As global markets continue to navigate a landscape of economic growth and geopolitical uncertainties, U.S. indexes are approaching record highs, driven by broad-based gains and positive sentiment from strong labor market data. In this context, dividend stocks can offer investors a combination of income stability and potential capital appreciation, making them an attractive option for those looking to balance risk in their portfolios amidst evolving market dynamics.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.55% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1982 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

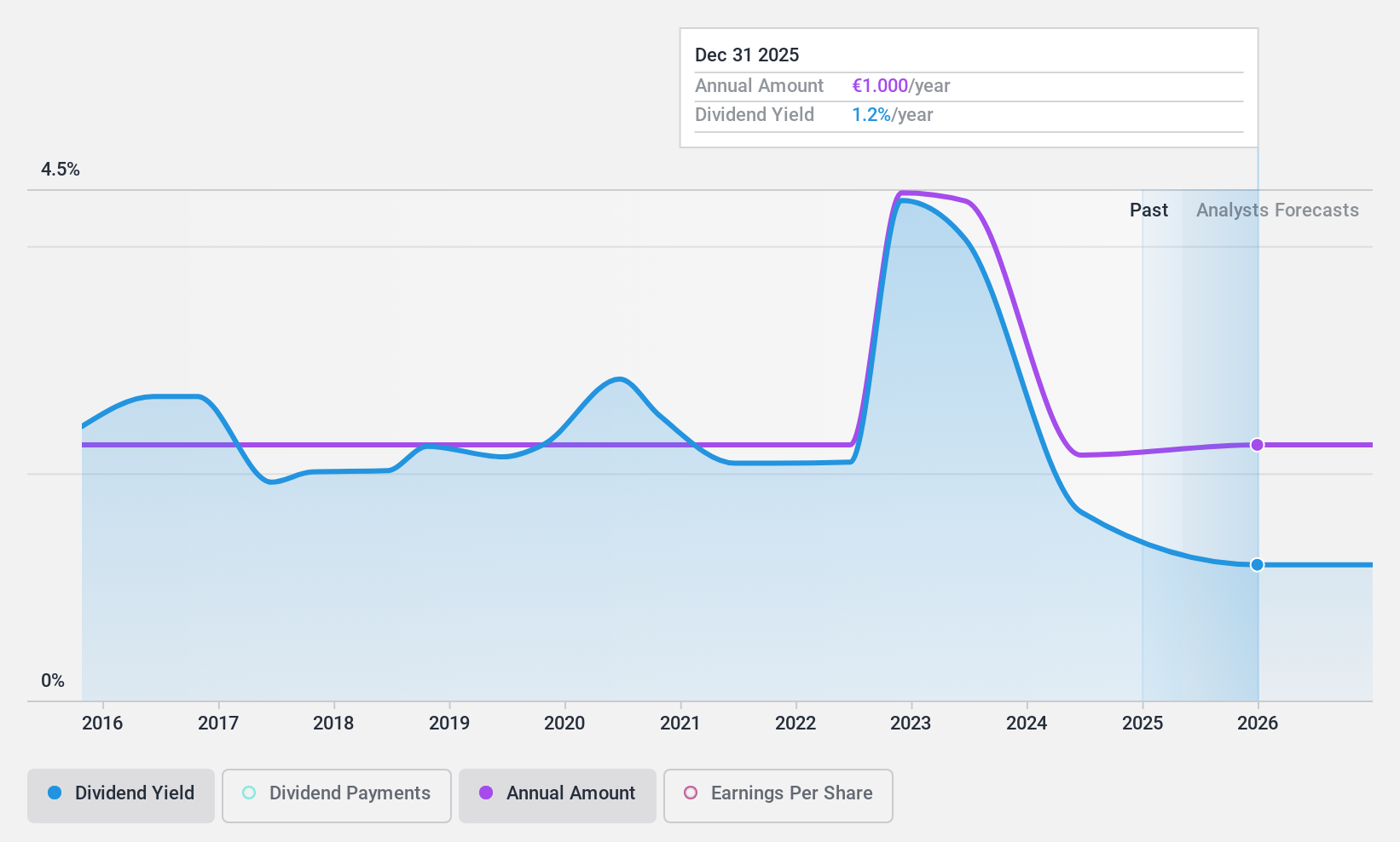

Corporación Financiera Alba (BME:ALB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Corporación Financiera Alba, S.A. is a private equity and venture capital firm that focuses on early to late-stage ventures, growth capital, and emerging growth financing for middle market and mature companies, with a market capitalization of approximately €2.86 billion.

Operations: Corporación Financiera Alba generates its revenue primarily from investment property (€140.80 million) and leasing of property (€17.90 million).

Dividend Yield: 4.1%

Corporación Financiera Alba's dividend payments are well-covered by earnings, with a low payout ratio of 9.2%, but cash flow coverage is tighter at 85.1%. The dividend yield of 4.12% trails behind the top quartile in Spain. Although dividends have increased over the past decade, they have been volatile and unreliable, experiencing significant annual drops. Recent earnings showed a decline in net income to €91.8 million from €146.9 million year-on-year, potentially impacting future payouts.

