- Spain

- /

- Construction

- /

- BME:MDF

Further Upside For Duro Felguera, S.A. (BME:MDF) Shares Could Introduce Price Risks After 50% Bounce

Duro Felguera, S.A. (BME:MDF) shares have had a really impressive month, gaining 50% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.9% over the last year.

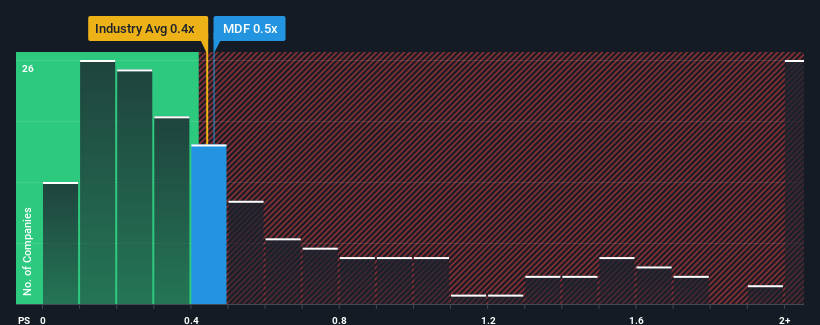

Even after such a large jump in price, there still wouldn't be many who think Duro Felguera's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Spain's Construction industry is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Duro Felguera

How Duro Felguera Has Been Performing

Recent times have been quite advantageous for Duro Felguera as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Duro Felguera will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Duro Felguera, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Duro Felguera would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 46%. The latest three year period has also seen an excellent 190% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 4.2% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that Duro Felguera is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Duro Felguera's P/S

Duro Felguera's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To our surprise, Duro Felguera revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You always need to take note of risks, for example - Duro Felguera has 3 warning signs we think you should be aware of.

If you're unsure about the strength of Duro Felguera's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:MDF

Duro Felguera

Duro Felguera, S.A. executes turnkey projects for the energy and industrial sectors in Spain, Latin America, Europe, Asia, Africa, and internationally.

Slight and slightly overvalued.

Market Insights

Community Narratives