- Spain

- /

- Construction

- /

- BME:CLR

Revenues Tell The Story For CLERHP Estructuras, S.A. (BME:CLR) As Its Stock Soars 32%

CLERHP Estructuras, S.A. (BME:CLR) shareholders have had their patience rewarded with a 32% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 74%.

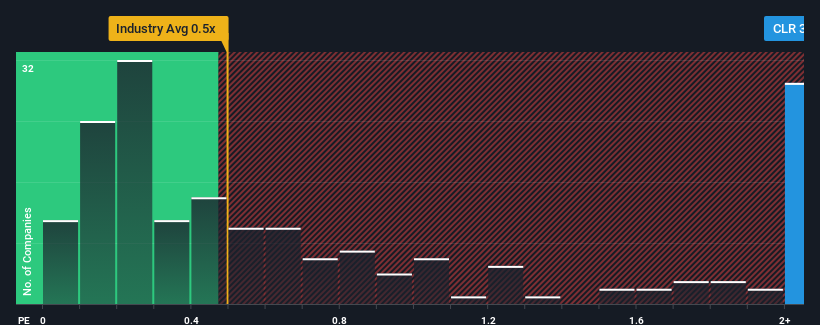

Following the firm bounce in price, given around half the companies in Spain's Construction industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider CLERHP Estructuras as a stock to avoid entirely with its 3.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for CLERHP Estructuras

How Has CLERHP Estructuras Performed Recently?

With revenue growth that's superior to most other companies of late, CLERHP Estructuras has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think CLERHP Estructuras' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like CLERHP Estructuras' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 34% gain to the company's top line. Pleasingly, revenue has also lifted 71% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 57% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 4.1%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that CLERHP Estructuras' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The strong share price surge has lead to CLERHP Estructuras' P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of CLERHP Estructuras' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with CLERHP Estructuras (at least 2 which are a bit unpleasant), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:CLR

CLERHP Estructuras

Engages in structural engineering and construction activities in Spain and internationally.

Exceptional growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026