- Take a closer look at Corporación Financiera Alba's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Corporación Financiera Alba shares in the market.

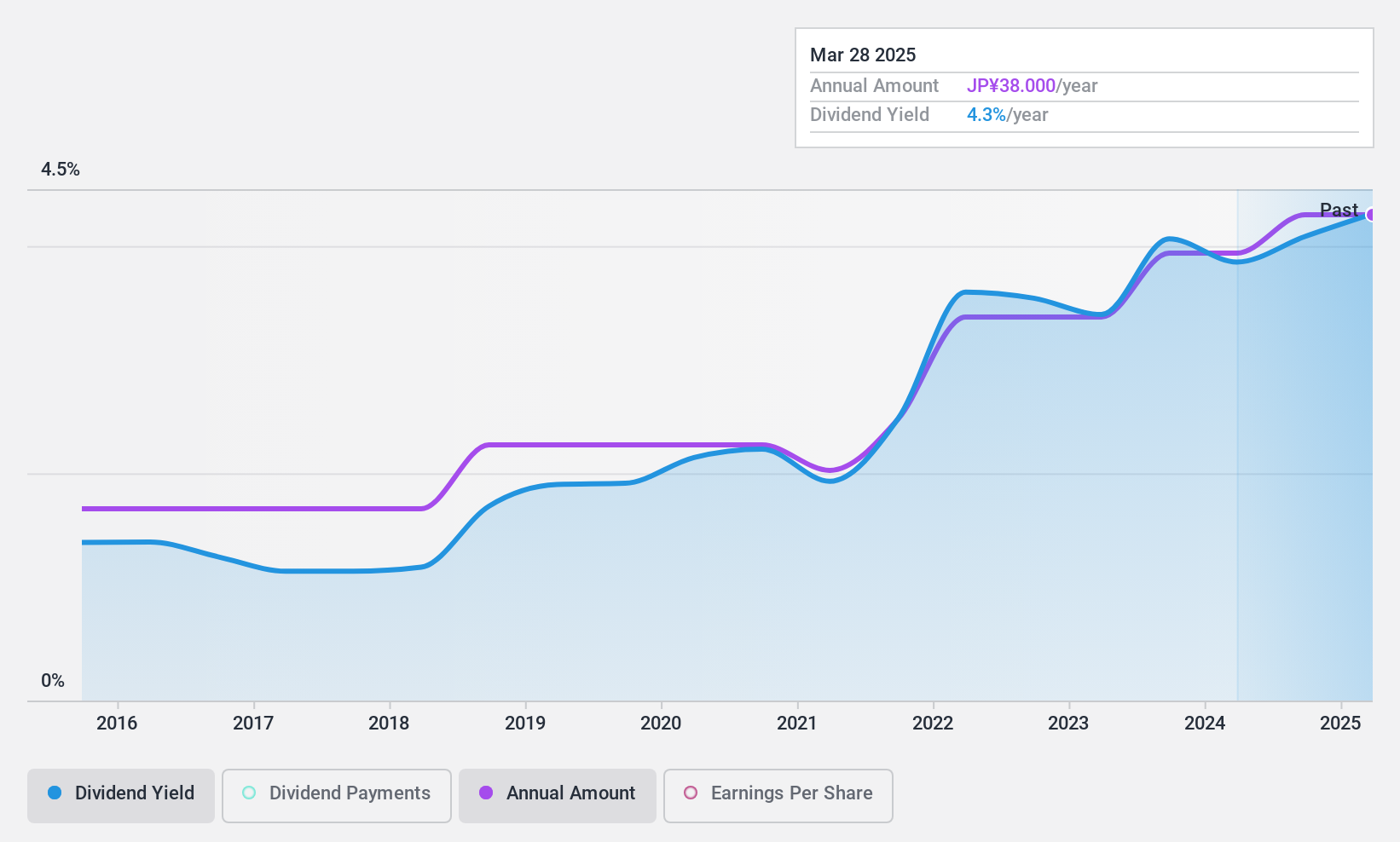

Asahi PrintingLtd (TSE:3951)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asahi Printing Co., Ltd. manufactures and sells printing and packaging materials for the pharmaceutical and cosmetic markets primarily in Japan, with a market cap of ¥18.70 billion.

Operations: Asahi Printing Co., Ltd.'s revenue is primarily derived from its Printed Packaging Business, contributing ¥39.25 billion, and its Packaging System Sales Business, which adds ¥2.87 billion.

Dividend Yield: 4.3%

Asahi Printing Ltd.'s dividend yield of 4.31% ranks in the top 25% of Japanese dividend payers, supported by a low payout ratio of 26.2%, indicating strong earnings coverage. However, despite growth over the last decade, dividends have been volatile and unreliable, with significant annual drops exceeding 20%. Cash flow coverage is reasonable at a cash payout ratio of 53.3%. Upcoming Q2 results on Nov 11 may provide further insights into sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Asahi PrintingLtd.

- Our valuation report here indicates Asahi PrintingLtd may be overvalued.

