- Spain

- /

- Construction

- /

- BME:OHLA

Would Shareholders Who Purchased Obrascón Huarte Lain's (BME:OHL) Stock Three Years Be Happy With The Share price Today?

Obrascón Huarte Lain, S.A. (BME:OHL) shareholders should be happy to see the share price up 10% in the last week. But only the myopic could ignore the astounding decline over three years. The share price has sunk like a leaky ship, down 88% in that time. So it sure is nice to see a bit of an improvement. The thing to think about is whether the business has really turned around.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Obrascón Huarte Lain

Because Obrascón Huarte Lain made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years Obrascón Huarte Lain saw its revenue shrink by 3.4% per year. That is not a good result. Having said that the 23% annualized share price decline highlights the risk of investing in unprofitable companies. This business clearly needs to grow revenues if it is to perform as investors hope. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

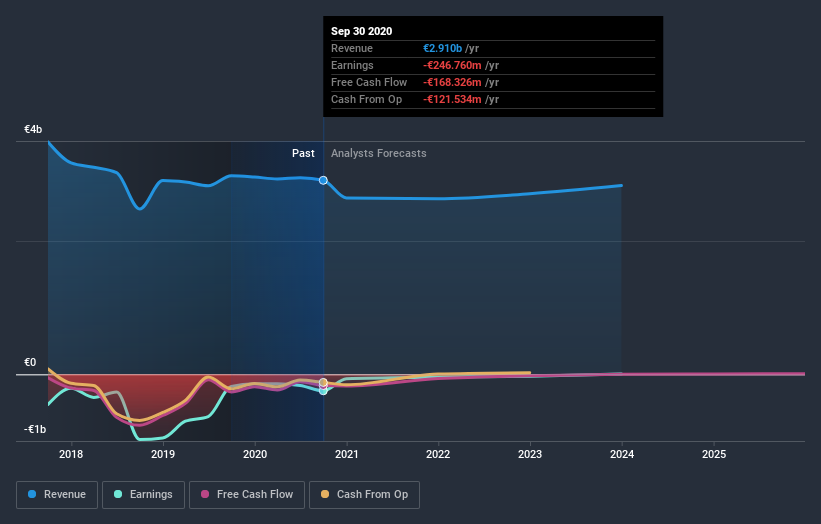

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Obrascón Huarte Lain's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Obrascón Huarte Lain shareholders are down 48% for the year. Unfortunately, that's worse than the broader market decline of 11%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Obrascón Huarte Lain you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you’re looking to trade Obrascón Huarte Lain, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:OHLA

Obrascón Huarte Lain

Engages in the construction and concession businesses in the United States, Canada, Mexico, Chile, Peru, Colombia, Spain, Central and Eastern Europe, Northern Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives