- Spain

- /

- Commercial Services

- /

- BME:FCC

Optimistic Investors Push Fomento de Construcciones y Contratas, S.A. (BME:FCC) Shares Up 27% But Growth Is Lacking

Fomento de Construcciones y Contratas, S.A. (BME:FCC) shareholders have had their patience rewarded with a 27% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 79%.

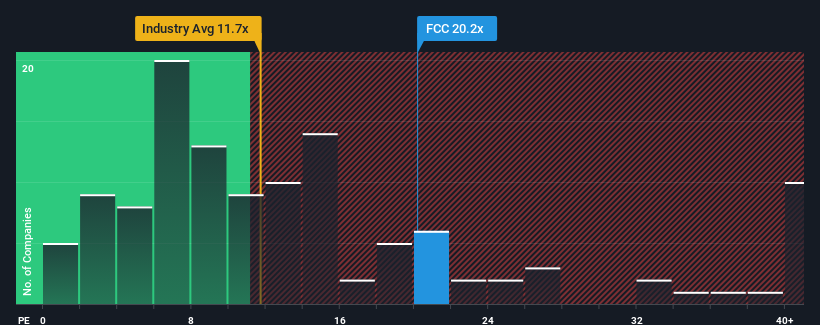

Following the firm bounce in price, Fomento de Construcciones y Contratas' price-to-earnings (or "P/E") ratio of 20.2x might make it look like a sell right now compared to the market in Spain, where around half of the companies have P/E ratios below 15x and even P/E's below 11x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Fomento de Construcciones y Contratas hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Fomento de Construcciones y Contratas

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Fomento de Construcciones y Contratas would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 42% decrease to the company's bottom line. Even so, admirably EPS has lifted 40% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 6.8% each year during the coming three years according to the five analysts following the company. That's shaping up to be materially lower than the 8.9% per year growth forecast for the broader market.

In light of this, it's alarming that Fomento de Construcciones y Contratas' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Fomento de Construcciones y Contratas' P/E?

Fomento de Construcciones y Contratas' P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Fomento de Construcciones y Contratas' analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Fomento de Construcciones y Contratas that you need to be mindful of.

You might be able to find a better investment than Fomento de Construcciones y Contratas. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:FCC

Fomento de Construcciones y Contratas

Engages in the environmental services, water management, infrastructure development, and real estate businesses in Europe and internationally.

Very undervalued with solid track record.