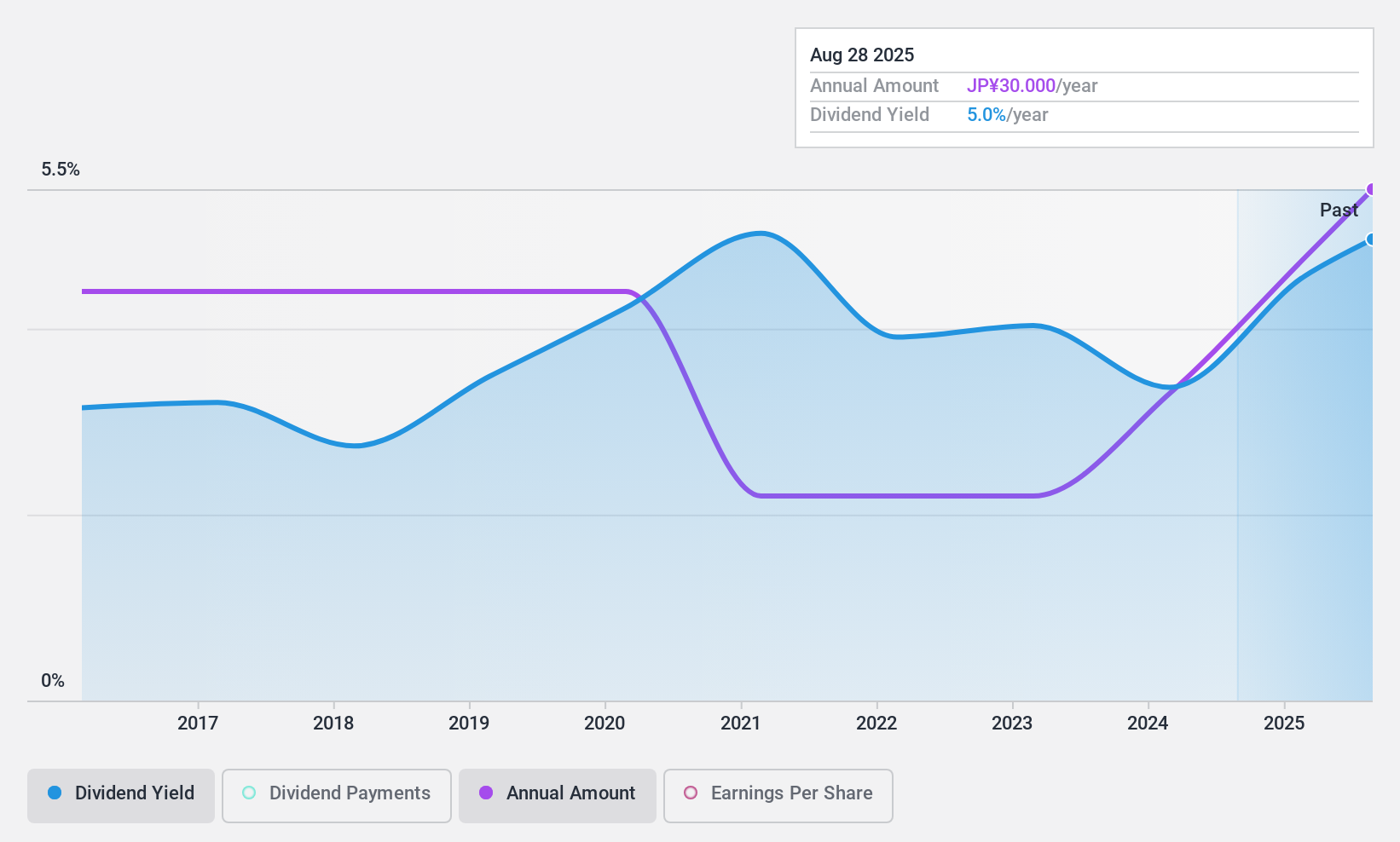

Onward Holdings (TSE:8016)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Onward Holdings Co., Ltd. designs, manufactures, and sells men's, women's, and children's apparel in Japan, China, the United Kingdom, and the United States with a market cap of ¥71.26 billion.

Operations: Onward Holdings Co., Ltd. generates revenue through its subsidiaries by engaging in the design, production, and retail of apparel for men, women, and children across Japan, China, the United Kingdom, and the United States.

Dividend Yield: 4.6%

Onward Holdings has a dividend yield of 4.57%, placing it among the top 25% of Japanese dividend payers, with dividends well-covered by earnings (payout ratio: 34.5%) and cash flows (cash payout ratio: 47.3%). Despite this, its dividend history is marked by volatility and unreliability over the past decade. Recent sales growth and a proposed interim dividend system could enhance shareholder returns, but historical instability remains a concern for consistent income seekers.

- Click to explore a detailed breakdown of our findings in Onward Holdings' dividend report.

- Upon reviewing our latest valuation report, Onward Holdings' share price might be too pessimistic.

Next Steps

- Discover the full array of 1982 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3951

Asahi PrintingLtd

Engages in the manufacture and sale of printing and packaging materials for the pharmaceutical and cosmetic markets primarily in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives