- Spain

- /

- Commercial Services

- /

- BME:CASH

Would Shareholders Who Purchased Prosegur Cash's (BME:CASH) Stock Three Years Be Happy With The Share price Today?

If you love investing in stocks you're bound to buy some losers. But the long term shareholders of Prosegur Cash, S.A. (BME:CASH) have had an unfortunate run in the last three years. Sadly for them, the share price is down 70% in that time. And more recent buyers are having a tough time too, with a drop of 41% in the last year. It's down 3.5% in the last seven days.

View our latest analysis for Prosegur Cash

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

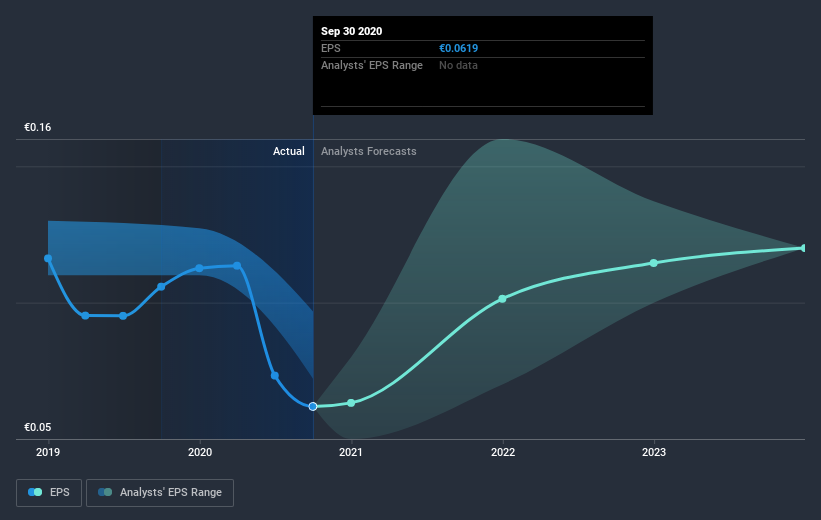

During the three years that the share price fell, Prosegur Cash's earnings per share (EPS) dropped by 43% each year. This fall in the EPS is worse than the 33% compound annual share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Prosegur Cash the TSR over the last 3 years was -66%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

The last twelve months weren't great for Prosegur Cash shares, which performed worse than the market, costing holders 38%, including dividends. Meanwhile, the broader market slid about 10.0%, likely weighing on the stock. The three-year loss of 18% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Prosegur Cash better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Prosegur Cash you should be aware of.

We will like Prosegur Cash better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you’re looking to trade Prosegur Cash, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BME:CASH

Prosegur Cash

Provides integrated cash cycle management solutions and automating payments in retail establishments and ATM management for financial institutions, retail establishments, business, government agencies, central banks, mints, and jewellery stores in Europe, LATAM, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives