- Spain

- /

- Commercial Services

- /

- BME:PSG

Investors five-year losses continue as Prosegur Compañía de Seguridad (BME:PSG) dips a further 6.0% this week, earnings continue to decline

Statistically speaking, long term investing is a profitable endeavour. But along the way some stocks are going to perform badly. To wit, the Prosegur Compañía de Seguridad, S.A. (BME:PSG) share price managed to fall 63% over five long years. That's not a lot of fun for true believers.

If the past week is anything to go by, investor sentiment for Prosegur Compañía de Seguridad isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Prosegur Compañía de Seguridad

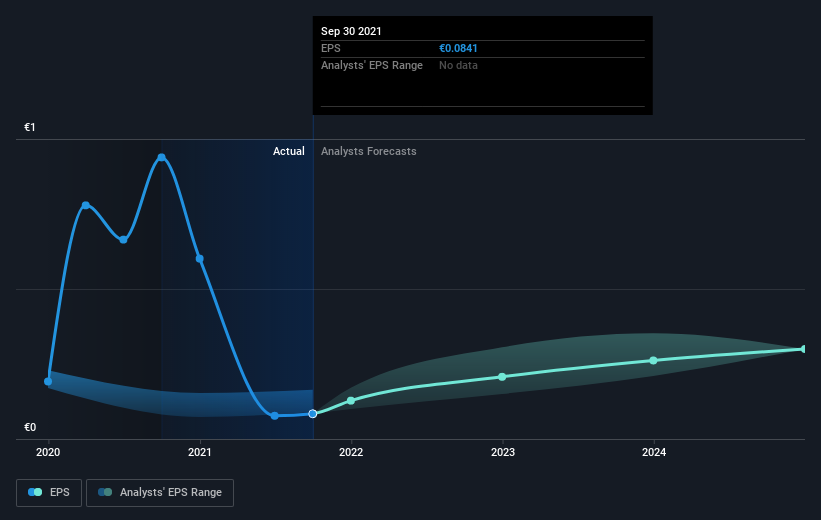

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Prosegur Compañía de Seguridad's share price and EPS declined; the latter at a rate of 22% per year. This fall in the EPS is worse than the 18% compound annual share price fall. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Prosegur Compañía de Seguridad's TSR for the last 5 years was -55%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Investors in Prosegur Compañía de Seguridad had a tough year, with a total loss of 1.4% (including dividends), against a market gain of about 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 9% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Prosegur Compañía de Seguridad (of which 1 is a bit concerning!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:PSG

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives