- Switzerland

- /

- Machinery

- /

- SWX:MIKN

European Dividend Stocks To Consider In March 2025

Reviewed by Simply Wall St

As European markets face challenges from U.S. trade policy uncertainties and a recent dip in the STOXX Europe 600 Index, investors are keenly observing how increased spending on defense and infrastructure might influence future growth. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.18% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.16% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.89% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 5.02% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.59% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.20% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.33% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.92% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.53% | ★★★★★★ |

| CaixaBank (BME:CABK) | 8.08% | ★★★★★☆ |

Click here to see the full list of 230 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

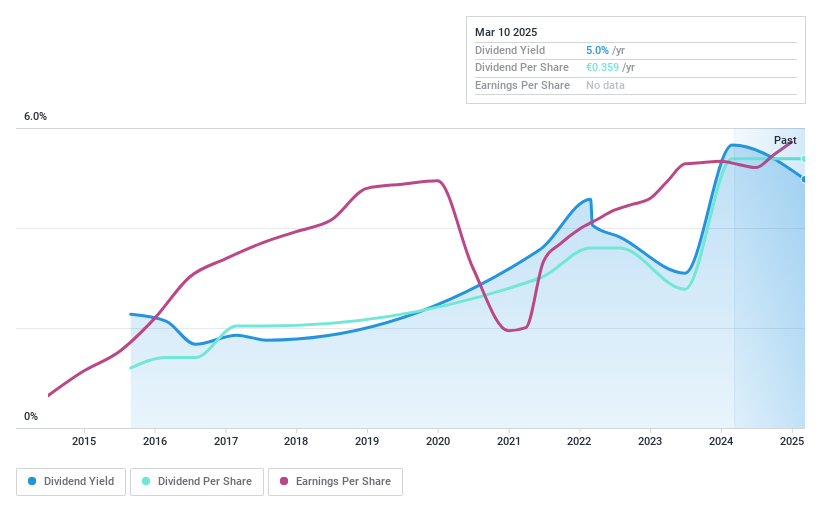

Azkoyen (BME:AZK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Azkoyen, S.A. designs, manufactures, and markets technology solutions both in Spain and internationally with a market cap of €176.04 million.

Operations: Azkoyen, S.A. generates its revenue through three primary segments: Time & Security (€67.13 million), Payment Technologies (€69.07 million), and Coffee & Vending Systems (€63.06 million).

Dividend Yield: 5%

Azkoyen's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 49.3% and a cash payout ratio of 26.2%, respectively. However, its dividend track record is unstable, showing volatility over the past decade despite recent growth. The stock trades significantly below its estimated fair value but offers a lower yield than top-tier Spanish dividend payers. Recent earnings showed modest growth in sales and net income for 2024, supporting dividend sustainability.

- Click to explore a detailed breakdown of our findings in Azkoyen's dividend report.

- Our valuation report here indicates Azkoyen may be undervalued.

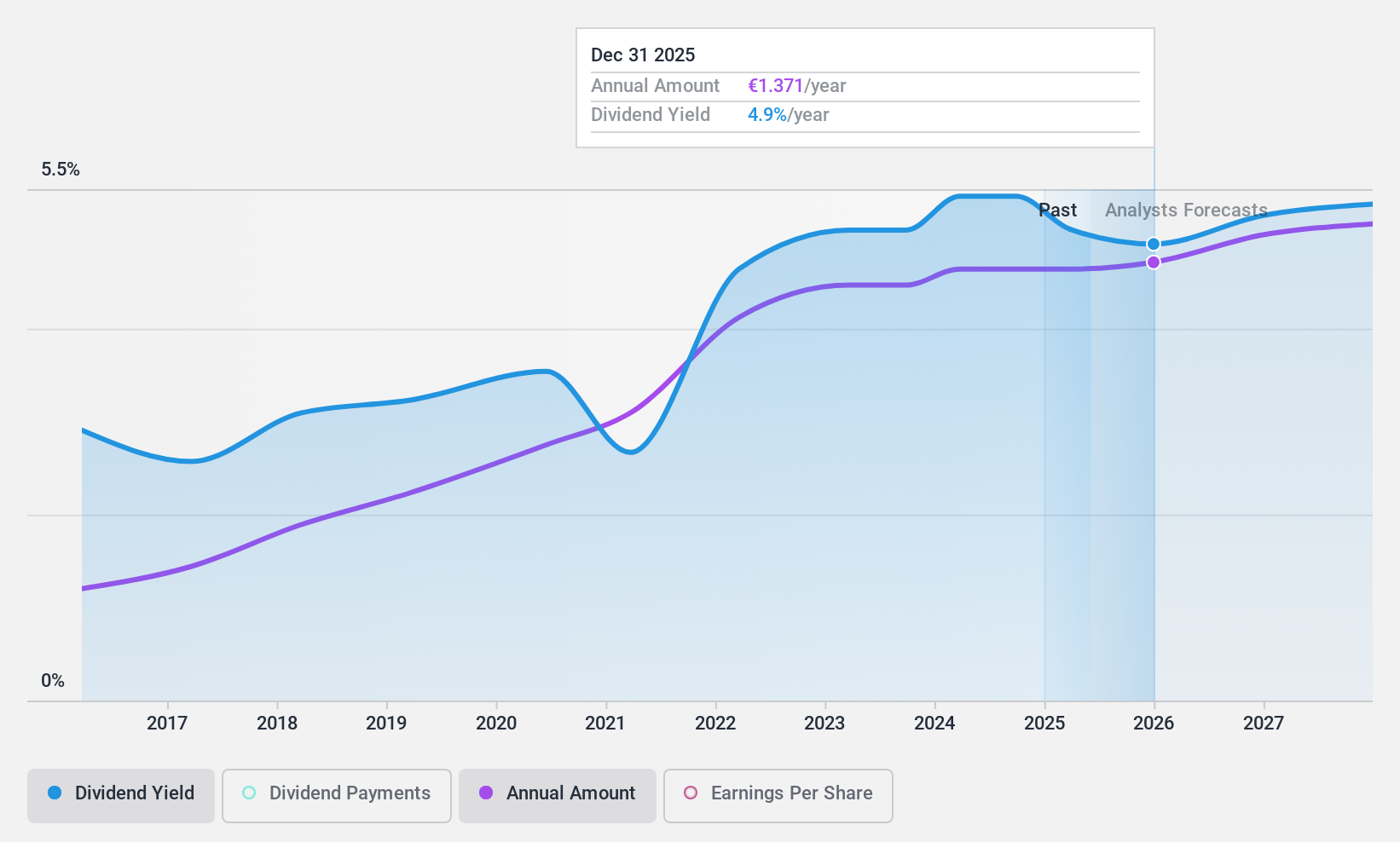

Valmet Oyj (HLSE:VALMT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Valmet Oyj is a company that develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries across various regions including North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific; it has a market cap of approximately €5.17 billion.

Operations: Valmet Oyj's revenue is segmented into Services (€1.90 billion), Automation (€1.44 billion), and Process Technologies (€2.02 billion).

Dividend Yield: 4.8%

Valmet Oyj's dividend payments are well-supported by earnings and cash flows, with a payout ratio of 88.8% and a cash payout ratio of 55.6%. Although its yield of 4.81% is lower than the top Finnish dividend payers, Valmet has maintained stable and growing dividends over the past decade. The company announced share repurchase plans to optimize capital structure, while recent earnings showed decreased net income but consistent sales, ensuring ongoing dividend reliability.

- Navigate through the intricacies of Valmet Oyj with our comprehensive dividend report here.

- According our valuation report, there's an indication that Valmet Oyj's share price might be on the cheaper side.

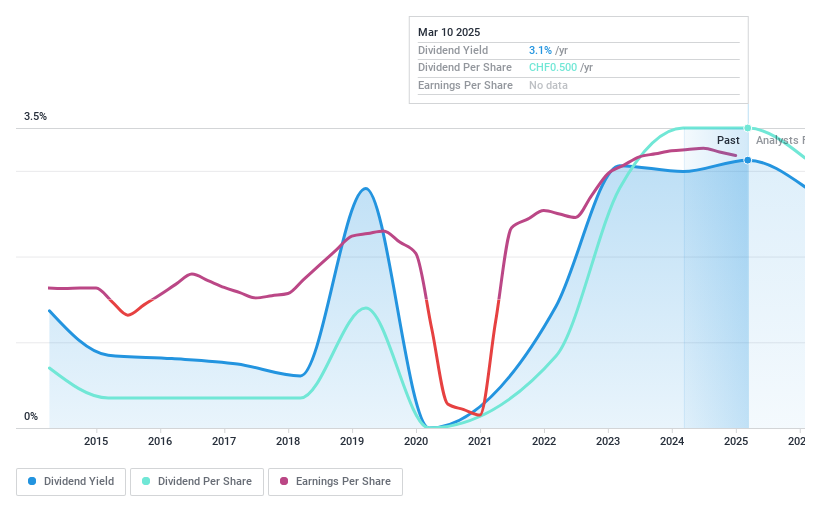

Mikron Holding (SWX:MIKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mikron Holding AG specializes in developing, producing, and marketing automation and machining systems for precise manufacturing processes across Switzerland, Europe, North America, the Asia Pacific, and internationally with a market cap of CHF264.74 million.

Operations: Mikron Holding AG generates revenue from its automation and machining systems designed for efficient manufacturing processes across various regions, including Switzerland, Europe, North America, and the Asia Pacific.

Dividend Yield: 3.1%

Mikron Holding's dividend payments, with a low payout ratio of 14.2% and cash payout ratio of 17.2%, are well-covered by earnings and cash flows, despite a volatile dividend history over the past decade. The company's price-to-earnings ratio of 9.5x is attractive compared to the Swiss market average, yet its dividend yield of 3.13% remains below top-tier Swiss payers. Recent earnings showed stable sales at CHF 374.06 million but slightly decreased net income year-over-year.

- Take a closer look at Mikron Holding's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Mikron Holding is priced higher than what may be justified by its financials.

Key Takeaways

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 227 more companies for you to explore.Click here to unveil our expertly curated list of 230 Top European Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Mikron Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MIKN

Mikron Holding

Develops, produces, and markets automation and machining systems for precise and productive manufacturing processes in the Switzerland, Europe, North America, the Asia Pacific, and internationally.

Flawless balance sheet average dividend payer.