- Spain

- /

- Diversified Financial

- /

- BME:ALB

Three Stocks That May Be Undervalued In November 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record highs in U.S. indices and geopolitical uncertainties, investors are increasingly focused on identifying opportunities that may be undervalued amidst the broader market gains. With U.S. initial jobless claims at their lowest in seven months and positive sentiment buoyed by strong labor market data, now could be a strategic time to consider stocks that might not yet reflect their full potential value in this environment of economic optimism and evolving fiscal policies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victory Capital Holdings (NasdaqGS:VCTR) | US$72.24 | US$144.03 | 49.8% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.12 | US$99.93 | 49.8% |

| Synovus Financial (NYSE:SNV) | US$57.97 | US$115.67 | 49.9% |

| CS Wind (KOSE:A112610) | ₩42100.00 | ₩83493.57 | 49.6% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.71 | CN¥43.37 | 49.9% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.85 | 49.8% |

| EuroGroup Laminations (BIT:EGLA) | €2.728 | €5.42 | 49.7% |

| Nidaros Sparebank (OB:NISB) | NOK100.00 | NOK198.62 | 49.7% |

| Nutanix (NasdaqGS:NTNX) | US$72.35 | US$143.99 | 49.8% |

| VerticalScope Holdings (TSX:FORA) | CA$9.01 | CA$18.01 | 50% |

Let's dive into some prime choices out of the screener.

Corporación Financiera Alba (BME:ALB)

Overview: Corporación Financiera Alba, S.A. is a private equity and venture capital firm that focuses on early to late-stage ventures, growth capital, and emerging growth financing for middle market and mature companies, with a market cap of approximately €2.85 billion.

Operations: The company's revenue is derived from investment property (€140.80 million) and leasing of property (€17.90 million).

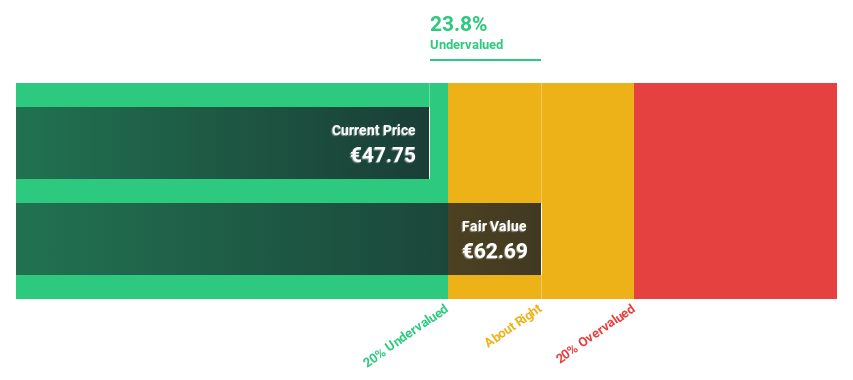

Estimated Discount To Fair Value: 24.9%

Corporación Financiera Alba is trading at €47.25, significantly below its estimated fair value of €62.94, indicating it may be undervalued based on cash flows. Despite a drop in earnings with net income at €91.8 million for the first half of 2024, future growth prospects are strong with forecasted annual earnings and revenue growth rates of 18.5% and 28.5%, respectively, outpacing the Spanish market averages. However, its return on equity remains low at an expected 6.3%.

- Our expertly prepared growth report on Corporación Financiera Alba implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Corporación Financiera Alba.

Husqvarna (OM:HUSQ B)

Overview: Husqvarna AB (publ) is a company that produces and sells outdoor power products, watering products, and lawn care power equipment, with a market cap of approximately SEK35.30 billion.

Operations: The company's revenue segments include Gardena with SEK12.34 billion, Husqvarna Construction at SEK7.91 billion, and Husqvarna Forest & Garden contributing SEK28.08 billion.

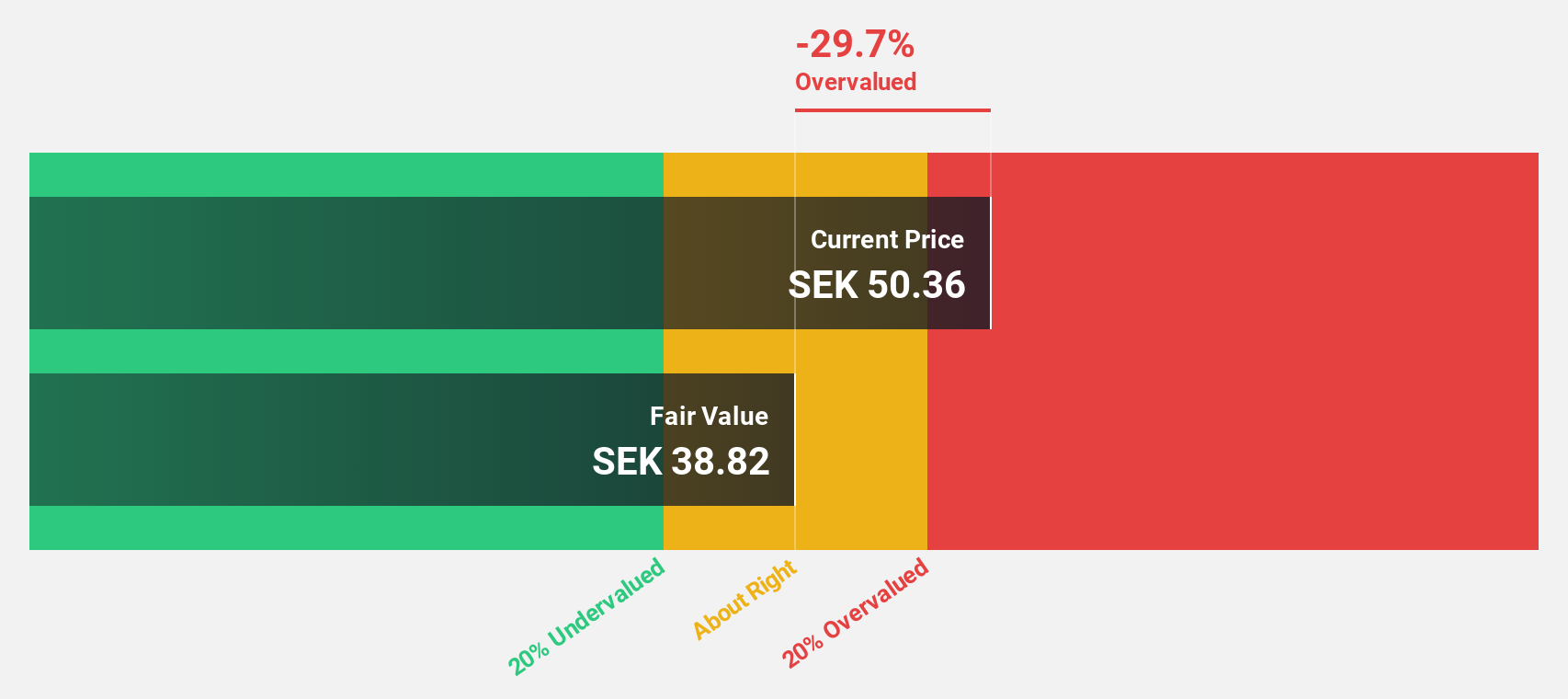

Estimated Discount To Fair Value: 13.6%

Husqvarna is trading at SEK61.7, slightly below its estimated fair value of SEK71.4, suggesting it might be undervalued based on cash flows. Despite a recent quarterly net loss of SEK153 million and declining sales, earnings growth is forecasted to significantly outpace the Swedish market at 37.2% annually over three years. However, challenges include unsustainable dividends and low return on equity forecasts, while new product innovations in robotic lawnmowers could bolster future performance.

- Our comprehensive growth report raises the possibility that Husqvarna is poised for substantial financial growth.

- Navigate through the intricacies of Husqvarna with our comprehensive financial health report here.

Murapol (WSE:MUR)

Overview: Murapol S.A. is a company involved in residential real estate development in Poland, with a market capitalization of PLN 1.39 billion.

Operations: The company's revenue segments are focused on residential real estate development in Poland.

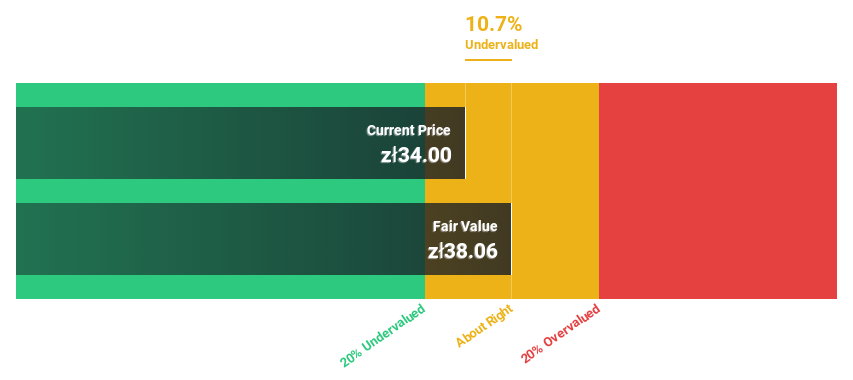

Estimated Discount To Fair Value: 10.9%

Murapol, trading at PLN34.02, is undervalued based on cash flows with a fair value estimate of PLN38.17. Despite recent declines in quarterly revenue and net income compared to last year, earnings are projected to grow significantly at 33.8% annually over the next three years—outpacing the Polish market. However, its dividend yield of 8.64% is unsustainable given current earnings and free cash flow coverage challenges amidst analyst expectations for a price rise by 44.2%.

- Insights from our recent growth report point to a promising forecast for Murapol's business outlook.

- Get an in-depth perspective on Murapol's balance sheet by reading our health report here.

Where To Now?

- Delve into our full catalog of 916 Undervalued Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ALB

Corporación Financiera Alba

A private equity and venture capital firm specializing in early venture, mid venture, late venture, growth capital, and emerging growth financing in middle market and mature companies.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives