A look at the shareholders of Obrascón Huarte Lain, S.A. (BME:OHL) can tell us which group is most powerful. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. We also tend to see lower insider ownership in companies that were previously publicly owned.

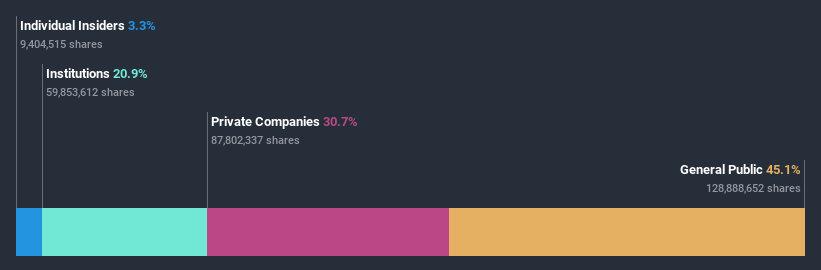

Obrascón Huarte Lain is not a large company by global standards. It has a market capitalization of €197m, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutional investors have bought into the company. Let's take a closer look to see what the different types of shareholders can tell us about Obrascón Huarte Lain.

See our latest analysis for Obrascón Huarte Lain

What Does The Institutional Ownership Tell Us About Obrascón Huarte Lain?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

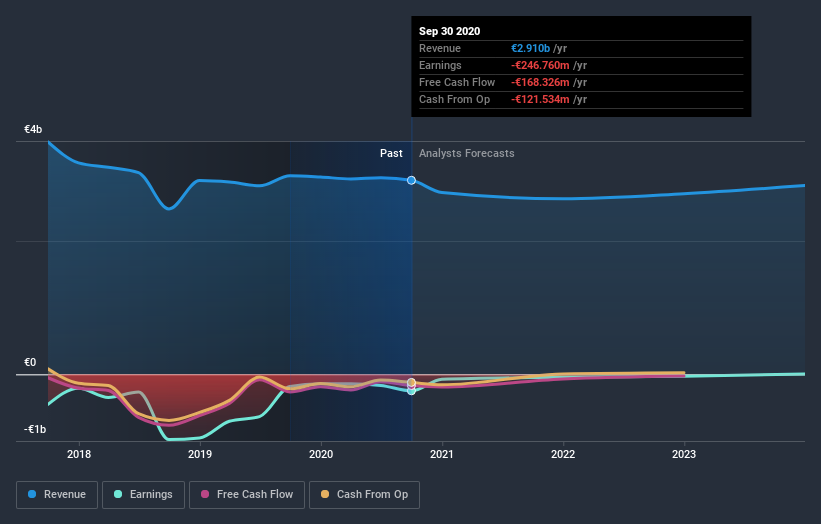

Obrascón Huarte Lain already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Obrascón Huarte Lain's historic earnings and revenue below, but keep in mind there's always more to the story.

Hedge funds don't have many shares in Obrascón Huarte Lain. Grupo Villar Mir, S.A.U. is currently the largest shareholder, with 15% of shares outstanding. The second and third largest shareholders are Solid Rock Capital, S.L.U. and Forjar Capital, S.L.U., with an equal amount of shares to their name at 8.0%.

A closer look at our ownership figures suggests that the top 11 shareholders have a combined ownership of 50% implying that no single shareholder has a majority.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Obrascón Huarte Lain

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

I can report that insiders do own shares in Obrascón Huarte Lain, S.A.. As individuals, the insiders collectively own €6.5m worth of the €197m company. It is good to see some investment by insiders, but it might be worth checking if those insiders have been buying.

General Public Ownership

The general public holds a 45% stake in Obrascón Huarte Lain. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

Our data indicates that Private Companies hold 31%, of the company's shares. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Be aware that Obrascón Huarte Lain is showing 1 warning sign in our investment analysis , you should know about...

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Obrascón Huarte Lain, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BME:OHLA

Obrascón Huarte Lain

Engages in the construction and concessions businesses in the United States, Canada, Mexico, Chile, Peru, Colombia, Spain, Central and Eastern Europe, and internationally.

Flawless balance sheet and undervalued.