- Spain

- /

- Commercial Services

- /

- BME:FCC

Fomento de Construcciones y Contratas' (BME:FCC) five-year earnings growth trails the 8.5% YoY shareholder returns

The simplest way to invest in stocks is to buy exchange traded funds. But the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the Fomento de Construcciones y Contratas, S.A. (BME:FCC) share price is up 26% in the last five years, slightly above the market return. Zooming in, the stock is up a respectable 11% in the last year.

Since it's been a strong week for Fomento de Construcciones y Contratas shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Fomento de Construcciones y Contratas

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

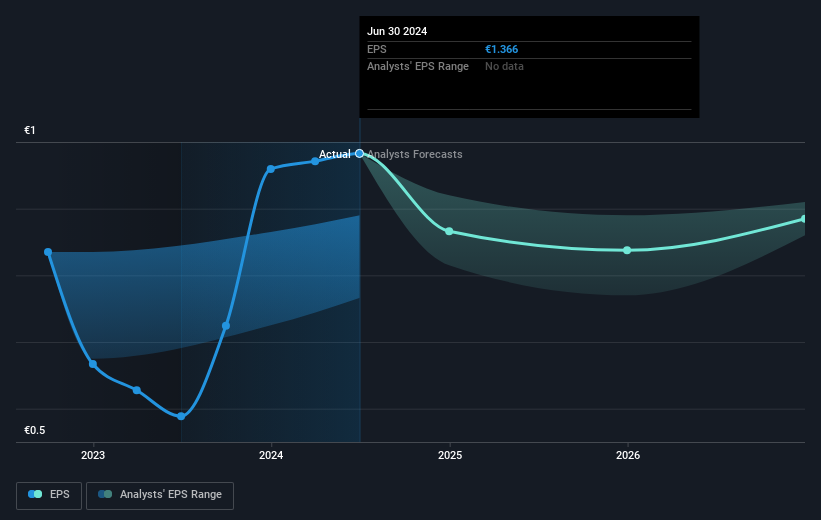

Over half a decade, Fomento de Construcciones y Contratas managed to grow its earnings per share at 17% a year. The EPS growth is more impressive than the yearly share price gain of 5% over the same period. Therefore, it seems the market has become relatively pessimistic about the company. This cautious sentiment is reflected in its (fairly low) P/E ratio of 9.76.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Fomento de Construcciones y Contratas has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Fomento de Construcciones y Contratas, it has a TSR of 50% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Fomento de Construcciones y Contratas shareholders gained a total return of 15% during the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 8% per year over five year. It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Fomento de Construcciones y Contratas has 4 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Spanish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:FCC

Fomento de Construcciones y Contratas

Engages in the environmental services, water management, infrastructure development, and real estate businesses in Europe and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives