an in-depth perspective on Ebro Foods' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Ebro Foods is priced lower than what may be justified by its financials.

KurimotoLtd (TSE:5602)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kurimoto Ltd. manufactures and sells ductile iron pipes, valves, industrial equipment, materials, and construction materials both in Japan and internationally, with a market cap of ¥48.45 billion.

Operations: Kurimoto Ltd.'s revenue segments include ductile iron pipes and accessories, valves, industrial equipment and materials, and construction materials.

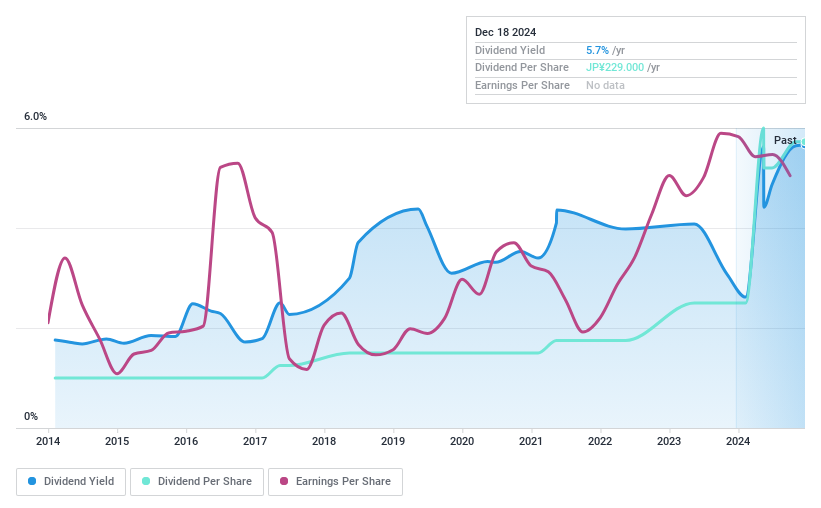

Dividend Yield: 5.7%

Kurimoto Ltd. offers a dividend yield of 5.66%, placing it in the top 25% of Japanese dividend payers, although its dividends are not covered by free cash flows. Despite this, the payout ratio is relatively low at 40.4%, indicating coverage by earnings. The company has maintained stable and growing dividends over the past decade, suggesting reliability despite concerns about sustainability from cash flow perspectives. The price-to-earnings ratio stands at a competitive 9.6x against the market average.

- Click here and access our complete dividend analysis report to understand the dynamics of KurimotoLtd.

- Insights from our recent valuation report point to the potential overvaluation of KurimotoLtd shares in the market.

NittoseikoLtd (TSE:5957)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nittoseiko Co., Ltd. is engaged in the manufacturing and sale of industrial fasteners, tools, machinery, precision equipment, and measurement control equipment both in Japan and internationally, with a market cap of ¥23.27 billion.

Operations: Nittoseiko Co., Ltd.'s revenue is derived from four main segments: Fastener at ¥32.68 billion, Control System at ¥6.81 billion, Assembly Machine at ¥6.04 billion, and Medical at ¥21.21 million.

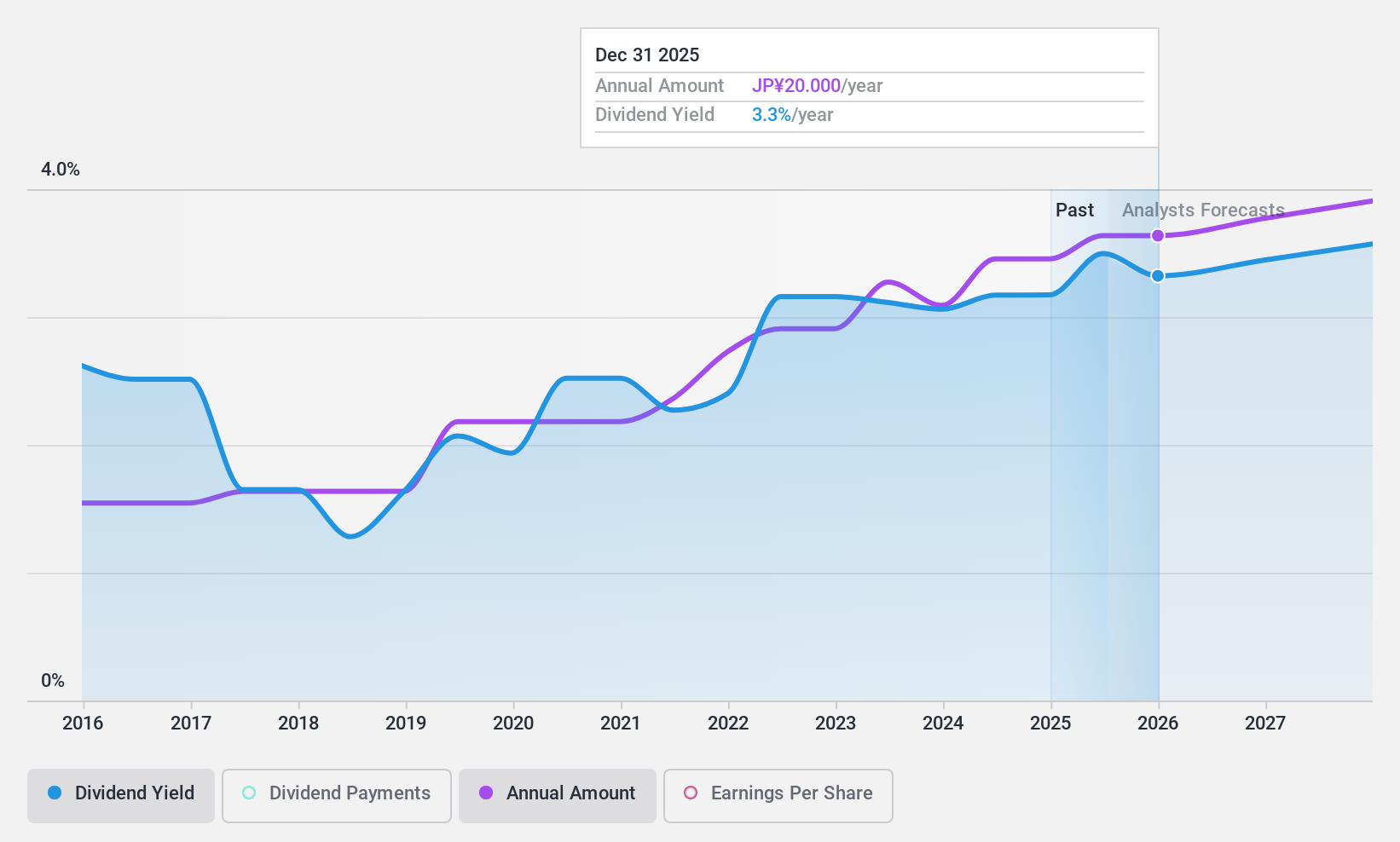

Dividend Yield: 3%

Nittoseiko Ltd. recently announced a share repurchase program aimed at enhancing shareholder returns and improving capital efficiency. Despite a history of volatile dividends, the company's payout ratio is low at 32.6%, indicating dividends are well covered by earnings. The dividend yield of 3% is below top-tier Japanese payers, but it remains sustainable with cash flow coverage at 57.6%. Earnings growth prospects appear strong, yet past dividend reliability issues persist.

- Take a closer look at NittoseikoLtd's potential here in our dividend report.

- Our expertly prepared valuation report NittoseikoLtd implies its share price may be lower than expected.

Seize The Opportunity

- Dive into all 1858 of the Top Dividend Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KurimotoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5602

KurimotoLtd

Manufactures and sells ductile iron pipes and accessories, valves, industrial equipment and materials, and construction materials in Japan and internationally.

Excellent balance sheet established dividend payer.